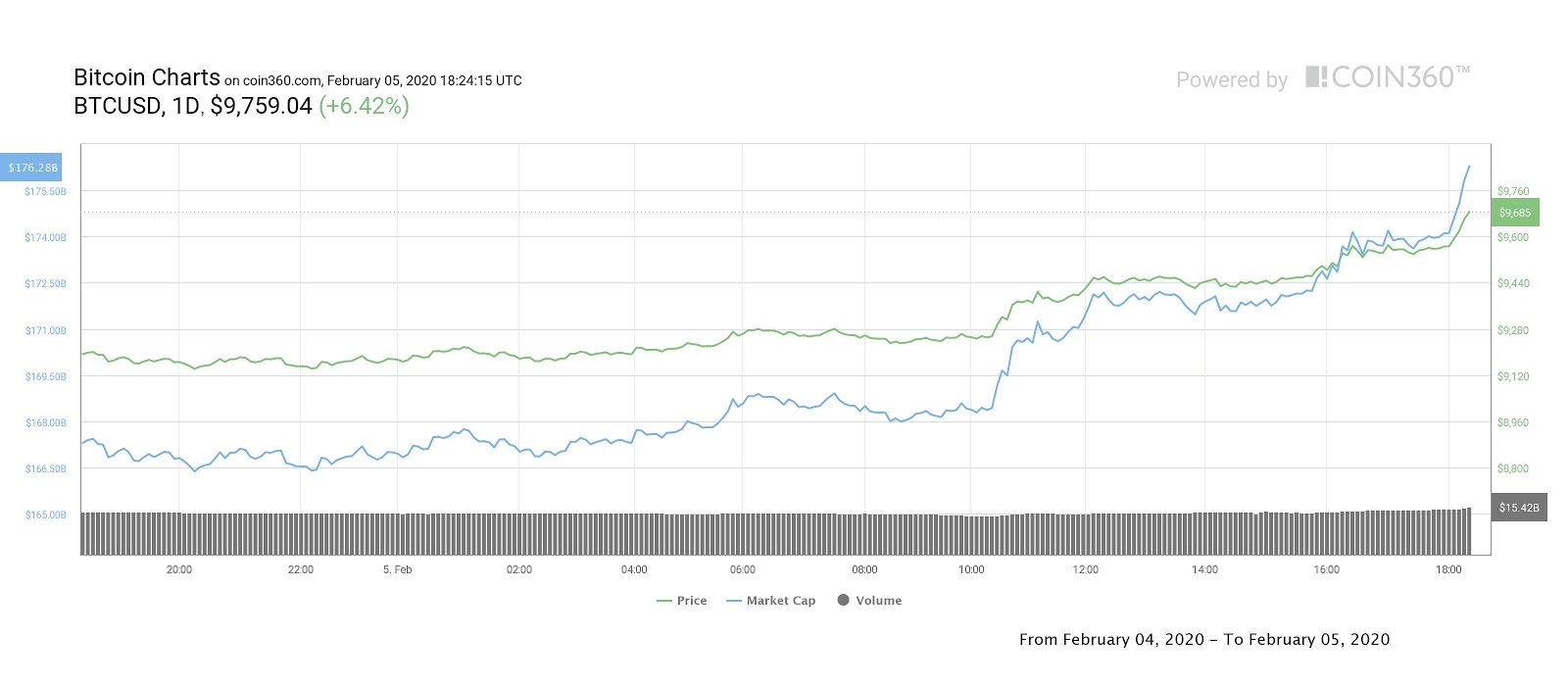

Today Bitcoin (BTC) price pushed through the resistance at $9,400-$9,500, opening the gate for bulls to stampede to a new 2020 high at $9,745.

Bitcoin daily price chart. Source: Coin360

On Feb. 4, BTC price traded slightly below $9,200 as bulls fought to keep the asset from falling below the key support. Today, alongside increasing purchasing volume, Bitcoin completed the three white soldiers candlestick pattern, which is a bullish arrangement and a signal that short-term trend reversal is in order.

