With the end of the year just a few days off, Bitcoin (BTC) looks set to close 2019 under $10,000. Despite the digital asset’s inability to change the bearish trend that has held a tight grip on price since June 26, the most recent price action has been a godsend for intraday traders playing the relatively predictable range.

Cryptocurrency market daily overview. Source: Coin360

Will volatility increase ahead of the monthly close?

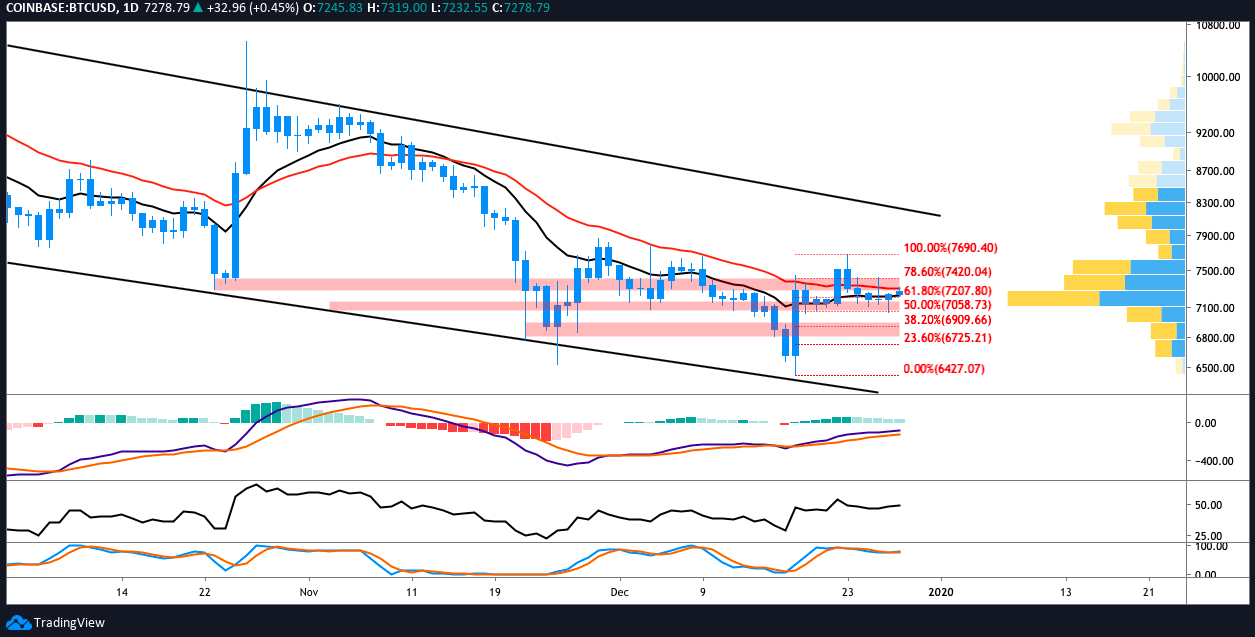

The daily chart shows Bitcoin price continues to trade in a tightening range and the Bollinger Bands indicator suggests that traders can expect some volatility over the coming days as the upper and lower bands are tightening and the monthly close fast approaches.

BTC USD daily chart. Source: TradingView

The price is also in the golden pocket (the zone between the 0.65% and 0.68% Fibonacci retracement levels) but whether this is bullish or bearish signal depends on a trader’s perspective.

Some say that if the price is rising into the golden pocket this can be interpreted as a place to open a short position, especially if there is strong overhead resistance. Alternatively, if the price is descending into the golden pocket traders will view this as an opportunity to open a position in anticipation of a bounce.

As it stands now, BTC price is trading above the middle moving average of the Bollinger Band indicator and the volume profile visible range (VPVR) shows the price supported at $7,200, a point which Bitcoin has ridden along for the last 4 days.

Thus, over the short-term, it seems likely that Bitcoin is en-route to have a go at $7,400, which is the most immediate resistance that the digital asset has struggled to flip to support over the past week.

Key resistances must become support

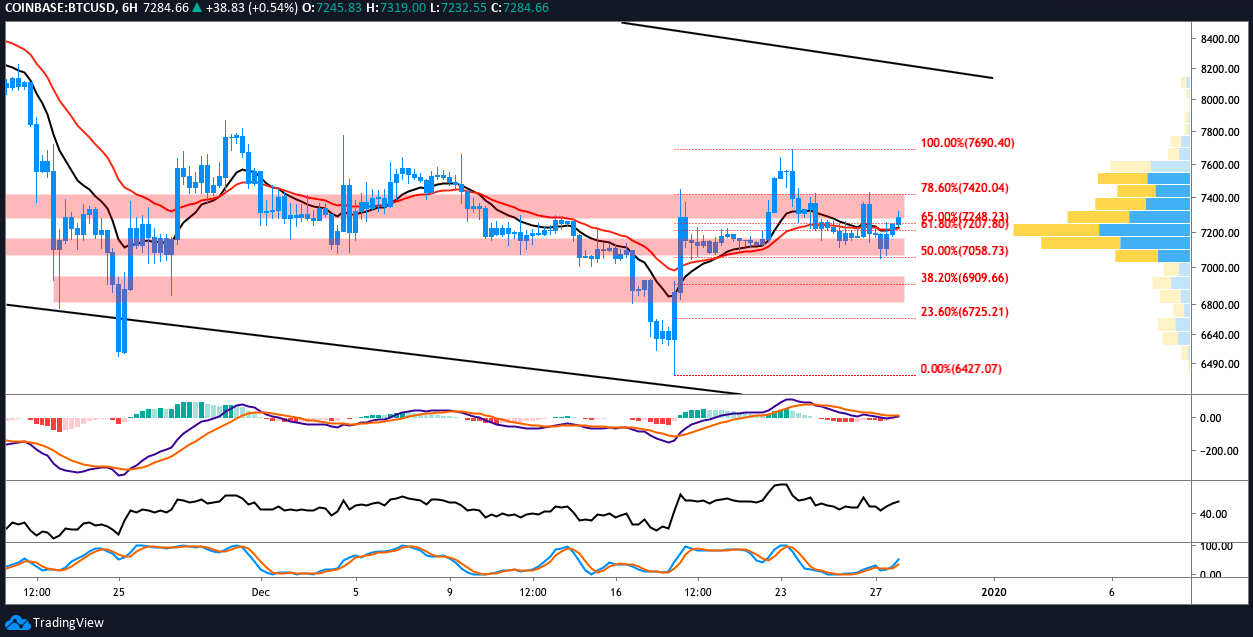

BTC USD 6-hour chart. Source: TradingView

Further short-term bullish evidence can be drawn from the 6-hour timeframe where the moving average convergence divergence (MACD) is on the verge of a bull cross with the signal line pulling above 0 and the histogram is coming closer to flipping positive.

Traders will also notice the “three white soldiers” candlestick pattern on the 6-hour chart. Cointelegraph contributor Scott Melker recently wrote that this pattern often marks the reversal of a short-term downtrend.

Traders who rely on moving averages for insight will notice that the 12 and 26-period exponential moving averages have converged on the 6-hour timeframe. While on the daily timeframe the price is pinched between the two as the 12-EMA inches closer to the 26-EMA.

BTC USD daily chart. Source: TradingView

While momentum is building and Bitcoin looks bullish on the shorter timeframes, the price will need to sustain above $7,290 and flip $7,300 to support in order to take another shot at the $7,400 resistance.

The views and opinions expressed here are solely those of the author (@HorusHughes) and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.