By CCN.com: Bitcoin trading volume tumbled to a two-year low in March 2019 as the industry was in the midst of a prolonged crypto bear market.

Cryptocurrency exchanges reacted by raising trading fees, according to TradeBlock, a provider of trading tools for digital currencies.

The fee hikes are not surprising because it’s a defensive maneuver to protect against dwindling revenues from falling trading volumes.

“In 2018 and early 2019, prices contracted and trading volumes declined significantly from their peak. On average, exchanges raised fees on both the maker and taker sides in 2018 and 2019.

“An increase in trading fees is in line with expectations that exchanges are looking to protect revenues, amidst continually dampened trading volumes.”

Trading Fees Rose as Trading Volume Fell

TradeBlock pointed out that crypto exchanges decreased fees in 2015 and 2016 when trading volumes rose. However, fees remained stable in 2017 as trading activity spiked to record highs during the bitcoin bull market.

“Exchanges lowered fees in 2015 and 2016 while volumes slowly began increasing.”

“In 2017, exchanges, on average, held fee schedules unchanged as trading activity rose to all time highs. However, as volumes have continued to decline, exchanges began raising fees in 2018 and 2019.”

Now that the bitcoin price is starting to rally, it remains to be seen whether exchanges will reduce fees again as competition for market share heats up.

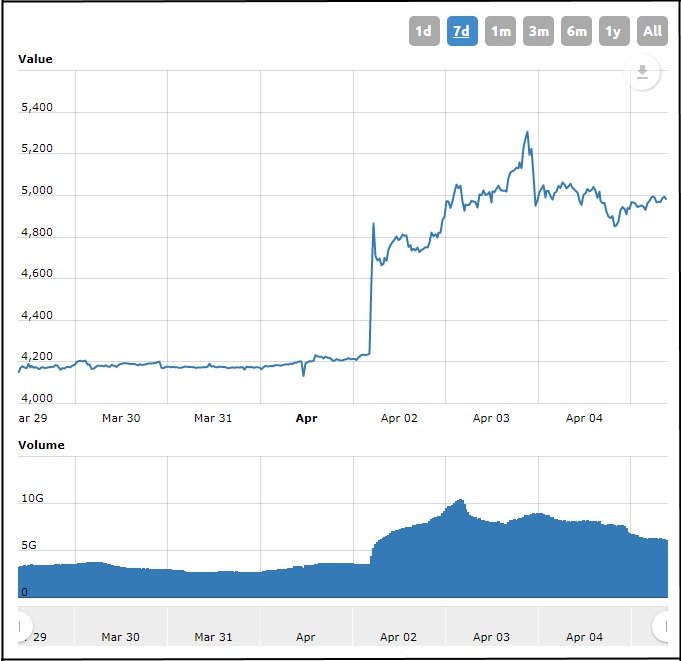

Meanwhile, trading volume has mushroomed during the past week as bitcoin prices experienced a mysterious spike.

Fund Manager: Bitcoin Is a Financial Hedge

Not surprisingly, bitcoin bulls are thrilled by the rally, with many declaring that the brutal Crypto Winter is now officially over.

As CCN reported, fund manager Travis Kling is optimistic that the bear market is behind us. Kling — the founder of Ikigai Asset Management — believes the recent rally is due to increasing public distrust of the Federal Reserve and its manipulation of interest rates.

In fact, Kling believes that more people will hop on the bitcoin bandwagon to protect themselves from the artificial machinations of central banks.

“I would say broadly it was central banks [that caused the recent rally]. [Bitcoin] has become a hedge against irresponsible monetary and fiscal policy.”

Bitcoin Is a Hedge Against ‘Irresponsible’ Federal Reserve: Asset Manager https://t.co/FuO6dee7K3

— CCN.com (@CCNMarkets) April 4, 2019

Investment Manager: Bitcoin Is a Sham

However, crypto perma-bears say bitcoin evangelists are deluding themselves.

They say the bitcoin rally is probably a dead cat bounce, (i.e., a temporary recovery) and predict that the original cryptocurrency will ultimately “collapse” and crater to zero. Why? Because bitcoin is a sham.

Peter Mallouk, the president of Kansas investment firm Creative Planning, says crypto fans need to wake up and face reality.

“We’re going to see cryptocurrencies collapse. [If you invest in crypto], you get no income. It’s not a real investment. It’s speculation. You don’t want to own something that’s not going to pay you.”

Crypto Perma-Bear Ridicules Rally, Warns Bitcoin Price Will ‘Collapse’ https://t.co/WySu0VFTaO

— CCN.com (@CCNMarkets) April 3, 2019

Peter Mallouk: Bitcoin Is Heading to Zero

Peter Mallouk has repeatedly warned investors to not get lured by the bitcoin delusion.

In December 2018, Mallouk called bitcoin a “dead man walking” and said it’s ultimately heading to zero. His advice? Get out while you can.

“The bottom for bitcoin is zero, and that’s where it’s heading. Everything about bitcoin is speculation or fraud.”

So who’s right — the bears or the bulls? As with all things, time will tell. Because money talks and BS walks.