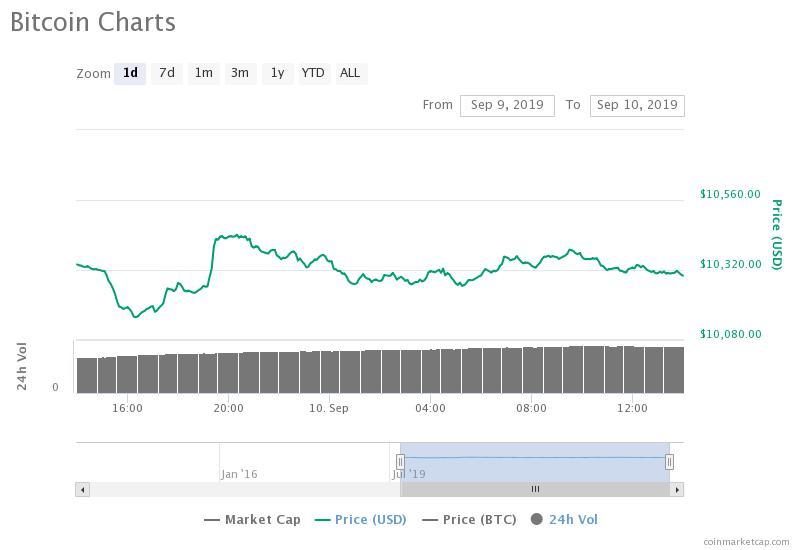

The bitcoin price has dropped from $10,968 to $10,285 in the past three days. If BTC fails to remain above $10,100, traders anticipate a bigger pullback below the $10,000 level.

Since early August, the bitcoin price has demonstrated volatility within a large range between $9,400 to $10,900, unable to break above or below key resistance or support levels.

Within the past month, the $10,000 support level has been broken a total of eight times, which has led technical analysts to question whether the support has been weakened and the next downward movement could result in testing lower support levels.

Key level here.

If we are going to bounce it happens here IMO.

No reason to be overly bearish until this level gives. pic.twitter.com/HSitT5y6mG

— Mayne (@Tradermayne) September 9, 2019

Traders like Josh Rager and DonAlt have emphasized that BTC has strong support in the mid-$7,000 to $8,000 range if it breaks below $9,000 in the short term.

Although traders generally expect the $9,000 level to be kept with strength considering various fundamental factors such as the launch of Bakkt on September 23, depending on how both bulls and bears react to $10,100 being breached, traders foresee a bigger drop below $10,000.

Bitcoin price on a short term downward trend

In July, bitcoin similarly tested $9,400 as a support level on a frequent basis, ranging in between $9,400 to $10,900.

The last time BTC dropped below $9,400, the $9,000 level acted as immediate support, allowing the cryptocurrency to rebound above $12,000 within merely days in a 30 percent rally.

Hence, while BTC has noticeably been in a short term downward trend since early August, several traders are also not dismissing a possibility of a sudden breakout once lower support levels at $9,000 to $9,400 are tested.

Josh Rager, a cryptocurrency trader, said that in June, he noted $11,700 as an important level of resistance for BTC and breaking above it could send the cryptocurrency to a new record high.

“Back in June, I jokingly mentioned that closing above $11,700 would be the launchpad level before new highs Funny thing is, the weekly was held below that level and Bitcoin has been sideways since,” he said.

The weekly candle of bitcoin never closed above $11,700 although it came close to breaching it on four occasions in August.

If the current trend continues, there exists a possibility that the $9,400 support level turns into resistance, leading the asset to engage in a sideways action before it initiates a new rally to the upside, potentially to $20,000.

Long term bullish

Most technical analysts and investors, regardless of short term predictions, maintain a highly optimistic stance towards the long term growth of bitcoin.

Murad Mahmudov, the chief investment officer at Adaptive Fund, said that BTC will eventually evolve into a proper safe haven asset over the long run fueled by uncertainty in the global financial market and currency wars.

He added:

“Bitcoin is going to start getting gradually treated as a safe haven asset just in time for a generational Blow-Off Top in the current monetary system. 7 billion people & their governments chasing true scarcity with infinite monopoly money. All about real vs. paper assets now.”

As seen in the contrast between the performance of BTC and gold in recent weeks, BTC has struggled to demonstrate signs of a safe haven asset and analysts say that it may need many more years for it to match gold and other traditional assets as a safe haven and an alternative store of value.

Click here for a real-time bitcoin price chart.