Top Shelf

Yesterday, some of the earliest mined bitcoin moved after more than a decade of dormancy.

Whale Alert – a popular, mostly-automated Twitter account that tracks major crypto transactions – broadcasted the message across the cryptoverse, saying 40 coins mined in the first month of the network’s operation had transferred from a “possible #Satoshi owned wallet,” referring to Bitcoin’s long silent creator, Satoshi Nakamoto.

This unfounded connection – based on the age of the bitcoin, and the fact that they had never moved – caused a minor market stir.

You’re reading Blockchain Bites, the daily roundup of the most pivotal stories in blockchain and crypto news, and why they’re significant. You can subscribe to this and all of CoinDesk’s newsletters here.

Since then, blockchain archeologists and Bitcoin sleuths have poked holes in the theory that the coins are Nakamoto’s, who, as far as we can tell, has never moved a single satoshi from the hoard of bitcoin he mined in the network’s early days. (Except for a test transaction sent to Hal Finney.)

Determining the sender of these coins is impossible, for now. But the occurrence is a moment to reflect on some important insights about the Bitcoin community, infrastructure and market.

Of the approximately 18.5 million coins already mined, about 2 million are dormant – either unspent because the keys have been lost, or for other personal or technological reasons. Estimates on the higher side assume as many as 4 million bitcoin are “lost forever.” Nakamoto once referred to lost coins as a “donation” to the network.

The Bitcoin protocol hardcaps the total supply of Bitcoin at 21 million coins, but knowing that some coins have been “donated” has led some researchers to develop a new metric: Realized Capitalization. This measure discounts Bitcoin’s total supply to account for lost or otherwise inaccessible coins.

When previously inert coins move – be they Nakamoto’s or not – this should challenge the assumption that coins in deep storage are out of circulation. Unless they’ve been tossed in the bin. Therefore, a price adjustment is logical.

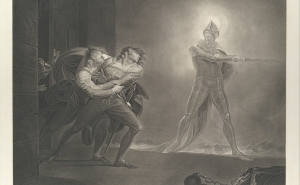

A partial cause for yesterday’s price movements were fears that Nakamoto has returned, and could potentially dump billions of dollars worth of bitcoin on the market. Nakamoto’s seemingly altruistic, or at the very least, mysterious, “donation” to the Bitcoin community hangs over the market like the sword of Damocles.

Like Nakamoto’s motivations, it’s an open question as to how many coins he holds. In 2013, Sergio Lerner wrote a blog post estimating the Satoshi stockpile to be around 1 million bitcoin. Years later, derivatives exchange BitMEX recounted and found the hoard to be in the neighborhood of 700,000 coins.

Both estimates look at a technical detail called the nonce value to determine what blocks Nakamoto was likely to have mined. It’s analysis of this same block feature that leads many to assume yesterday’s transaction did not belong to Nakamoto, but one of the dozens of other miners assumed to be live on the network at the time.

Curiously, when these bitcoin were mined, bitcoin itself had no market value. The block reward is now worth just shy of half a million dollars. There were also no CoinJoins or SegWit code updates, modern wallet features yesterday’s transaction utilized, nor a host of blockchain analyzers watching where these coins will jump to next.

How far Bitcoin has come!

Castle Island Venture’s Nic Carter, in conversation with Moneymail developer Lawson Baker, said the biggest clue into the identity of the owner of the coins could come in a couple of days. Just look at the OP_RETURN field, a place to encode permanent messages on the Bitcoin blockchain, Carter said. We’ll be watching.

Media Diet

Red Flags: Citizen, the mobile application that alerts its more than two million users to crime and disaster around them, has launched a contact tracing functionality, called SafeTrace, in the fight against the coronavirus. The application, which makes use of GPS and Bluetooth proximity tracking and stores data in a centralized manner, has raised alarms among privacy experts and technologists. “GPS data tracking a person’s movements is very revealing, and difficult to effectively anonymize,” said Ángel Díaz, counsel at the Liberty and National Security Program of The Brennan Center for Justice in New York.

