Bitcoin is stable after a volatile Wednesday and mostly trading at $51,220.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- BTC/USD technical analysis.

- MicroStrategy is investing $900 million in BTC.

- SynBiotic SE is converting some of its funds into BTC.

The weekly chart of Bitcoin shows the ascending tendency with the target at $57,000. The MACD signal lines are moving upwards within the histogram area as they have already formed the “Black cross”, and that’s another signal in favor of further growth. At the same time, the Stochastic Oscillator has also the “Black cross” within the “overbought area”, thus leaving room for a correction on the price chart in the nearest future. All these factors taken together let us assume that the cryptoasset may form a slight pullback towards 23.6% fibo and resume trading upwards after finishing this correction.

Photo: RoboForex / TradingView

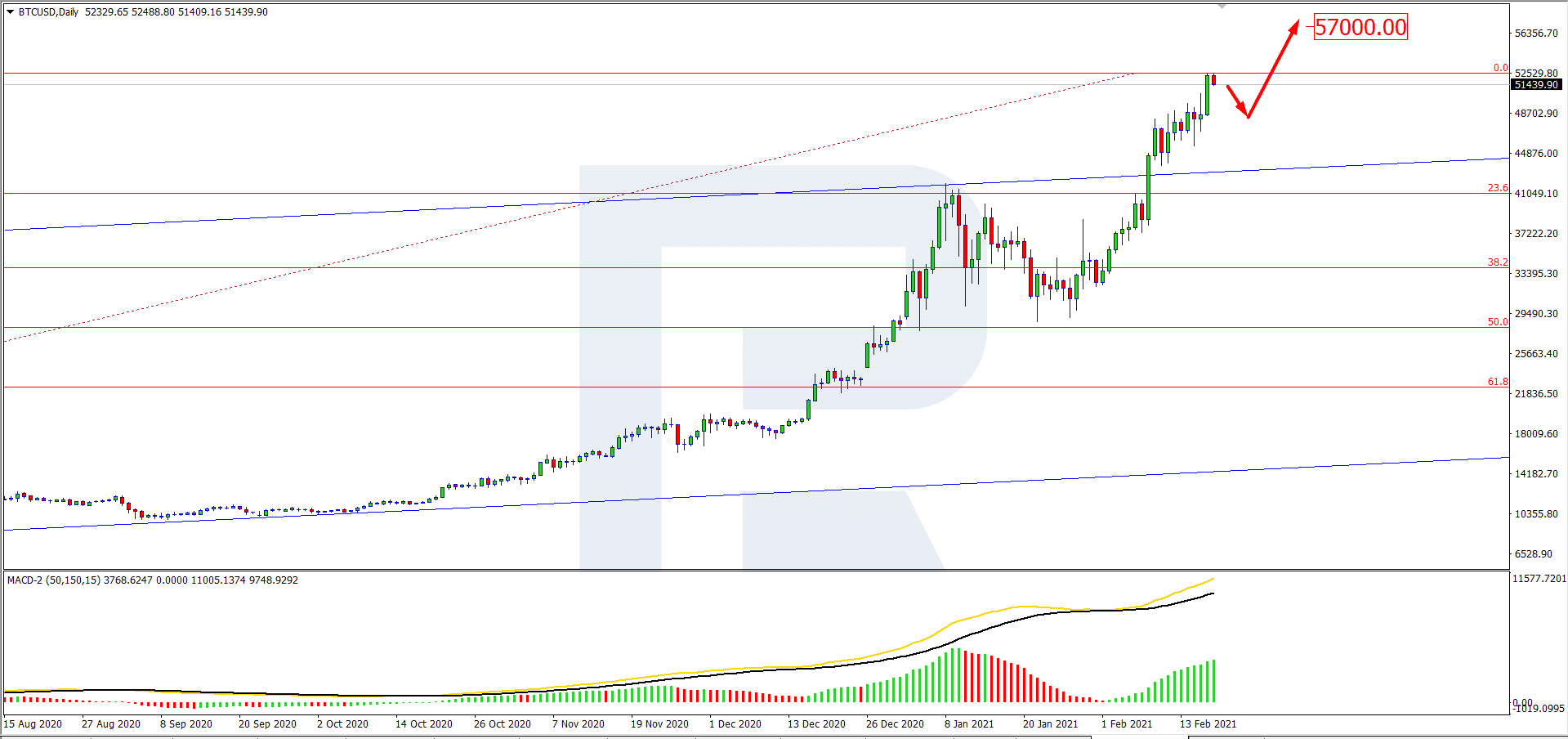

In the daily chart, BTC/USD is starting a new correction. The MACD histogram is moving upwards, thus implying a further uptrend. The indicator’s signal lines are forming the “Black cross”, which is a signal in favor of the correction. All these factors say that the asset may correct on its way towards the resistance area. The upside target here is the same as in the weekly chart, $57,000.

