The Federal Reserve will hold its next policy meeting tomorrow, and analysts predict that the US central bank will adopt its second straight interest rate cut. That move should bolster the stock market, but does it mean anything for bitcoin?

Will Interest Rate Cut Ignite Bitcoin Price Boom?

Nigel Green, the founder of $10 billion wealth advisor deVere, says that the Fed’s ongoing dovish pivot should snap the bitcoin price out of its recent slump and launch it to a new yearly high.

“Bitcoin, the world’s largest cryptocurrency by market cap, is likely to breakout of its recent sideways trading pattern and be given a healthy boost by the Fed’s rate cut,” Green said in remarks shared with CCN. “This is because an interest rate cut reduces the incentive to keep the fiat currency. In addition, rate cuts typically lead to higher inflation, which reduces the purchasing power of traditional currencies.

“As such, Bitcoin, and other decentralized cryptocurrencies, become more attractive and the price will adjust upwards accordingly,” Green added.

If this story sounds familiar, that’s because you’ve heard it before.

In theory, dovish central banks are bullish for disinflationary assets like bitcoin. Over time. But that doesn’t necessarily mean that BTC will operate as a real-time hedge against specific central bank policy adjustments.

Just look at what happened two months ago.

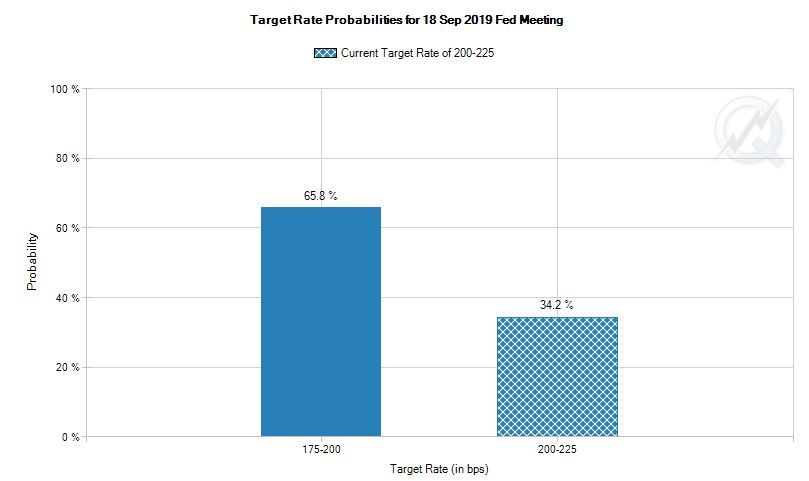

As the July Federal Open Market Committee (FOMC) meeting loomed, crypto investors waited with bated breath to see how the bitcoin price would respond to the Fed’s interest rate cut – the first in the asset’s lifetime.

This rabid optimism ignored that bitcoin had never reacted to the numerous rate hikes the Fed had adopted over the past decade, and – surprise! – the central bank’s policy meeting appeared to have no fundamental impact on BTC’s trajectory.

Will this time really be different?

Geopolitical Risks Could Leave Investors With an Equities Hangover

Even discounting his Fed prediction, Green remains wildly bullish on bitcoin, anticipating that the hangover from a cocktail of geopolitical issues will persuade investors to imbibe crypto instead.

The deVere CEO identifies Brexit and the US-China trade war as specific catalysts that could bolster bitcoin while muting returns in equities and other markets.

He said:

“[G]eopolitical issues, such as the U.S.-China trade war and Brexit, are intensifying and investors will increase exposure to decentralized, non-sovereign, secure digital currencies, such as Bitcoin, to shield them from the turmoil taking place in traditional markets.”

As CCN reported, bitcoin hasn’t lived up to its reputation as a macroeconomic hedge, at least not yet. However, it’s possible that’s beginning to change. In late August, the bitcoin price appeared to react in real-time to President Trump’s announcement that he was raising tariffs on Chinese imports.

Consequently, this prediction from Green has a more robust foundation than his FOMC forecast. But other analysts have differing opinions on the relationship between bitcoin and the stock market.

Tom Lee: Don’t Root for Stocks to Tank

Like Nigel Green, Wall Street strategist Tom Lee is unashamedly bullish on bitcoin. However, his positive forecast relies on a vastly different argument.

While Green believes stock market turmoil will send investors piling into bitcoin, Lee – the co-founder of Fundstrat Global Advisors – says the dominant cryptocurrency needs equities prices to continue rising before it can achieve a new all-time high of its own.

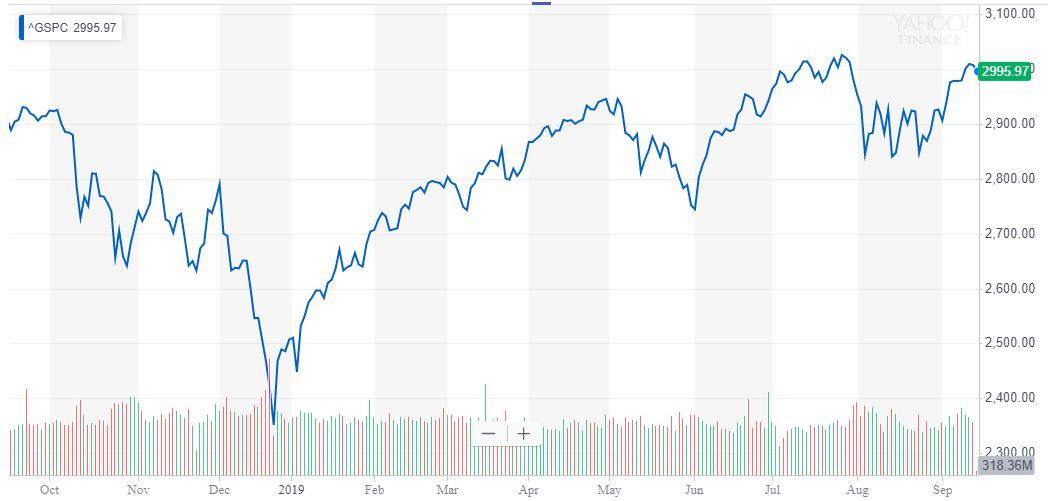

Noting that bitcoin’s best years have correlated with substantial gains in the S&P 500, Lee said that a “decisive breakout in…equity markets” could transform bitcoin into a “risk-on asset.”

Unpopular opinion, Bitcoin won’t make a new high until S&P 500 makes a new high.

– $BTC has been rangebound because macro trendless. Confirmed by our Bitcoin Misery Index falling from 66 (50 now)

– Since 2009, best years for Bitcoin is when S&P 500 >15% #Bitcoin#BTFD pic.twitter.com/1gWqZlnxfE

— Thomas Lee (@fundstrat) September 12, 2019

For evidence that bitcoin won’t necessarily shine in a risk-off environment, one need look no deeper into the history books than 2018.

Having spent the first three-fourths of the year grinding lower, the cryptocurrency market sell-off only seemed to quicken when equities plunged during the last three months of 2018.

Bitcoin’s ensuing recovery didn’t gather steam until well after the mood on Wall Street had turned bullish.

Past performance isn’t indicative of future results, but it appears that although bitcoin might one day prove to be digital gold, it’s not there yet.

Last modified (UTC): September 16, 2019 3:43 PM