Bitcoin has nearly halved in value since peaking near $69,000 on Nov. 10, predominantly due to fears of faster Fed tightening. The cryptocurrency’s fortunes are closely tied with the equity markets, with the 60-day correlation between the two assets now at 65% versus virtually zero in 2017. The sensitivity to stock market gyrations and macro factors like central bank decisions perhaps stems from increased institutional participation. Besides, bitcoin has been one of the inflation trades.

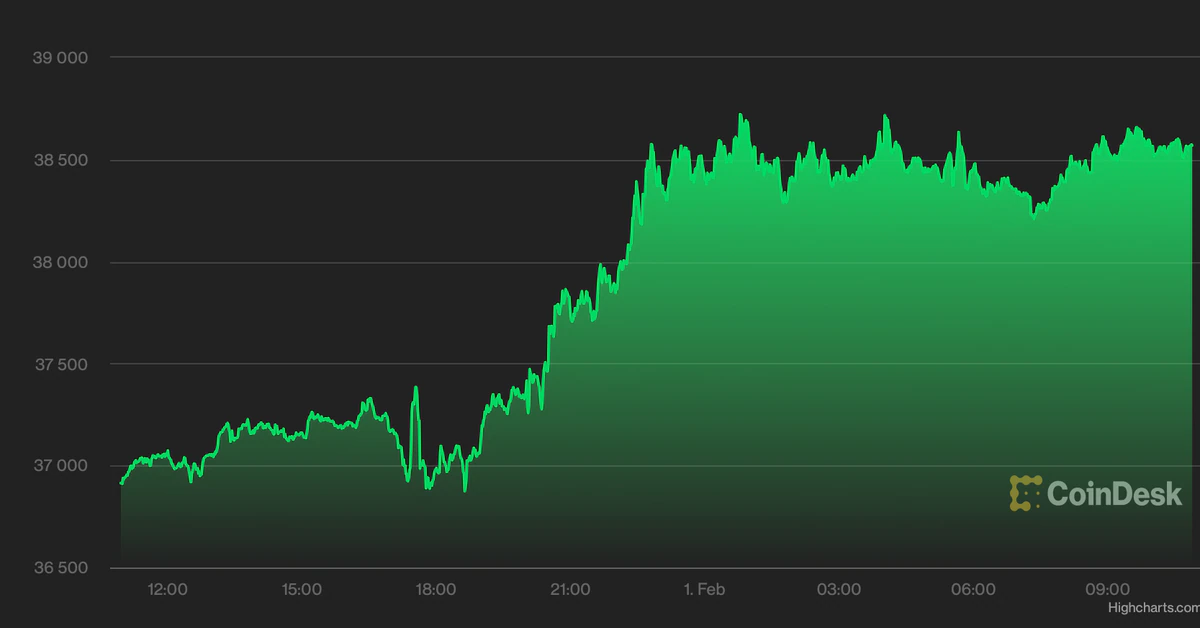

Bitcoin Steady Near $38.5K as Australian Central Bank Ends Easing Program