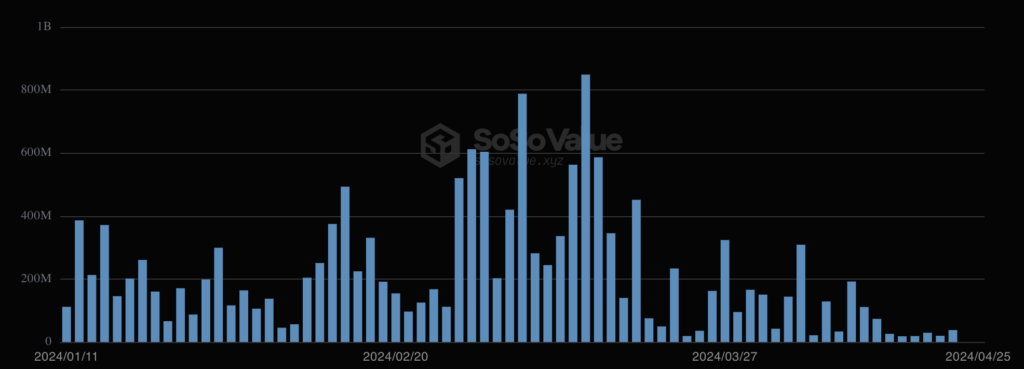

The spot Bitcoin ETF sector is again in the red zone, experiencing a capital outflow of $217 million on April 25.

According to SoSo Value, funds did not move in five ETFs, including BlackRock’s iShares Bitcoin Trust ETF (IBIT). This is the second day in a row that the BlackRock fund has not recorded an inflow of capital.

In addition to the Grayscale Bitcoin Trust ETF (GBTC), outflows were recorded in four ETFs, including the one from Fidelity Investments and ARK Invest/21Shares.

Despite the latest trend, IBIT was among the top 10 ETFs with a long period of uninterrupted capital inflows. However, since the beginning of March 2024, capital inflows into the fund have declined.

The average volume of capital inflows into spot Bitcoin ETFs has also slowed significantly in recent weeks. Bitwise CEO Hunter Horsley says many institutional players in the market are still secretly preparing for large infusions of funds into crypto-based instruments.

Horsley is convinced that spreading a new class of digital assets will help the crypto market become even more attractive to investors.

Recently, investor interest in cryptocurrency-based products has weakened. Over the past week, $206 million was withdrawn from crypto products for large professional investors, CoinShares analysts have noted.