Today is September 30, and while for most all it does is mark the last day of the month, for Bitcoin, it marks an incredibly critical monthly candle close.

The first-ever cryptocurrency is retesting an important resistance level turned support on monthly timeframes, and holding strong could be a confirmation of a breakout from the bear market. Here’s the exact price Bitcoin needs to close at tonight to make September a month to remember for a long time to come.

Bitcoin Monthly Close Is Coincidentally Critical Resistance Flipped Support Retest

In technical analysis, support and resistance are among the most important factors to pay attention to for volatile price action to occur. This is where rejections or rebounds take place, or if price gets through, an explosive outcome follows.

For example, when the cryptocurrency finally plowed through $10,000 it very quickly was trading at well over $12,000. There, Bitcoin price was rejected, forced to retest previous resistance as support before removing higher.

Related Reading | Bitcoin Faces Pivotal Quarterly Close, Here’s Why

It is not clear why markets work this way, but retests of resistance turned support are common. Failure for bears to push prices back below the former resistance level gives bulls confidence to send prices soaring higher.

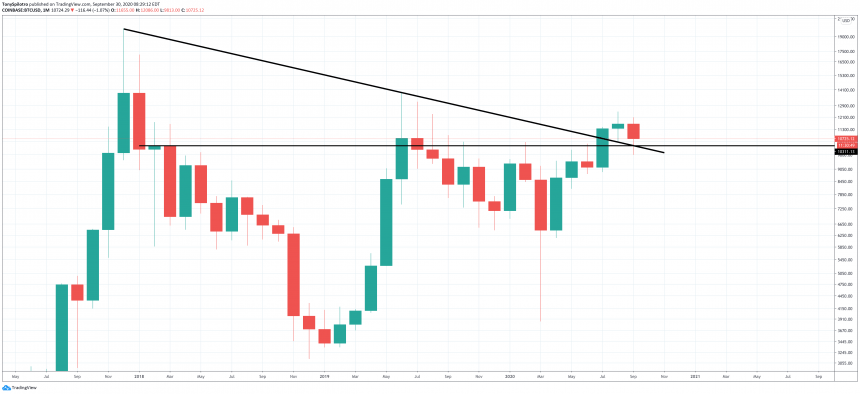

Bitcoin’s monthly close is one of its most important retests of high timeframe resistance turned support in its short history. If the cryptocurrency can close above this key resistance level, there’s only one left before another crack at breaking $20,000 is next.

The price for Bitcoin bulls to beat tonight is clearly drawn at $10,750.

BTCUSD Monthly Resistance / Support Flip Retest | Source: TradingView

Why This September Monthly Close Is So Crucial For Crypto Uptrend Continuation

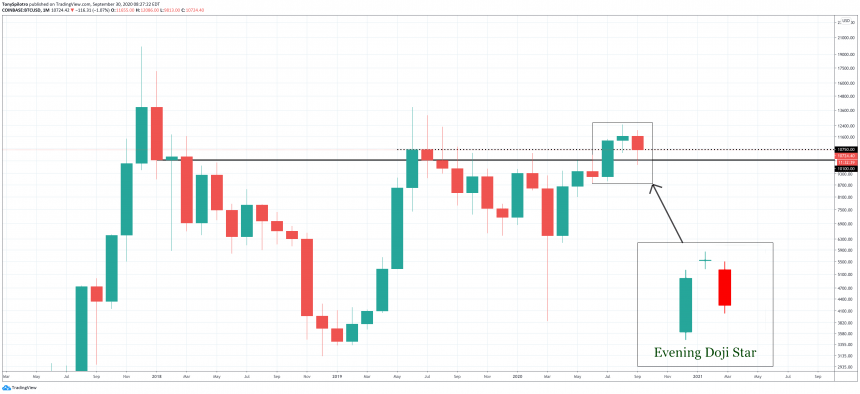

If for some reason Bitcoin loses $10,750 tonight, it isn’t all said and done for bulls. The cryptocurrency could very well continue to hold strong above another support level – “meme” downtrend resistance from all-time high.

Resistance and support can run diagonally, just as it does horizontally. It also exists at rounded numbers, like $10,000 and $20,000, or at in number strings such as $6,666.

BTCUSD Monthly Downtrend Meme Trend Line Retest | Source: TradingView

This diagonal resistance level also coincides with another important monthly resistance level, from the first phase of the bear market. This bearish block is at the top of a long-legged doji where the February 2018 V-shaped low took place.

Related Reading | Bitcoin Descending Triangle Hints At Third Downtrend Before Bear Market Finish

Bitcoin closed higher that month, but not again until 2019. Now, it’s back above it. The cryptocurrency is currently trading at roughly $10,750 as of right now, but if somehow the rug is pulled and the cryptocurrency drops to below $10,100, an evening star pattern will confirm.

BTCUSD Monthly Possible Evening Star If Close Below $10,100 | Source: TradingView

An evening star pattern is a bearish Japanese candlestick reversal pattern. A close like this tonight would indicate another fall into a downtrend, while a strong close above it could be confirmation of an uptrend.

However tonight’s close ends, it should be a September to remember.

Featured image from Deposit Photos, Charts from TradingView