Since March 2020, the Fed has been buying assets worth $120 billion a month via a monetary-stimulus program known as quantitative easing, or QE. The program, launched to contain the economic fallout from the coronavirus pandemic, triggered unprecedented asset price inflation. Bitcoin, for one, charted a 10-fold rally to $64,801 in the 12 months to April 2021.

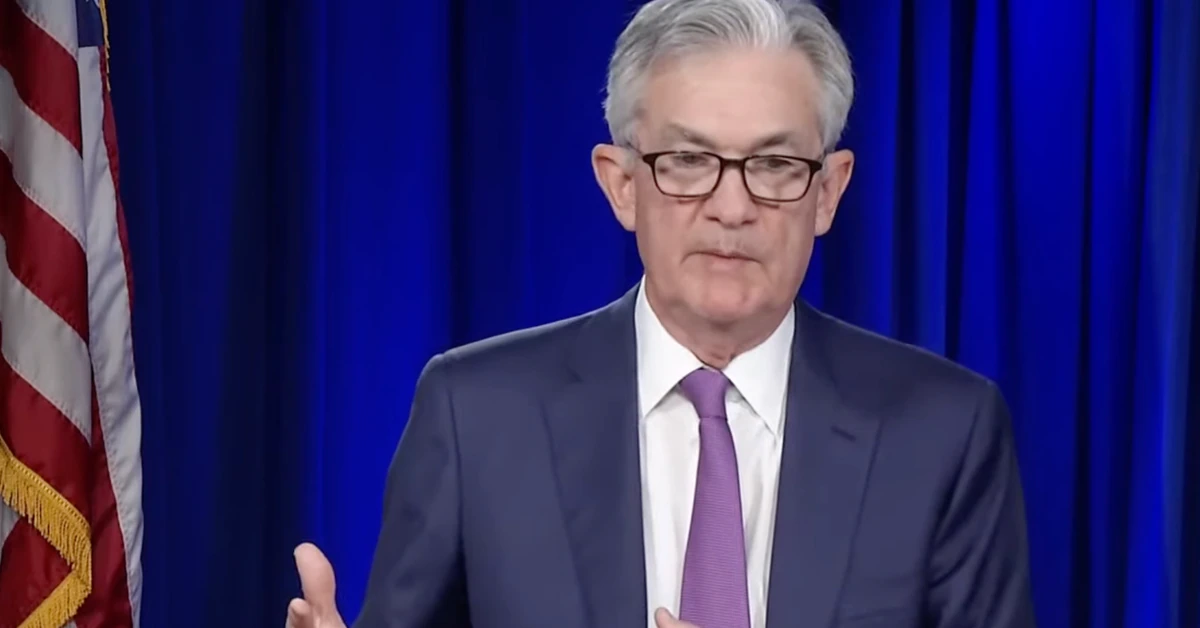

Bitcoin to Remain Resilient to Fed’s Impending Taper: Analysts — CoinDesk