On Thursday, December 10th, the BTC is correcting, trading at 18,478 USD. This is a pause to put your nerves “in order” – you will definitely need them later.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- Tech analysis of BTC/USD

- The BTC dynamics might be dangerous for gold

- The BTC is aiming deeper into our daily life.

On W1, the BTC keeps correcting from 100.0% Fibo. The aim of the pullback might be the nearest support level of 18,000 USD. The MACD histogram is in the positive area, which is another signal for the growth of the price. The signal lines of the indicator have formed a Black Cross and go on growing, supporting the development of the ascending dynamics. The Stochastic is in the overbought area, providing an opportunity for a correction in the nearest future. All these factors taken together suggest that after a correction the pair will resume the growth.

Photo: RoboForex / TradingView

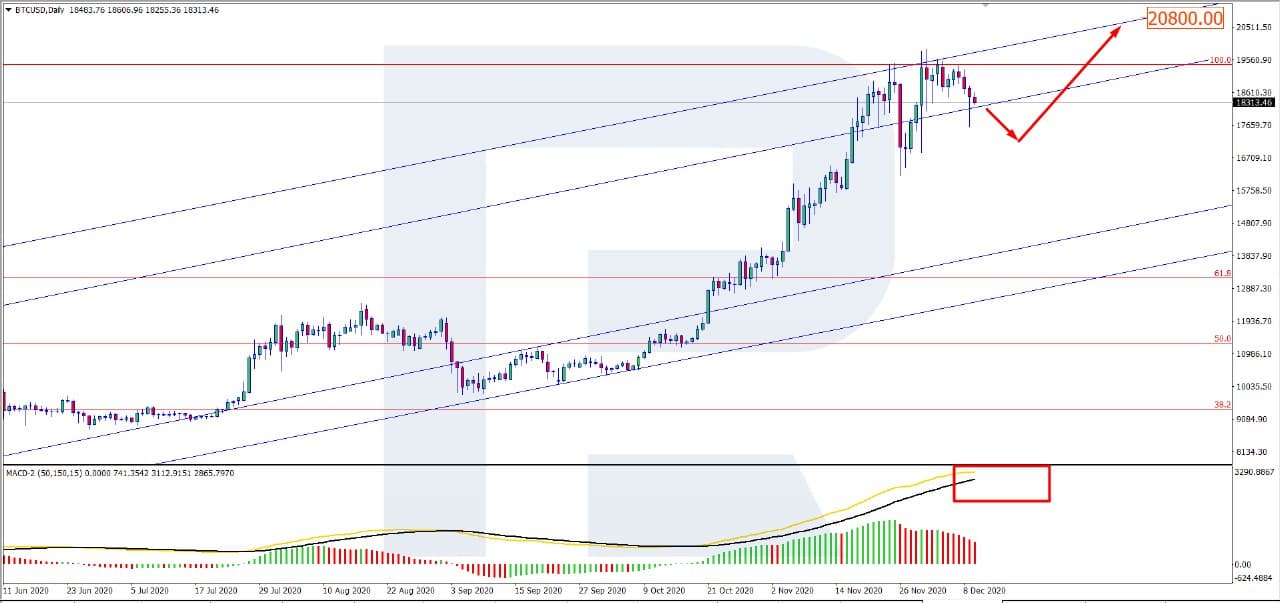

On D1, the technical picture reveals further development of the correction. The quotations have bounced off 100.0% Fibo. The aim of the growth after a pullback and breakaway of the upper border of the ascending channel is 20,800 USD. The MACD histogram is above zero but is declining slightly, which hints at a correction before further growth. The signal lines of the indicator are forming a Black Cross, supporting the idea of the correction. Judging by all the factors, a correction to the resistance level during growth looks probable. The aim of the uptrend after the correction remains 20,800 USD.

