Photo: Shutterstock

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- The Bitcoin may have hard time in July.

- The largest South Korea bank to start using cryptocurrency.

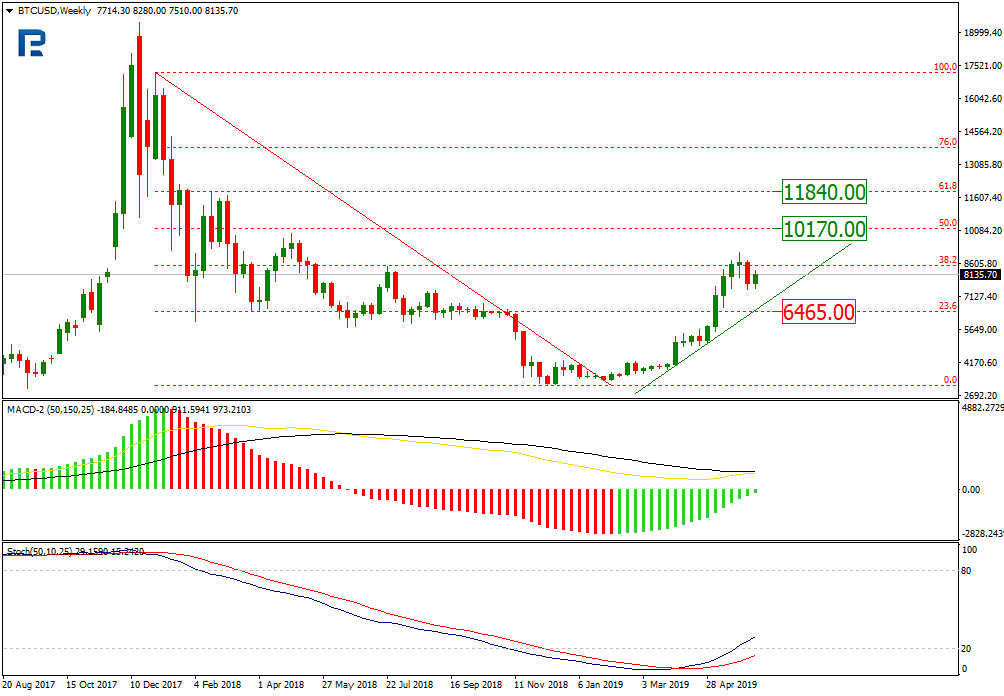

On W1, the major crypto reached 38.20% Fibo, and the uptrend stopped. The new target may lie at $6465, which is the support. Still, the Stochastic is definitely up after forming a golden cross, so the BTC may continue rising to 50% and 61.80% Fibo, or $10,170 and $11,840, respectively.

