The price of Bitcoin (BTC) has seen a relatively stable week, as BTC/USD has been hovering between $6,000 and $7,300.

However, due to the low volatility, the volume also diminished, which is a sign of a big move in the works. What can be expected of the markets while the coronavirus pandemic is taking a toll on the global economy?

Crypto market daily performance. Source: Coin360

Bitcoin hovering against crucial resistance for bullish momentum

The price of Bitcoin is hovering against the crucial resistance for bullish momentum. A clean break above the resistance of $6,900-7,100 would indicate bullish momentum, which opens the door to $8K.

BTC USD 1-day chart. Source: TradingView

The reasoning behind this thought is quite clear. Bitcoin has seen a massive retracement in the past few weeks, after which the price slowly started to move up, as it’s up almost 100% since the recent low of $3,750.

However, no level has been claimed for support again, which is a crucial ingredient in becoming bullish. The price of Bitcoin needs to claim old support levels to flip levels from resistance to support and to generate a further optimistic outlook for the market.

Price of Bitcoin also fighting 100-Week MA

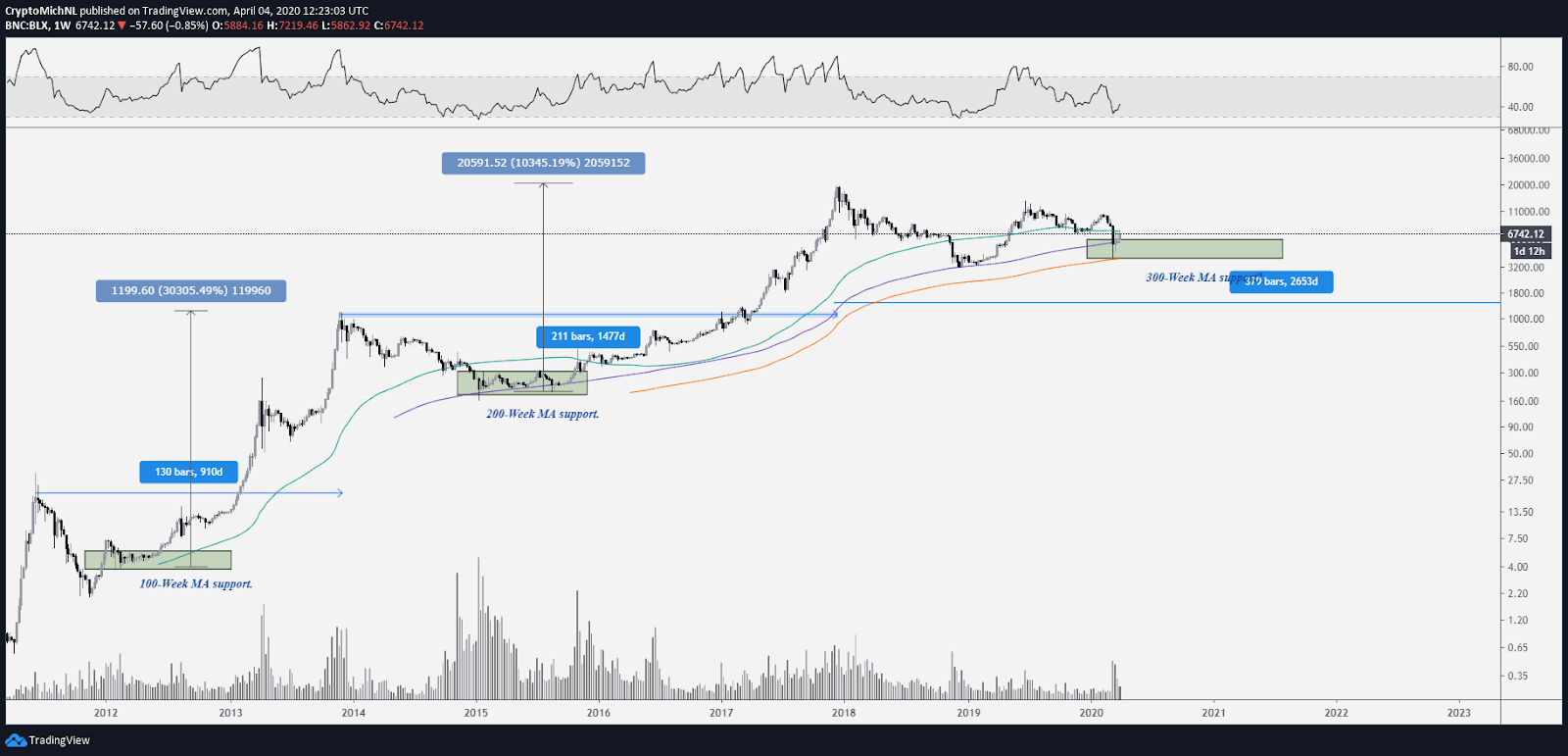

BLX 1-week chart. Source: TradingView

The higher time frame charts are the charts to watch at this point, as they provide massive support and resistance levels.

The weekly chart is one of those charts, as the 100, 200 and 300-moving averages show significant support and resistance levels.

Currently, the price of Bitcoin bounced from the 300-Week MA, closed above the 200-Week MA, and rejected at the 100-Week MA. The latter, the 100-Week MA, is a crucial factor to watch for if the market wants to turn bull.

An apparent breakthrough of the $6,900 level (as that’s the level around the 100-Week MA) would mean that the market regains this moving average as support. A conclusion can be drawn that a bull market has started if that moving average can become support.

However, losing the 200-Week MA (which is around $5,400), would generally lead to a further drop to the $4,000 area, which is around the 300-Week MA. Such a drop would inevitably result in a period of accumulation as witnessed in previous cycles.

An accumulation and sideways period wouldn’t be strange in the current economic climate surrounding the coronavirus. However, if Bitcoin can reclaim the 100-Week MA and turn bullish, then that would be a major bull market signal.