Photo: RoboForex / TradingView

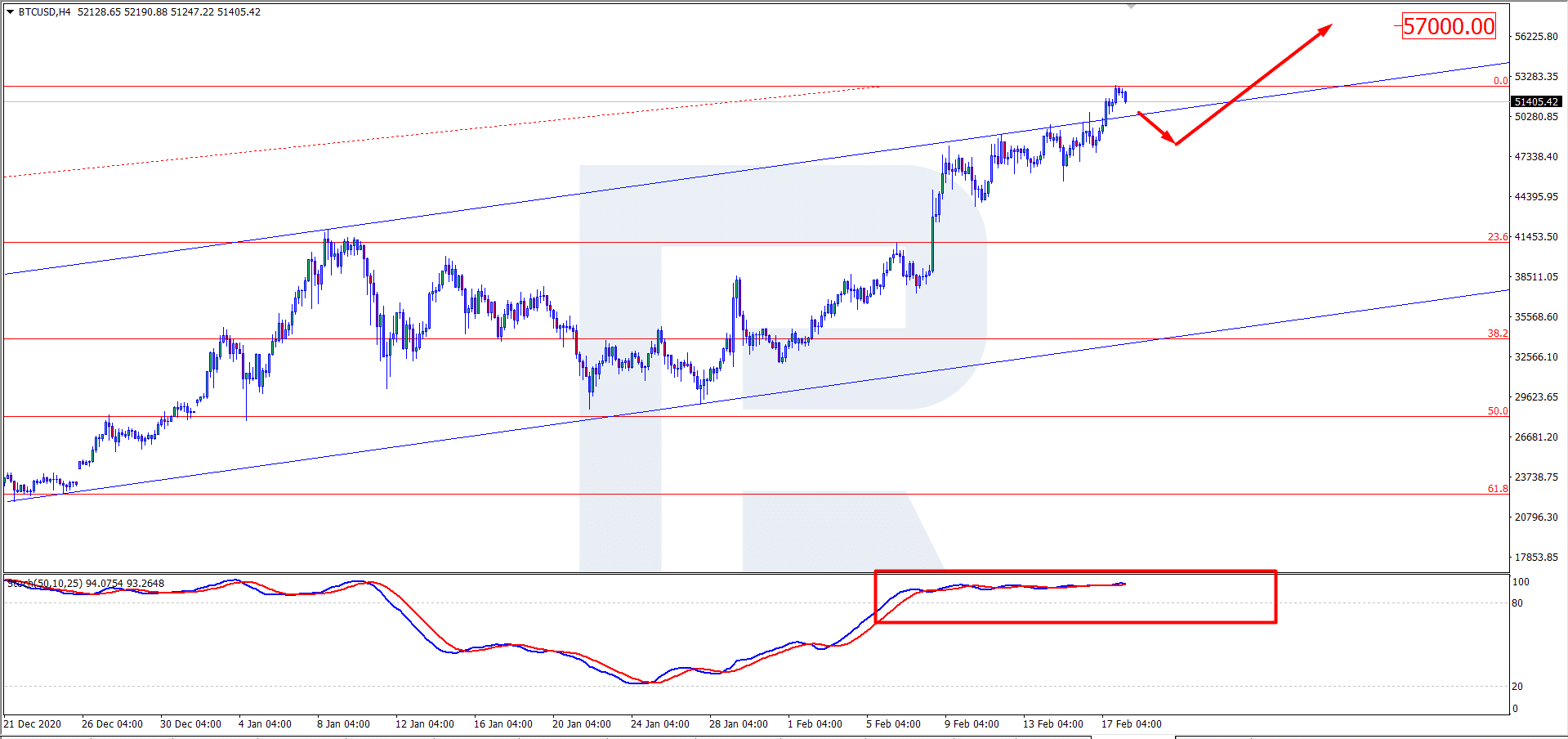

As we can see in the H4 chart, BTC/USD has broken the ascending channel. The Stochastic Oscillator is moving close to 80, thus increasing the chances of the correction. Judging by the previous movements, one may assume that the pair may form another slight correction and then resume the ascending tendency. after completing the correction, the cryptocurrency is expected to continue growing with the same target as above, $57,000.

Photo: RoboForex / TradingView

According to MicroStrategy, the company is planning to increase its investments in BTC by $300 million, up to $900 million. At first, it was assumed that investments in the cryptocurrency would be around $600 million. To do this, MicroStrategy announced a sold-out of its convertible senior notes due 2027 or, subject to certain conditions, in 2024. As a result, the company may receive from $880 million to $1 billion, depending on whether investors exercise the right of redemption of additional bonds. MicroStrategy also retains the opportunity to buy BTC for an additional $150.

In such a way, MicroStrategy keeps the status of a public company that owns the digital currency. Investments in the cryptoasset yield MicroStrategy a profit: in 2020, the company earned $2.3 billion on buying BTC.

This week’s Bitcoin rally was supported by the information that the German company called SynBiotic SE decided to convert some of its funds into cryptocurrencies, BTC in particular. The decision is based on fears of further USD and Euro devaluation. According to the company’s CEO, they have more long-term confidence in bitcoin than in euros or dollars where a central institution, influenced by politicians, can expand the money supply immeasurably.

As a result, cryptocurrencies become ingrained in our everyday lives being both a promising investment and a way to hedge risks.

For this article, we’ve used BTCUSD charts by TradingView.

Disclaimer: Any predictions contained herein are based on the authors’ particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.