Bitcoin investors are shrugging off the recent drop in value that saw a loss of over 10.9% on Sunday. A number of speculators believe the price is still very bullish but expect some more big dips along the way. Meanwhile, optimism has been cushioned as onchain statistics show that exchange withdrawals also surpassed deposits on Sunday.

This past Sunday, bitcoin (BTC) took a price hit and the entire crypto market followed it’s downward slump from a high of $12,000 to below $10,700 losing 10.9% in value. The sharp drop was quick and even though a decent amount of value was lost, investors believe that BTC will recoup the losses and continue to gain.

During the bull run that started at the end of 2016 and all the way until December 17, 2017, there were at least six large drops in value on the way up. The third most copied trader on Etoro, @Anders, told his 2,800 Twitter followers that the recent dip was all part of the game.

“This is nothing,” Anders said after the 10.9% drop. “Get ready for 30+% corrections. If you can’t handle those, you won’t make it to blow-off top. The first 30% correction in the last bull run saw weak hands leave BTC at $800. They then watched it go to $20,000. I believe there were six 30% corrections 2016-2017.”

There were in fact six 30% dips between those periods although some of them were in the 29% range. After the last two big drops between June 23, to July 16, and September 3, to September 14, 2017, the dips contracted lower on the way up to the all-time high (ATH).

In 2017, on June 23, bitcoin’s price hit a high of $2,720 but subsequently dropped 29.4% to $1,920 on July 16. Then the following September 3, BTC hit a high of $4,918 but dropped a whopping 34% down to $3,242 ten days later.

As mentioned above BTC’s price drops were much smaller from here on out and shrank up until the $19,600 ATH. The next drop was 10% smaller as the price ran up to $7,415 on November 8, 2017. But four days later the price dropped 20.5% as BTC touched a low of $5,892.

From this point, there were a few smaller dips as the price jogged its way up to $16,039 on December 8, and two days later it slid by 6% to $15,061. There was one more drop in value over 4% as the price of bitcoin slid from $17,120 to $16,395 between December 12 and 14. Three days later the price touched its all-time price high and the BTC/USD ATH on the exchange Bitstamp was $19,600 per coin.

The recent drop in value was decent, but many bitcoiners expect some more 30% slides even if the bulls break the ATH. BTC is still down 43% below the ATH and that was more than three years ago from today.

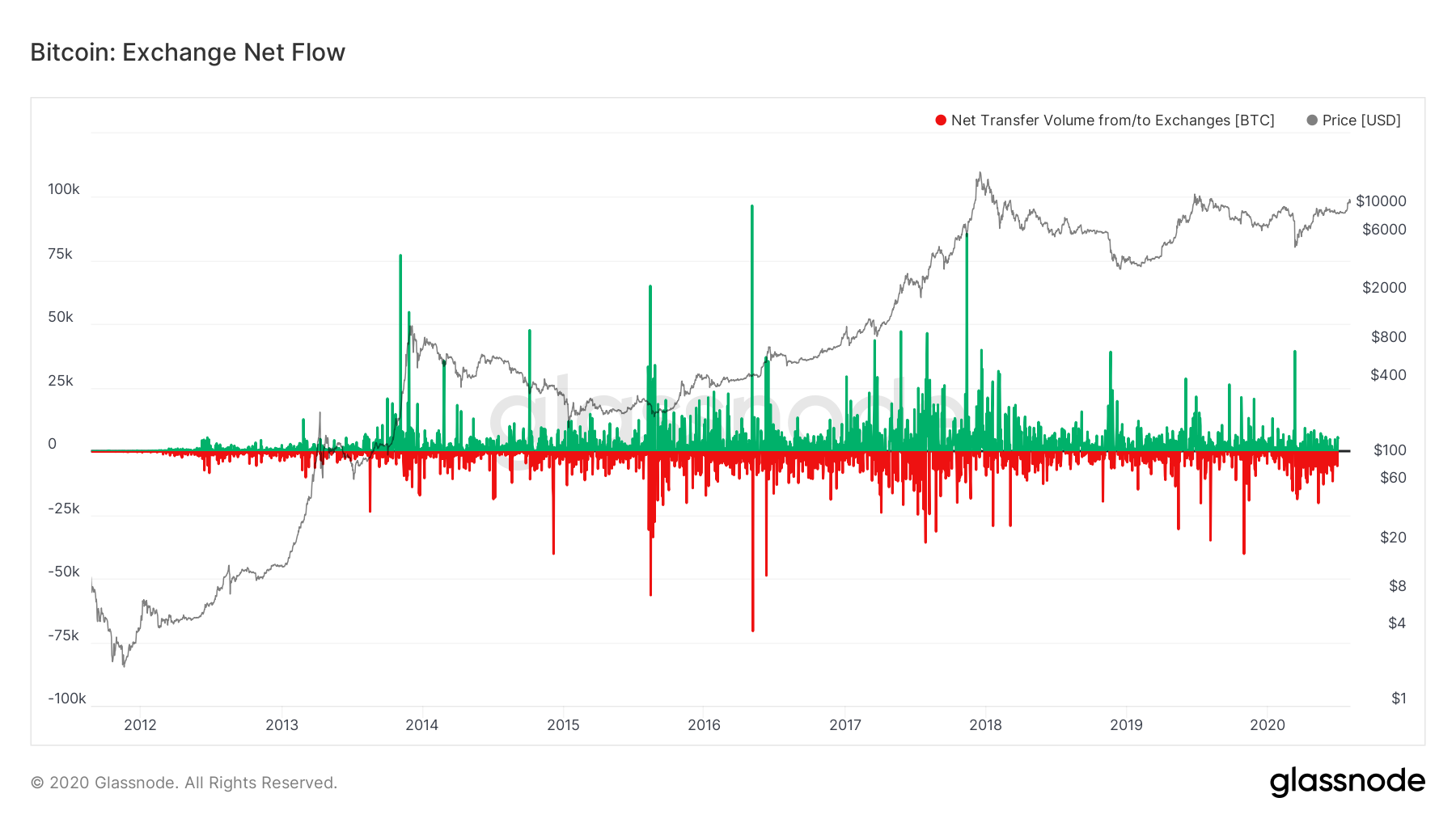

Data from Glassnode’s “Exchange Net Flow” statistics indicate that even though there was a 10.9% drop, crypto exchange withdrawals outpaced deposits. The data suggests that traders are long and not willing to sell their coins as a stronger net flow of deposits may mean traders are preparing to sell on exchanges.

Moreover, Glassnode researchers say that “less than 10% of the BTC supply was last moved at prices above $11,000.”

No one is sure why BTC’s price slid over 10% on Sunday, but the Dutch serial entrepreneur Marc van der Chijs claimed it could be a large BTC whale. “When the whale took profit it immediately caused a (small) price drop,” Marc van der Chijs tweeted.

“However, because speculators were long some of them had to put up additional margins to keep their positions open. Being leveraged they could not do that, so they had to close their position (=sell BTC).” The Dutch entrepreneur added:

Because the liquidity was so low on a Saturday night/Sunday morning hat caused more traders to be liquidated (=forced to sell), causing the price to fall even further. This chain reaction basically led to a $1,500 fall in the BTC price within 10 minutes.

What do you think about the 10% drop this past Sunday? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Markets.bitcoin.com, Glassnode,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.