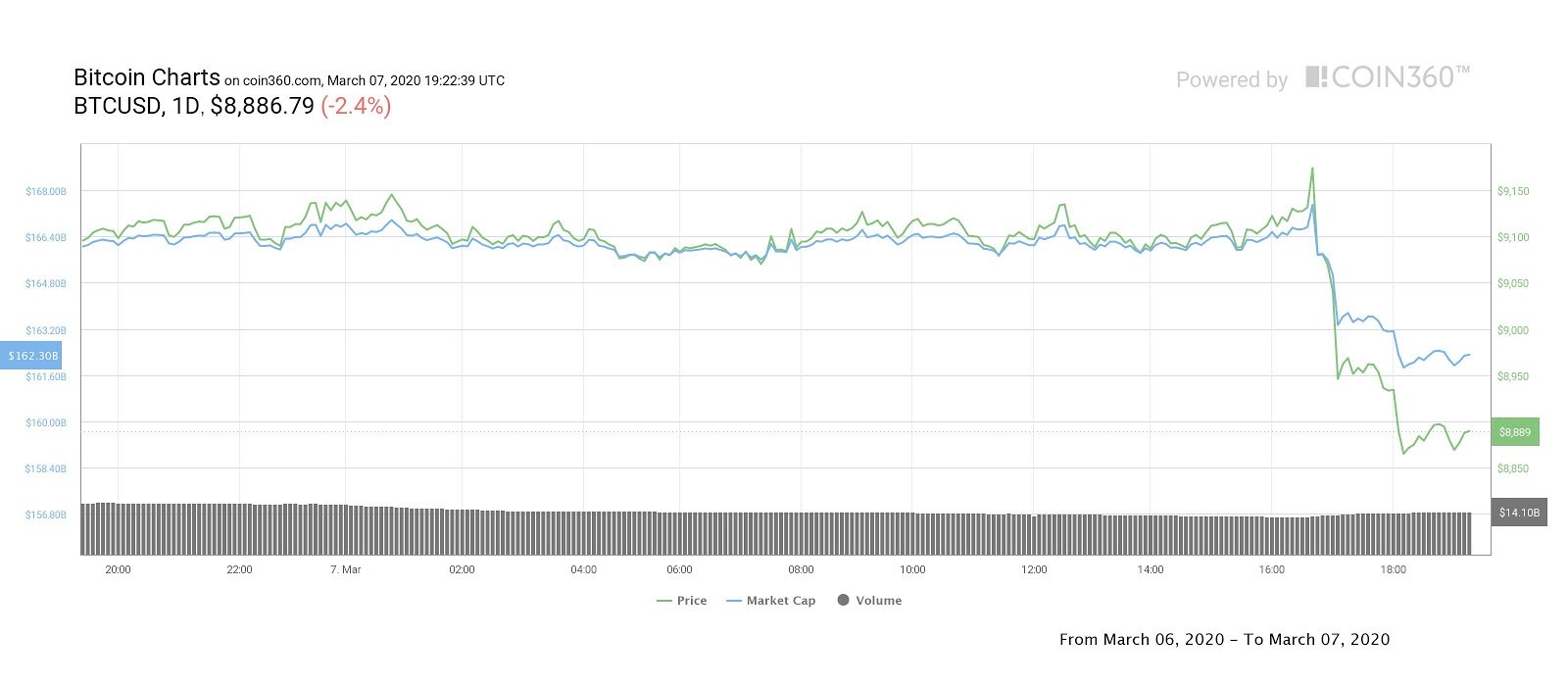

In the past few hours, Bitcoin (BTC) price dropped 3.85%, losing $9,000 and pulling back to $8,835.

The abrupt downside move occurred after Bitcoin price rallied to $9,188, slightly above the $9,150 target many traders had suggested the asset would reach before attempting a more decisive move toward $9,300.

Crypto market daily price chart. Source: Coin360

Traders had anticipated a rejection at either $9,150 or $9,300 and at the time of writing the daily timeframe shows the price holding above the 20-MA of the Bollinger Band indicator at $8,858.

BTC USDT daily chart. Source: TradingView

If the $8,900 support cannot be reclaimed, it’s possible that the price could drop to the 200-day moving average at $8,695 and below this the frequently tested support at $8,400 where the 128-DMA resides.

According to Cointelegraph contributor Michaël van de Poppe, a possible bearish scenario that could play out after the rejection at $9,150 would involve Bitcoin price failing to hold the 21-week moving average at $8,676.

BTC USD weekly chart. Source: TradingView

“Losing that zone and we’ll see momentum and $8,200 retest downwards as the primary possible outcome,” Van de Poppe explained. However, he emphasizes that from a macro perspective, Bitcoin’s market structure is more inspiring than worrying and explains that:

“The market has seen a big rally in the first weeks of this year, a retracement and correction are only healthy for a sustainable continuation of the market.”

In the short-term, holding the zone between the 200-DMA and $8,900 support is crucial or a retest of the $8,400 support is likely. A weekly close below the 21-WMA ($8,676) would raise concern as it is a closely watched level by many traders.

But currently, Bitcoin is yet to make a lower low under the $8,400 support so a short phase of consolidation leading to another retest of the $9,150 resistance seems more likely than a drop below key support levels.

Bitcoin daily price chart. Source: Coin360

As Bitcoin price pulled back, the bulk of top-20 altcoins followed suit by pulling back 3% to 5%. Bitcoin Cash (BCH) pulled back 4.16%, Litecoin (LTC) dropped 2.67%, and Binance Coin (BNB) and Tron (TRX) dropped 5.03% to 5.78%, respectively.

The overall cryptocurrency market cap now stands at $256.6 billion and Bitcoin’s dominance rate is 63.3%.