Bitcoin’s (BTC) double-digit drop may have sent the bulls packing, however, a long-term bearish reversal is still not confirmed, technical studies indicate.

At press time, the leading cryptocurrency is changing hands at $6,422 on Bitfinex – down 13 percent from the previous day’s high of $7,404.

Notably, BTC has erased gains made in the last two weeks in a single day. Further, the sharp drop has poured cold water over the optimism generated by the falling channel breakout and the bullish turn of the weekly MACD.

Still, it is premature to call a long-term bullish-to-bearish trend change, as the prices are holding well above the crucial support of $6,000.

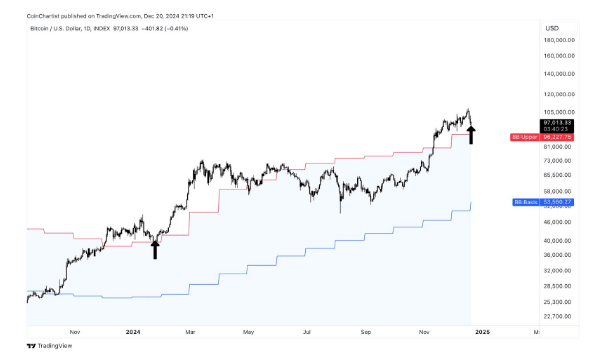

Weekly chart

As seen in the above chart, the bears have repeatedly failed in the last 11 weeks to secure a weekly close (Sunday’s UTC close) below $6,000 (Feb. 6 low), signaling the sell-off from the record high of $20,000 has run out of steam.

Hence, the bears will likely feel emboldened if BTC closes the week below $6,000.

One way to determine whether BTC will end this week below the significant support is to study the line chart, which paints a better picture of the broader trend by focusing only on the UTC close, unlike the candlestick chart, which also takes into account the daily high and low.

Daily line chart

BTC has charted a pennant pattern on the daily line chart. A UTC close below the pennant support of $6,340 would signal a revival of the long-term market. Thus, the probability of BTC ending the week below $6,000 would rise sharply on pennant breakdown.

That said, BTC may not suffer a bearish close on the line chart today, as the sell-off is looking overstretched on the short-duration charts.

Bitcoin RSI

The relative strength index (RSI) on the 4-hour chart is hovering at its lowest level since June 11, signaling extreme oversold conditions. A similar sentiment is being echoed by the hourly chart RSI. Hence, a minor corrective rally cannot be ruled out.

View

- BTC’s drop to the low of $6,302 has neutralized the long-term bullish outlook.

- Prices could drop to $6,000, albeit after a minor corrective rally due to intraday oversold conditions.

- A weekly close below $6,000 would confirm a long-term bearish reversal.

- The odds of BTC ending this week below $6,000 would go up if the bitcoin closes below the pennant support for two consecutive days.

- In the short-term, $7,429 (Sep. 2 high) is the level to beat for the bulls. Meanwhile, a convincing move above the July high of $8,507 would confirm a long-term bullish reversal.

Disclosure: The author holds no cryptocurrency assets at the time of writing.

Bitcoin image via Shutterstock; Charts by Trading View

Join 10,000+ traders who come to us to be their eyes on the charts and sign up for Markets Daily, sent Monday-Friday. By signing up, you agree to our terms & conditions and privacy policy

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.