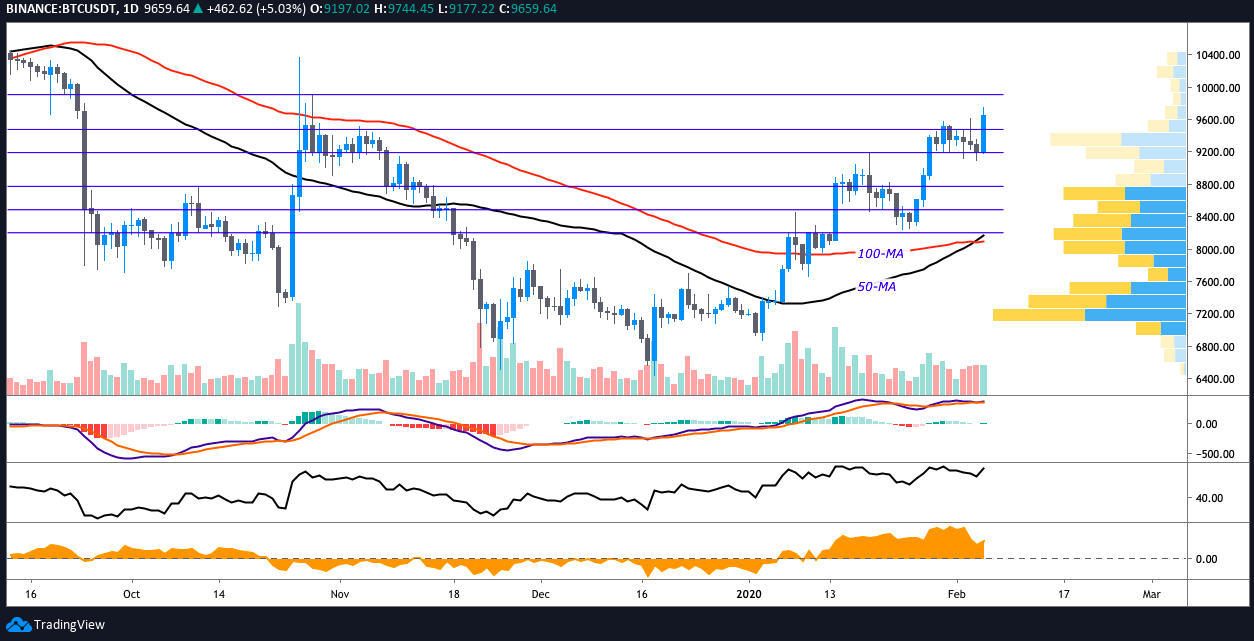

BTC USDT 6-hour chart. Source: TradingView

Further continuation past $9,700 seems likely as the Chaikin Money Flow indicator shows bulls are maintaining purchasing volume and the moving average convergence divergence (MACD) is in the process of pulling above the signal line on the 6-hour timeframe.

If Bitcoin can flip $9,500 to support, there is a volume gap on the volume profile visible range (VPVR) indicator, suggesting the price could run to $9,975 to $10,160 unopposed.

BTC USDT daily chart. Source: TradingView

In a previous analysis, Cointelegraph contributor Michaël van de Poppe suggested that investor FOMO above the $10K mark could quickly drive the price to $11,500 before a short-term correction takes place.

Today’s surge above $9,500 also coincided with the 50-MA converging with the 100-MA, a strong bullish signal that investors often refer to as a golden cross.

Further continuation of today’s uptrend is likely to be the plat du jour but in the event that Bitcoin is unable to hold $9,500 as support, the price could pullback to the $9,400 to $9,350 area and below this $9,200 which is slightly above the 50-MA.

Bitcoin daily price chart. Source: Coin360

The overall cryptocurrency market cap now stands at $271.5 billion and Bitcoin’s dominance rate is 64.6%. Altcoins also mirrored Bitcoin’s price action with many producing double-digit gains.

Ether (ETH) rallied 7.67% and broke above $200 which has served as formidable resistance. Bitcoin Cash (BCH) added 13.45%, Bitcoin SV (BSV) 11.64% and Tezos (XTZ) gained 9.94%.