Based on a slew of recent predictions, bitcoin prices could more than double this year to $20,000. Or go to $250,000 by early 2023. Or $300,000 within five years.

What’s confounding cryptocurrency traders now is the wide gap between such lofty forecasts and the banal reality: Since late April, bitcoin has traded in a range between roughly $8,500 and $10,200.

Thursday’s market action was no different, with prices rising 1.3% to about $9,800. The highest in two days. Not much to get excited about.

You’re reading First Mover, CoinDesk’s daily markets newsletter. Assembled by the CoinDesk Markets Team, First Mover starts your day with the most up-to-date sentiment around crypto markets, which of course never close, putting in context every wild swing in bitcoin and more. We follow the money so you don’t have to. You can subscribe here.

The newest forecast attracting chatter, on Twitter and elsewhere, emerged this week when analysts at Bloomberg predicted, based largely on an analysis of historical trading patterns, that bitcoin prices would approach $20,000 later this year.

A jump to that level would bring bitcoin back to its December 2017 all-time-high of $20,089. Clearing the threshold would represent a remarkable comeback for bitcoin, and it would reset many of the conversations around the market. Imagine the daily breathless headlines – in both cryptocurrency- and Wall Street-focused media – as the 11-year-old digital asset charted new price records.

A glance at bitcoin’s price chart since early 2017 shows how far off bitcoin remains from that $20,000 threshold. But it also shows how rapidly the price ran up in 2017. In the volatile bitcoin market, it’s hard to rule anything out.

Greg Cipolaro, co-founder of the cryptocurrency analysis firm Digital Asset Research, says “predicting prices for bitcoin has been notoriously difficult.”

“It’s a highly volatile asset with not a lot of understanding of valuation and pricing frameworks,” Cipolaro said in a phone interview. “People kind of throw darts at a dart board. Sometimes they’ve been proven to be wildly low, and sometimes wildly optimistic.”

What’s easier to predict, according to Cipolaro, is where prices are headed more generally. He says he’s bullish.

“The current backdrop, the macroeconomic and social and political divide that we’re experiencing, all point to a non-sovereign-backed store of value, and that is something like bitcoin,” Cipolaro said.

Maybe that’s the right approach. Such finger-in-the-wind forecasts are increasingly the modus operandi on Wall Street these days.

The Standard & Poor’s 500 Index is now close to its 2019 year-end level, even though the coronavirus and related lockdowns have pushed the global economy into its worst contraction since the 1930s, hitting corporate profits and driving large retailers into bankruptcy. Unemployment is soaring.

Some commentators on U.S. stocks argue that valuations aren’t really supported by the fundamentals, but by a belief that governments and central banks like the Federal Reserve will pull every official lever to keep share prices from falling. The implication is that stocks might have little downside, but little upside either.

With bitcoin, there are naysayers of course. Goldman Sachs’s money-management division wrote last week that bitcoin is “not a suitable investment.” The billionaire investor Warren Buffett said in February that bitcoin has “no value.”

But to professional crypto analysts, the downside risks are far more mundane. Nicholas Pelecanos, head of trading at NEM Ventures, said in an email that bitcoin prices could fall toward $7,000 if they break below the $8,500 mark. Not exactly catastrophic, given that prices have often traded below $7,000 over the past six months.

And there’s a lot to talk about when it comes to the upside.

The European Central Bank on Thursday announced it would inject as much as 600 billion euros more into financial markets than previously promised, potentially bolstering bitcoin’s use as a hedge against inflation.

CoinDesk’s Zack Voell reported on Thursday that bitcoin is increasingly being used in “tokenized” form when transacting on decentralized-finance networks on the Ethereum blockchain. A fast-growing use case, as it were.

CryptoCompare, a London-based data aggregator, said Thursday in a report that cryptocurrency derivatives volumes surged to a record $602 billion in May.

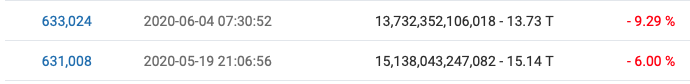

And CoinDesk’s Wolfie Zhao reported Thursday that the Bitcoin blockchain underwent an automatic adjustment that will make it easier to mine new units of the cryptocurrency, theoretically luring more operators back to the network to keep its distributed ledger secure.

Mati Greenspan, of the foreign-exchange and cryptocurrency-analysis firm Quantum Economics, says the milestone could catapult bitcoin into the “next wave” of its price cycle. The adjustment comes roughly a month after bitcoin’s once-every-four-years halving, which cut bitcoin rewards for miners in half.

“Though we only have two examples of previous halving events, the price began to rise approximately one month after the event, begging a brand new massive bull run each time,” Greenspan wrote in an e-mail to clients.

Bitcoin may not go to $300,000. It may not even go to $20,000.

But the base case for now is that the price is likely to go up. First it needs to get past $10,000.

Tweet of the day

Bitcoin watch

BTC: Price: $9,738 (BPI) | 24-Hr High: $9,875| 24-Hr Low: $9,472

Trend: A key bitcoin price indicator continues to call a bullish move despite the cryptocurrency’s recent failure to keep gains above the $10,000 mark.

The weekly chart’s moving average convergence divergence (MACD) histogram is producing higher bars above the zero line, indicating a strengthening of upward momentum. It’s now reporting a value of 282 – the highest since mid-July 2019. Put simply, the indicator is currently suggesting the strongest bullish bias in 11 months.

While the MACD is based on backward-looking moving average studies, it has proven its fortitude in the past by marking the beginning of bullish trends with a cross above zero. For instance, the MACD crossed above zero in mid-February 2019 and began climbing above zero well before the cryptocurrency broke into a bull market with a 26% rise in the first week of April 2019. Similarly, the bearish trend seen in the second half of last year began after the MACD moved back below zero.

The weekly chart’s relative strength index is also signaling bullish bias with an above-50 reading, while the daily chart is flashing a golden crossover, a long-term bull market indicator.

Multiple long-tailed candles seen on the hourly chart show persistent dip demand near the 200 hour average, currently at $9,581. The immediate bias will remain bullish as long as prices are holding above that level.

All in all, the charts seem to have aligned in favor of a re-test of $10,000. The cryptocurrency was rejected above that hurdle on Tuesday, falling sharply by $800 in just five minutes. As a result, some analysts say a sustained move above $10,000 is required to restore the rally from the March low of $3,867.

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.