Photo: RoboForex / TradingView

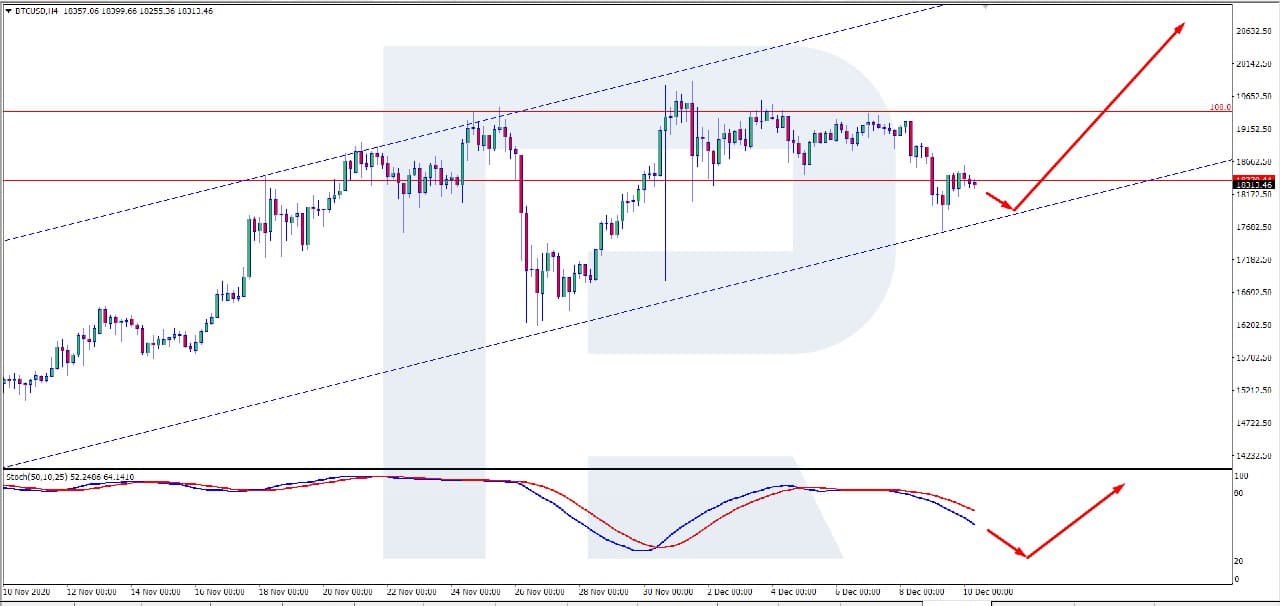

On H4, the perspectives for growth after the correction are also bright. The Stochastic keeps declining to the oversold area, signaling a pullback. The aim of the decline might be the support level of 18,000 USD. The aim of the growth after the correction is, again, 20,800 USD.

Photo: RoboForex / TradingView

The latest steep increase in the BTC price made watchers look for parallels with the world of fiat assets to forecast the future. For example, several users (such as JPMorgan) named the falling of the BTC a risk for gold as well.

Well, the leading cryptocurrency demonstrated impressive dynamics, few market assets can boast such achievements. During this period, the gold price fell by 10% on average (to 1,800 USD from 2,000 USD).

What is the danger here? One thing is that investors holding their positions in gold for long might decide to switch for a more dynamic asset – the BTC – and the price of “archaic” gold will drop significantly. The risky part is that it might be not a light breeze of change in market moods but a strategic decision. This might become a revolution in the world of protective assets.

For most of us, 2020 has become a time of trouble rather than a transition stage to some new stage of development. However, with the BTC, it is quite the opposite. It is already obvious how fast the BTC is entering the main financial market, and quite traditionally: the wider an asset is used in daily life, the better it develops. Moreover, any devaluation of fiat assets is known to lead to a surge in the interest in alternative assets. This must be what is going on with the BTC. And there must be much interesting to follow.

For this article, we’ve used BTCUSD charts by TradingView.

Disclaimer: Any predictions contained herein are based on the authors’ particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.