Brazil Banks Investigated: On Wednesday, Brazil’s antitrust watchdog, the Administrative Council for Economic Defense (CADE), voted to continue its investigation of banks who denied financial services to crypto brokers in alleged violation of Brazilian competition law. CADE’s nearly two-year-old inquiry into Itaú Unibanco, Banco do Brasil, Santander, Inter, Bradesco and Sicredi now returns to the General Superintendency for further review. Those six banks, which comprise nearly 80% of Brazil’s deposit market share, could face eventual sanctions and even be forced to provide financial services to crypto brokers.

Geographic Details: Block.one, a primary EOS developer wielding about 9% of the total token supply, is about to begin voting in the ecosystem, after years of holding back its influence. In a note last Friday, the Cayman Island-based company outlined criteria it would use to decide on which block producer candidates to support and vote for, including information pertaining to the public disclosure of the “location of the node.” While Block.one representatives downplay the significance of this geographic information, other stakeholders believe it could lead to favoring specific countries.

New Shareholder: IBM has become a shareholder in we.trade, the trade-finance platform jointly owned by 12 European banks, signaling further consolidation across the enterprise blockchain space. While IBM has been a technology partner since the beginning, we.trade has always intended ween itself off the Hyperledger-based IBM Blockchain Platform and take its tech stack in-house. Ciaran McGowan, we.trade’s CEO, said this financial relationship with Big Blue will help the platform in its next phase of global expansion.

Digital Dividend: Online retailer Overstock has finally distributed its digital dividend to shareholders, after a series of delays including an investor class action suit against the company and the ousting of the dividend’s brainchild former Overstock CEO Patrick Byrne. The digital security, called OSKTO, can now be freely traded on Overstock subsidiary tZERO’s blockchain-underpinned platform. Shareholders need to open a brokerage account with a broker-dealer that subscribes to the tZERO ATS to trade the securities, the firm said.

Genesis Brokerage: Genesis Global Trading is moving toward full-service prime brokerage – covering lending, trading and custody – with the acquisition of crypto custodian Vo1t. The terms of the deal were not disclosed. “We’re coming at this after having a successful business on the trading and lending side,” said Genesis CEO Michael Moro. “The goal is for clients to be able to do any and all activities with Genesis.”

Blockchain Strategy: A U.S. lawmaker introduced a bill calling on the Federal Trade Commission (FTC) to survey how blockchain technology is being used by other nations as well as outline a comprehensive blockchain strategy for the United States.

‘Bloodbath’: Highly leveraged crypto hedge funds are struggling to recover from recent volatility, reports the Financial Times.

Digital Euros: Societe Generale issued €40 million worth of covered bonds as security tokens that were then settled by the Banque de France, the nation’s central bank, in blockchain-based digital euros. (The Block)

Synthetic, Priceless Token Model: The UMA Project community approved contracts that allowed creating its first token: ETHBTC. This is also the first experiment with UMA’s priceless token model, which minimizes the need for oracles, allowing for the synthetic ETHBTC token to track the relative value of ETH to BTC, without requiring users to stake either of the two cryptos.

Staking Services: Coinbase Custody now offers staking services for Cosmos and Algorand tokens. Last year the firm added staking support for Tezos tokens. (The Block)

Market Intel

Buyers Exhausted? Bitcoin prices look to be struggling with buyer exhaustion, having put in a negative performance in the last 24 hours despite positive developments on both the macro and technical fronts. Despite intimations from JP Morgan and Goldman Sachs calling upon the Federal Reserve to step up its inflationary bond purchase programs, analysts at Stack, a provider of cryptocurrency trackers and index funds, expect bitcoin to consolidate in the range of $8,000–$10,000 for some time.

The Breakdown

Dollar’s Strength Weakens the World: Lyn Alden, founder of Lyn Alden Investment Strategy, joins The Breakdown to discuss why the U.S. dollar’s persistent hegemony is bad for everyone.

Who Won #CryptoTwitter?

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.