After a flash surge to $10,800 on BitMEX, the most widely utilized margin trading platform for cryptocurrency traders, the bitcoin price has slipped back to the $9,900 to $10,300 range.

On major spot cryptocurrency exchanges like Bitstamp and Coinbase, the bitcoin price rose to as high as $10,650 on Monday, following the liquidation of nearly $52 million worth of short contracts on BitMEX.

Support at $8,000 Becoming More Likely For Bitcoin Price

According to technical analysts, if the bitcoin price fails to close above a key psychological level at $10,000 in the near term, it is likely to test strong support levels in the $8,000 region.

“The price compression is reducing gains from swing lows to swing highs: 86%, 36% and recently only 15%. Wanting price to keep closing above $10,025. Large gap in VPVR (supply/demand and areas by price) and if the price breaks down, lots of interest right below $8,000,” said Rager.

Similarly, in late August, technical analyst and trader DonAlt noted that if the bitcoin price struggles to reclaim an important resistance range in $10,300 to $10,400, it is expected to slip to the $8,000 region.

“Rejected by resistance, bought up in support. If $10,800 gives way I think we see $11,700 again. If current support at 10400 does, I expect $8,000. Looks weak but looks too good to short. Once this trading range resolves one way or the other the chop will end,” DonAlt said subsequent to a fall below $10,700.

Not All Analysts Are Bearish

Murad Mahmudov, the head of investments and trading at Adaptive Capital, a multi-strategy cryptocurrency hedge fund, stated that $10,000 is likely to hold stable for bitcoin in the upcoming months as a strong support level.

While many analysts anticipated $10,000 to break down as $6,000 did in December 2018, Mahmudov said that it is likely to trigger an extended upside movement.

“‘~10K is the new ~6K,'” but instead of breaking down it will hold and start grinding UP. You heard it here first,” he said.

Last week, prior to the flash surge of bitcoin, Mahmudov added that the MACD bear cross, which has been recognized as a bearish indicator for bitcoin, could be considered as an indicator for a local bottom.

“People out here be talking about the Weekly MACD ‘bear cross’ like its some kind of a doom verdict. Ironically it marked the local bottom every single time during the last bull cycle. I repeat for the last time. This is a BULL market,” he added.

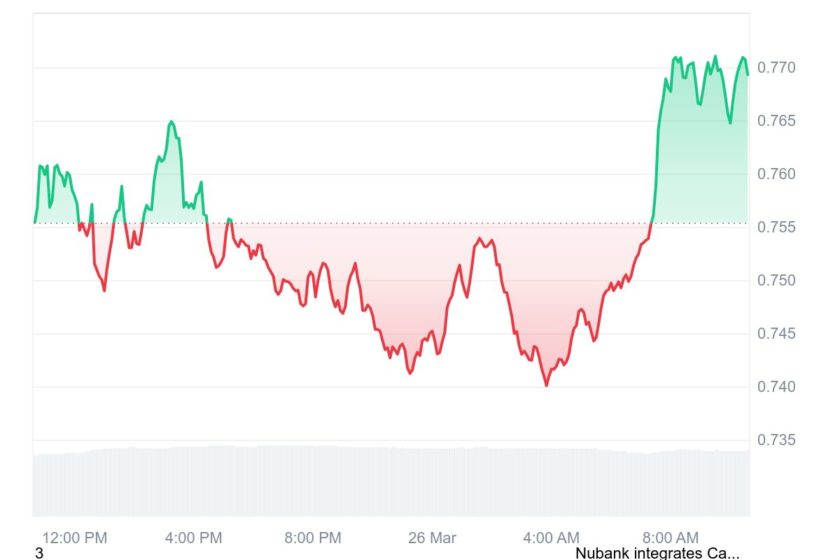

Click here for a real-time bitcoin price chart.