Total market capitalization also fighting crucial resistance

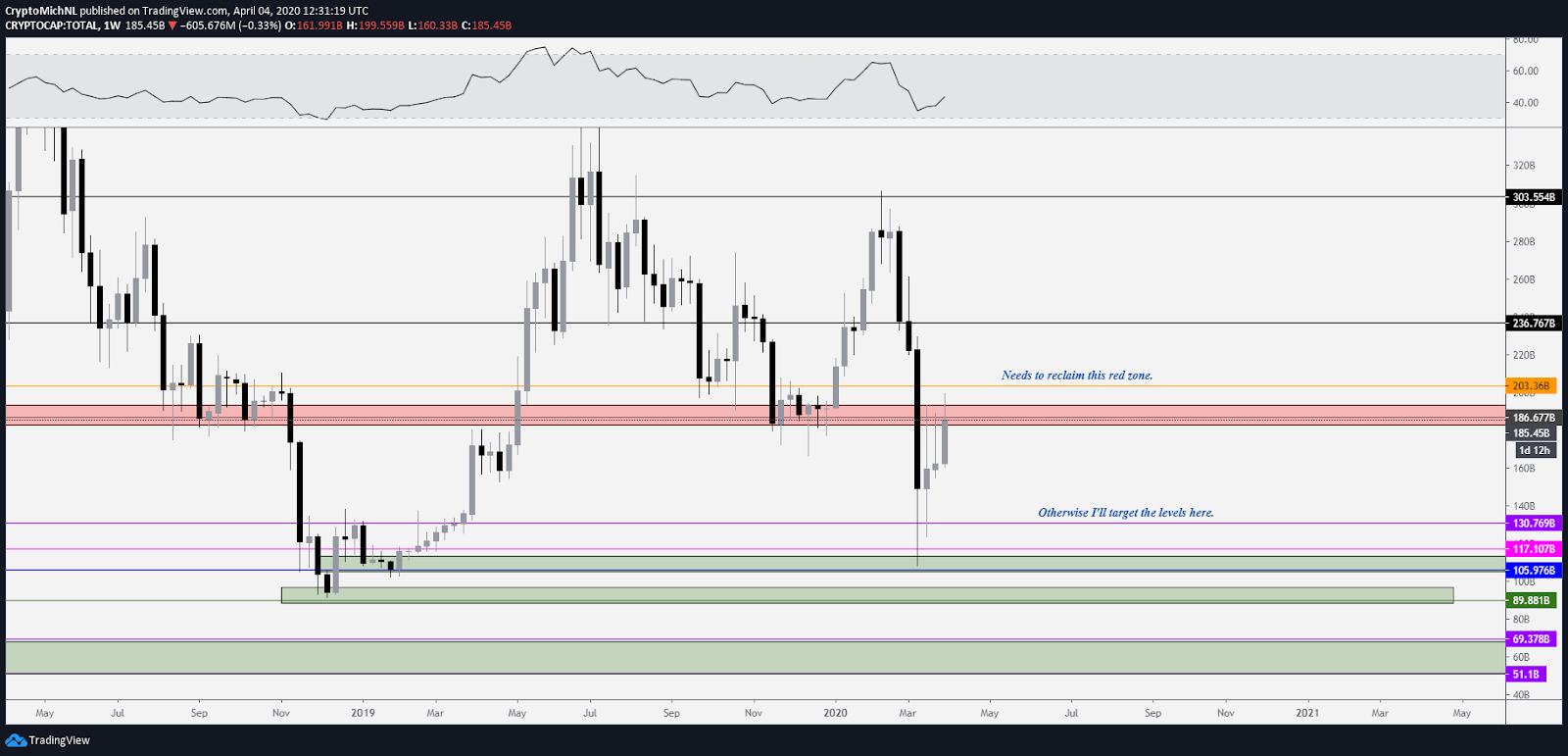

Total market capitalization cryptocurrency 1-week chart. Source: TradingView

The total market capitalization of cryptocurrencies is showing a clear view. A break and a close above the $185-190 billion resistance level would suggest a bull market and put the $240 and $300 billion resistance levels in sight.

However, if the market goes into the red next week, a further downwards test could also occur in the total market capitalization chart.

The levels to watch for are the $130 and $105-115 billion regions. As discussed previously in the article, the 300-Week MA could serve as major support.

This moving average is lying around $117 billion as we speak, confluent with the support levels lying beneath the markets. If the market decides to fall further, this level is the primary area to look for.

