Bitwise Asset Management has launched two new cryptocurrency funds, one of which only invests in BTC. The launch “is driven by inbound client interest and investor dissatisfaction with existing options,” the company says. The market downturn has also given investors “a unique opportunity to enter the market at prices many thought we’d never see again.”

Also read: Indian Supreme Court Moves Crypto Hearing, Community Calls for Positive Regulations

Two New Funds

The launch of the funds is driven by inbound client interest and investor dissatisfaction with existing options, many of which carry premiums, charge exit fees, have lockups, and/or charge expenses to the fund outside the stated management fee.

Starting on Wednesday, two share classes are available for both funds. The first, aimed at institutional investors, has “an all-in expense ratio of 1.0% and a minimum investment of $1 million,” the company described. The other has “an all-in expense ratio of 1.5% and a minimum investment of $25,000.” Subscriptions and redemptions are accepted every Wednesday, “with no lockups, withdrawal fees, or performance fees,” the announcement details.

Existing Index Funds

The two funds launched on Wednesday are the company’s second and third strategies, the announcement clarifies, adding that the first is “the broad-market Bitwise 10 Private Index Fund.” This fund tracks the cryptocurrencies in the Bitwise 10 Index, “which is a basket of the largest coins, weighted by 5-year diluted market capitalization and rebalanced monthly,” its website describes. The constituents of this index are currently BTC, XRP, ETH, XLM, BCH, EOS, LTC, ZEC, XMR, and DASH.

In addition to the Bitwise 10 Index, the company has three other indices: the 20 mid cap, the 70 small cap, and the 100 total market.

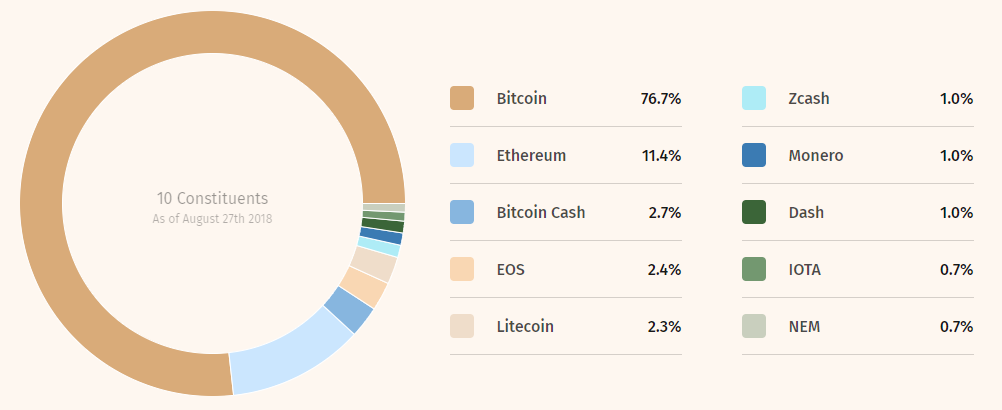

Furthermore, the company has partnered with Morgan Creek Capital Management to offer investors another index fund called Digital Asset Index Fund. According to its website, this fund “tracks the Morgan Creek Bitwise Digital Asset Index.” Its current constituents are BTC, ETH, BCH, EOS, LTC, ZEC, XMR, DASH, IOTA, and NEM.

Clients Are Interested

Bitwise CEO Hunter Horsley commented:

The 68% drawdown in bitcoin prices this year has given investors a unique opportunity to enter the market at prices many thought we’d never see again.

He added that, while “an ETF [exchange-traded-fund] has not yet been approved, investors and advisors like the fund format because it’s professionally managed and simplifies access to best-in-class custody, trading, reporting, and tax preparation, and allows for the safe capture of events like hard forks and airdrops.”

The company’s global head of research elaborated:

Our clients have been adding to their positions throughout the downturn, and many who’ve been following the space for a while are using this opportunity to finally come in.

What do you think of Bitwise’s various crypto funds? Let us know in the comments section below.

Images courtesy of Shutterstock, Morgan Creek Capital Management, and Bitwise Asset Management.

Need to calculate your bitcoin holdings? Check our tools section.