Bitcoin flipped into positive territory ahead of the New York opening bell, tracking US stock futures’ gains as investors pinned hopes on Washington’s economic relief package.

The benchmark cryptocurrency jumped 1.48 percent from its Asian session intraday low of $19,051. Its move uphill took it up to $19,333, raising prospects that it would retest the weekly resistance area above $19,500 in the US session to attempt an extended move towards $20,000.

Bitcoin is trading inside an Ascending Triangle channel pattern. Source: BTCUSD on TradingView.com

The moves matched the ones in the US stock derivatives market. For instance, futures tied to the S&P 500 rose 0.6 percent in the pre-trading US session, pointing the benchmark stock index may open higher after falling consecutive for four days. Similarly, Nasdaq futures also jumped 0.4 percent.

Stimulus

A bipartisan group of US senate urged Congressional lawmakers on Monday to pass a $748 billion stimulus package for struggling American households amid fresh lockdowns and a rising number of COVID-19 infections. Investors anticipated that Congress would pass an interim package before the holiday season.

“It’s very tight,” Hani Redha, a portfolio manager at PineBridge Investments, told the Wall Street Journal. “There are decent odds we will still get something in the lame-duck session, which would obviously be a great bridge over to the spring.”

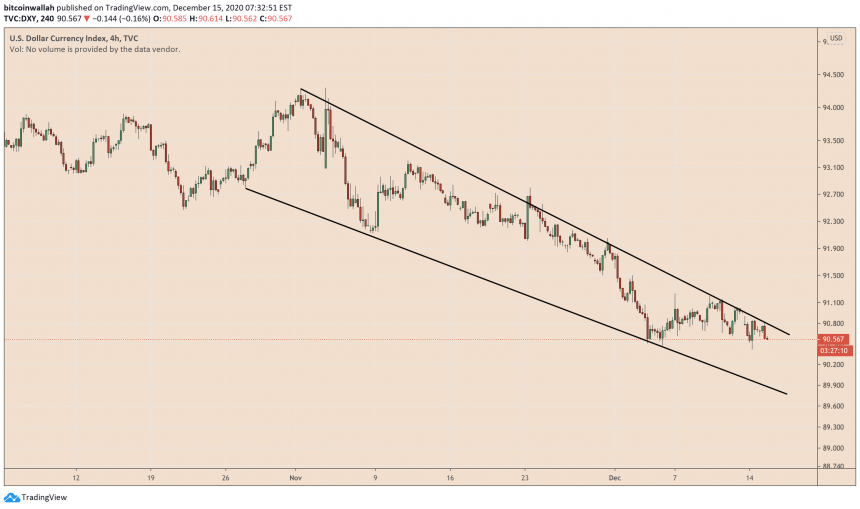

The second COVID-19 relief bill’s prospects lowered the US dollar’s strength against the basket of foreign currencies. As of 0725 EST, the US dollar index was down 0.15 percent, further positioning anti-fiat assets like stocks, gold, and bitcoin for a fruitful New York session on Tuesday.

US Dollar Index remains pressured by the Fed's dovish policies. Source: DXY on TradingView.com

Meanwhile, further tailwinds for Bitcoin could come from the Federal Reserve’s two-day policy meeting ending Wednesday. The market anticipates that the Fed chairman Jerome Powell would maintain their existing expansionary policies of ultralow interest rates and unlimited bond-buying intact because of an uncertain economic outlook in the US.

Besides, Mr. Powell has already admitted that his office would target an inflation rate above 2 percent in the coming years unless the unemployment claims reverse back into a normal range. That further lifts the appeal of assets like Bitcoin that behave as a hedge against lower-yielding bonds.

Bitcoin Technical Outlook

Technically, Bitcoin is looking for a clear breakout move above the resistance area of $19,500-19,600. Such a move open its potential of extending its upside range towards $20,000. Else, the price risks correcting lower to test its verifiable support trendline as shown in the chart above.

That could have the price plunge down towards $18,200.