Bitcoin almost hit the $90,000 mark earlier today and became the eighth-largest asset in the world.

Bitcoin (BTC) reached an all-time high of $89,604 earlier today as the broader crypto market enjoyed impressive gains — the global crypto market cap also hit an ATH of $3.11 trillion.

Following the rally, Bitcoin’s market cap surged to $1.77 trillion, surpassing silver’s $1.7 trillion value, and sitting close to the $1.8 trillion market cap of Saudi Aramco, a national Saudi Arabian petroleum and gas company.

One reason was the $1.1 billion net inflows into the U.S.-based spot BTC exchange-traded funds on Monday, Nov. 11.

Bitcoin’s whale transactions also surpassed the $100 billion mark yesterday, data from IntoTheBlock shows.

Large waves of whale transactions often trigger the fear of missing out among retail investors, triggering huge inflows.

The road to $100k

Bitcoin’s upward momentum seems to have cooled down after nearing $90,000. This is a natural cycle as some investors will take profits following massive gains.

A poll with a $238,000 volume on Polymarket shows a 40% chance of Bitcoin surpassing $100,000.

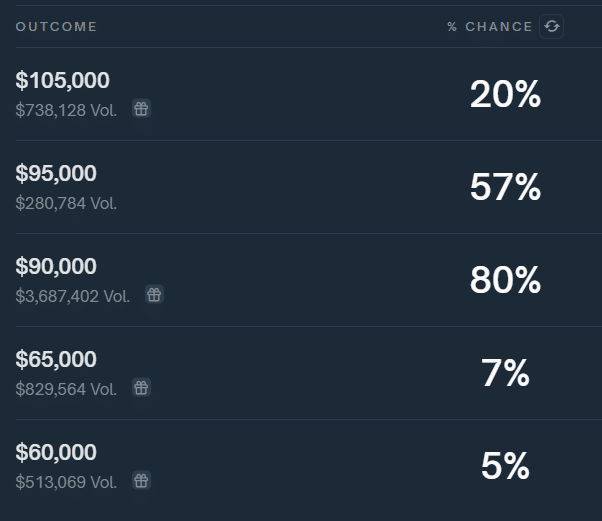

Another ballot, with a betting volume of $3.6 million, suggests an 80% chance of BTC reaching $90,000. The odds of Bitcoin touching $95,000 and $105,000 are sitting at 57% and 20%, respectively, the poll data shows.

On Kalshi, a market prediction platform, the chance of the BTC price achieving the $100,000 mark remains at 45%.

Bitcoin is currently trading below $87,000 as the broader market is also showing signs of a cool-down.

The global crypto market cap also declined to $3.08 trillion, according to CoinGecko data.

The incoming U.S. Consumer Price Index report for October, scheduled for Nov. 13, could either strengthen the bull run or potentially change its direction. The CPI report shows the inflation rate in the U.S.

The CPI for September came at 2.4% and is expected to reach 2.6% for the previous month, according to Trading Economics data. Notably, the inflation report is one of the most important factors in the December interest rate decision-making.