Photo: Unsplash

Current Bitcoin price rally could soon retest the all-time high of $20,000. The head of operations at OKEx, a Malta-based cryptocurrency exchange called $20,000 a “conservative prediction.” According to him, a majority of the speculators will hold their long positions now that Bitcoin is rising. The token has rebounded by at least 180% from its bottom of $3,120 in just 163 days.

He explained:

“$20,000 is a conservative prediction for Bitcoin price this year, as I said last year. The rally won’t stop here since more institutional investors are joining the market, and the 2020 halving effect starts to take place. We are excited to witness such [a] bullish trend, and I look forward to a new high that the Bitcoin deserves. Bitcoin is not just a digital coin but a spirit that hinders the crypto-industry.”

Trying to get them to accept BTC or other cryptocurrency instead of being a Fiat only Cafe :p pic.twitter.com/b7SEJh347E

— Andy Cheung OKEx (@AndyC0125) May 17, 2019

HODLERS Gaining Confidence

Cheung was speaking after Bitcoin’s Monday rally that saw the cryptocurrency reach fresh 2019 highs close to $9,000. The rally took Bitcoins gains for the year to 140% which includes a 120% jump in the past two months. The profits were a reminder of some of the most essential benefits experienced in the December 2017 price boom.

During the 2017 rally, it took Bitcoin just 10 days to get to $20,000 as its all-time high. The price jumped after it had closed above $8,300. Nevertheless, the dynamics surrounding the current boom are quite different from those in the previous ones. Bitcoin surged close to 219% in Q4 2017 due to the infamous ICO mania.

At that time, investors bought BTC not for holding purposes but to purchase tokens issued by the then-emerging blockchain start-ups. Reports show that most of these firms failed. Thus, they could be the reason why Bitcoin crashed by over 75% in 2018 since they might have sold off the tokens acquired from their crowdfunds.

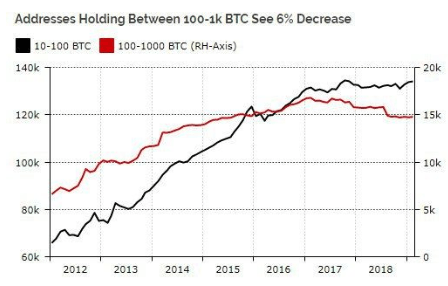

However, investors are currently buying bitcoin to hold instead of giving away for other assets like it was the case in 2017. Diar reported in February that the number of bitcoin holders was increasing. Diar also noted that the number of wallets holding 100-1,000 BTC was declining. The decline could be as a result of fund distribution.

The CEO of Xapo, Wences Casares, stated in another study that around 60 million wallets are holding Bitcoin. Statistics confirm that some BTC traders could be waiting for the big whales to drive Bitcoin toward $20,000. Casares said:

“After 10 years of working well without interruption, with over 60 million holders, adding more than 1 million new holders monthly and moving more than $1 billion per day worldwide, [Bitcoin] has a good chance of succeeding.”

John McAfee’s $1 Million Price Prediction

John McAfee, the self-proclaimed ‘mad man’ has stuck to his call for BTC to rise past $1 million before 2021. As we reported earlier, McAfee thinks that Bitcoin will replace fiat in receipts and payments making its price to rise. The billionaire crypto evangelist got an unlikely ally in his super-bullish crusade: the “Bitcoin time traveler” who McAfee claims has “never been wrong.”

I’m not the only madman in crypto apparently. $1 mil prediction by 2021 by the man who has never been wrong in his predictions.. 2021 us just one day away from my prediction of $1 mil by 12/31/2020.https://t.co/9dafiU4P9R

— John McAfee (@officialmcafee) May 28, 2019

Although a time traveller is rarely a credible source, his famous post shows that he certainly has been largely correct so far. These predictions are quite broad and the ‘time traveler’ might not have envisioned Bitcoin at $8,800 in May 2019. Nevertheless, McAfee is sold and does not care where the information comes from as long as it supports his predictions.

A few accurate forecasts are nowhere close enough of a significant sample size to imply that someone has an edge. The secret to the direction that the price of Bitcoin will take is hidden in time; only time will tell.