The derivatives exchange Bitget issued an official announcement that in order to meet the needs of more trading users and improve user experience, Bitget will officially launch USDT Unified Account and Quanto Swap Contract at the end of March. Several days ago, Bitget launched a new feature voting and set up a $100,000 prize pool to invite users to participate. Bitget will invite global users to experience the beta version of USDT Unified Account and Quanto Swap Contract

Bitget will divide the contract products into four major sectors after the new feature is launched: USDT Margined contract/Coin Margined Contract/USDT Unified Account/Quanto Swap Contract. The USDT Margined Contract uses stable currency USDT as the margin; The Coin Margined Contract uses the coin held as the margin, and is priced, traded and settled by the coin

The biggest highlight of USDT Unified Account is that users can choose USDT to trade multiple trading pairs at the same time, in which multiple contracts share the equity of one account, and the profit and loss, occupation and risk in the account are shared. Currently, Bitget can support up to 20 currencies such as BTC, ETH, UNI, AAVE, etc. This means that users can open contracts of multiple trading pairs in the same account when using USDT as the margin, and realize the multi-currency hedging in one account.

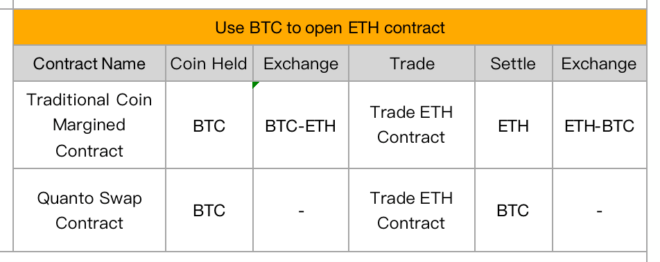

Quanto Swap contract supports one or more currencies as a margin to trade other coins. The highlight is that it has changed the traditional trading method that coin margined contracts only apply to trade the margined coin contract. Now one coin can be used as a margin for multiple trading pairs at the same time, without the need for currency exchange.

For example, a trader holds and is optimistic about BTC for the long term, but predicts that ETH is going to rise recently. The trader hopes that after completing the contract transaction, BTC will be returned to his account.

It is not difficult to tell that, compared with traditional Coin Margined Contract, the advantages of Quanto Swap Contract are particularly obvious. First of all, during the transaction process, the operation is extremely simple, without the loss caused by the currency exchange process. Secondly, in the settlement, the currency of the account can be used as a margin for profit and loss settlement, and the user can finally get the desired currency. Thirdly, you can get a profit when the margin coin price rises while trading. For example, when you trade ETH, use BTC as the margin. If the BTC rises, you can get both the trading income and the increased income. Lastly, the Quanto Swap Contract supports using certain margin currencies to trade multiple trading pairs at the same time and accomplishes internal hedging, equity sharing, and risk-sharing.

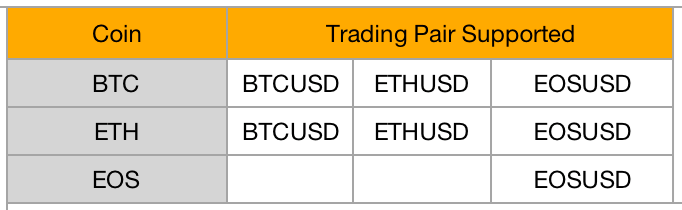

It is reported that the Bitget Quanto Swap Contract will be launched at the end of March, and the global public beta will be launched. Bitget will support the three mainstream currencies of BTC, ETH, and EOS. Bitget CEO Sandra said, “USDT Unified Account and Quanto Swap Contract are a sincere work launched by Bitget for global users this year. After it is launched at the end of March, welcome to experience them and give us suggestions. Quanto Swap Contract will add more coins based on user feedback”