Photo: Roboforex / TradingView

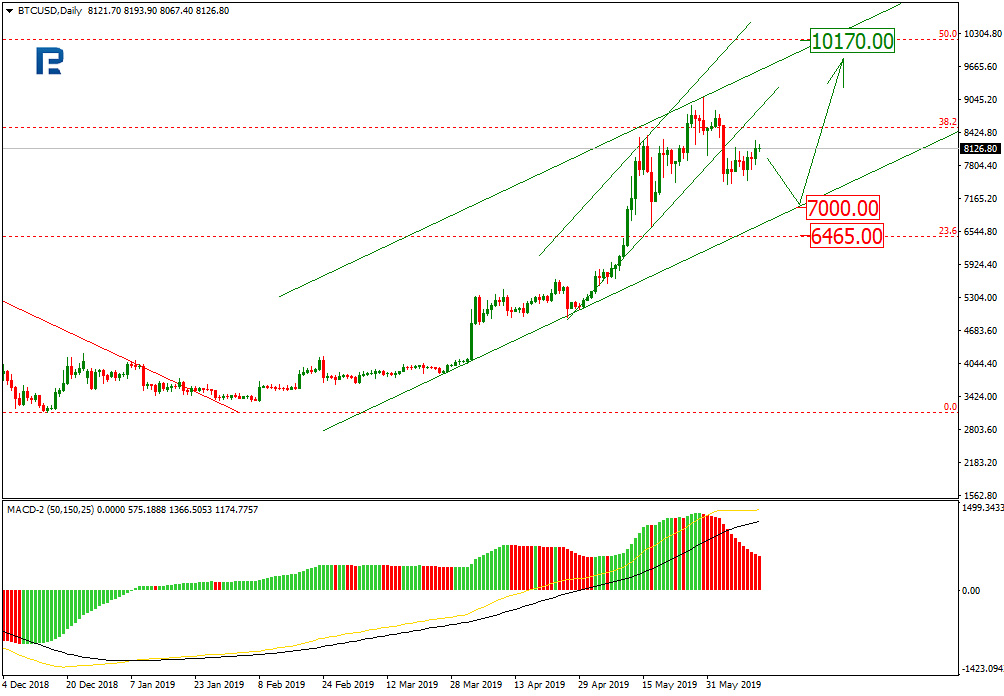

Photo: Roboforex / TradingViewOn D1, the BTC is aimed at the current channel support, or the round number of $7,000. After reaching it, the Bitcoin is likely to bounce up to $10,170. The MACD is not issuing any reversal signals, confirming the midterm rise.

Photo: Roboforex / TradingView

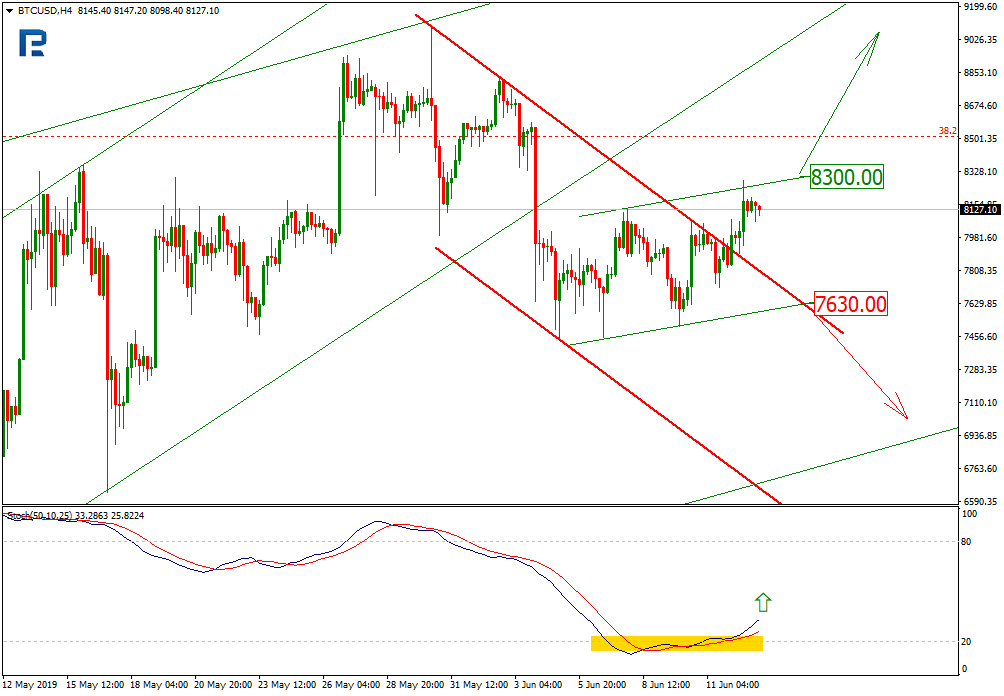

Photo: Roboforex / TradingViewOn H4, the crypto broke out the descending channel resistance, thus complicating the things. On the one hand, this may signal the downtrend is over and an uptrend is likely to start; on the other, a range trading pattern is also possible, in which case it will act as a correction sideways trading pattern after the falling impulse. This may send the BTC again between the support at $7,630 and the resistance at $8,300. The Stochastic, meanwhile, has left the oversold territory and is going up, which may signal a local resistance breakout and a rise to $9,090.

Photo: Roboforex / TradingView

Photo: Roboforex / TradingViewAn analyst nicknamed as Cane Island Crypto says the BTC may face issues in July, adding that summer in general is a hard season for the flagship crypto. Cane Island Crypto points out that a rise in June means a rise in general, with a 75% likelihood. With a fall in early summer, however, the likelihood of the fall continuing in July and August is 100%.

The historical data are quite a good source of information, but not that much in case of cryptocurrencies, as we still don’t have sufficient data.

Meanwhile, Kookmin, the largest South Korean bank is going to start working with cryptos. Namely, the bank has partnered with Atomic Labs in order to arrange appropriate crypto storing and launch a joint custodian service involving cryptocurrencies. Bank infrastructure and safe crypto storage combined mean an innovative advantage, especially for the Asian market, where the BTC is definitely going to take the lead.

Disclaimer: Any predictions contained herein are based on the authors’ particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held Company for the results of the trades arising from relying upon trading recommendations and reviews contained herein.