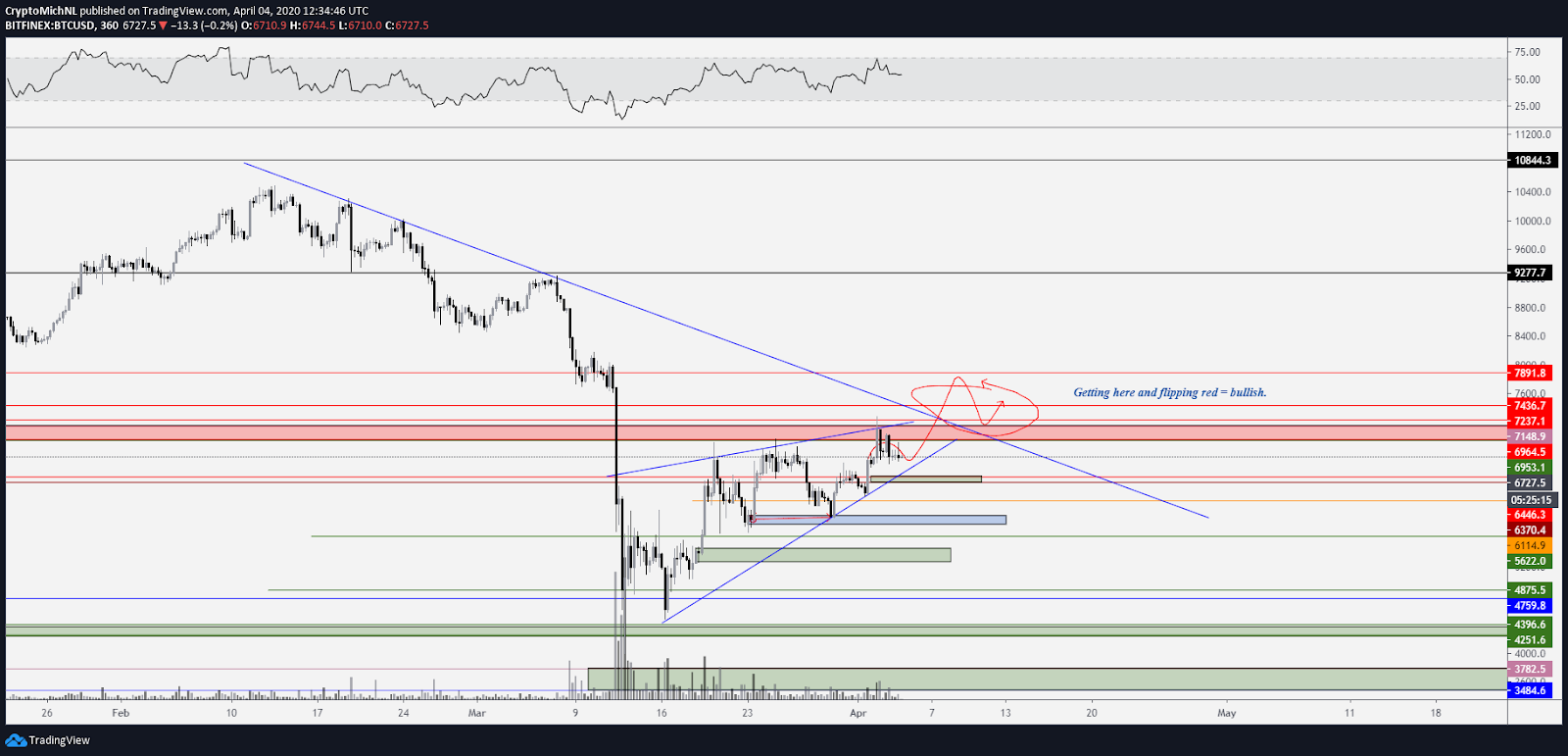

The bullish scenario for Bitcoin

BTC USD 6-hour bullish chart. Source: TradingView

The bullish scenario for Bitcoin is now pretty straightforward. The chart is showing a clear downwards pointing trendline, which needs to be broken to the upside for a bullish outlook.

Therefore, Bitcoin has to remain above $6,300-6,400 for support as the first step, after which the next massive step would be to generate a breakout to the upside.

The moment that Bitcoin decides to break through the $6,900-7,100 resistance level, a green $700-1,000 candle may be expected, as it’s pretty much open-air until the major next resistance level at $7,800-8,000.

The final step for a massively bullish outlook would be to flip the $6,900-7,100 for support. If that happens, further upwards momentum can be expected with targets at $8,500, $9,300 and $10,400 after that.

For now, a breakout above the current resistance level would be a great signal.

The bearish scenario for Bitcoin

BTC USD 6-hour bearish chart. Source: TradingView

The bearish outlook is still likely given the current economic instabilities and Bitcoin price trend, which can be said is in a rising wedge within a general downtrend.

Given that the volume is decreasing in the recent movements, a big move is to be expected from the markets. Combining everything alongside the resistances, a downwards move is the most likely to occur.

Therefore, if the price of Bitcoin can’t break above $6,900-7,100 (red zone), a drop towards $5,600-5,800 is to be expected. The movements to watch for traders then are the support/resistance flips in continuation.

If the price of Bitcoin drops to $5,600 and the bounce gets rejected instantly at $6,300, then further downward momentum should be expected.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.