Bitcoin (BTC ) hodlers hoping for a return to the bull run may not have long to wait, as a popular indicator gives cause for optimism.

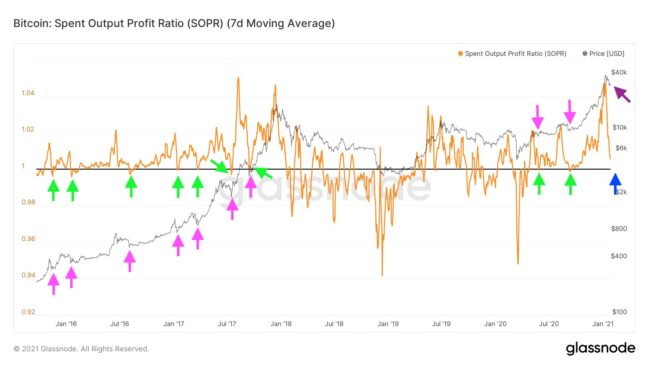

As compiled by on-chain monitoring resource Glassnode, data from the Bitcoin spent output profit ratio (SOPR) suggests that the current BTC price correction is almost complete.

BTC price correction should end “soon”

The SOPR tracks the percentage of coins being moved that are in profit — in other words, whether hodlers are selling at a profit or loss.

When the indicator is above 1 and falling, it reflects sellers divorcing themselves of their holdings at various profit margins. Once 1 is hit, “resetting” the SOPR, sellers have sold all that they can, which reduces downward price pressure and notionally allows Bitcoin to increase once again.

The SOPR has shown its muscle in various phases of past bull cycles, and the resetting phenomenon was particularly successful at charting price bottoms in 2020.

Now, with a decreasing trend nearing the magical 1 value, market participants are hoping that the past week’s sell-off may be the end, rather than the beginning, of lackluster performance.

“So, if we are in a bull market now, according to the SOPR the correction is not over yet, but it will end soon,” popular Twitter account CryptoHamster wrote on Tuesday, uploading an annotated Glassnode chart.

Bitcoin SOPR chart with “resets” highlighted. Source: CryptoHamster/Twitter Inflows speak for themselves

If the SOPR repeats its historical pattern, it may please some investors who have witnessed considerable volatility so far this year.

While commentators argue that Bitcoin could not have continued its vertical gains for an extended period under any circumstances, cold feet have characterized reactions to Bitcoin’s correction from $42,000 to under $30,000.

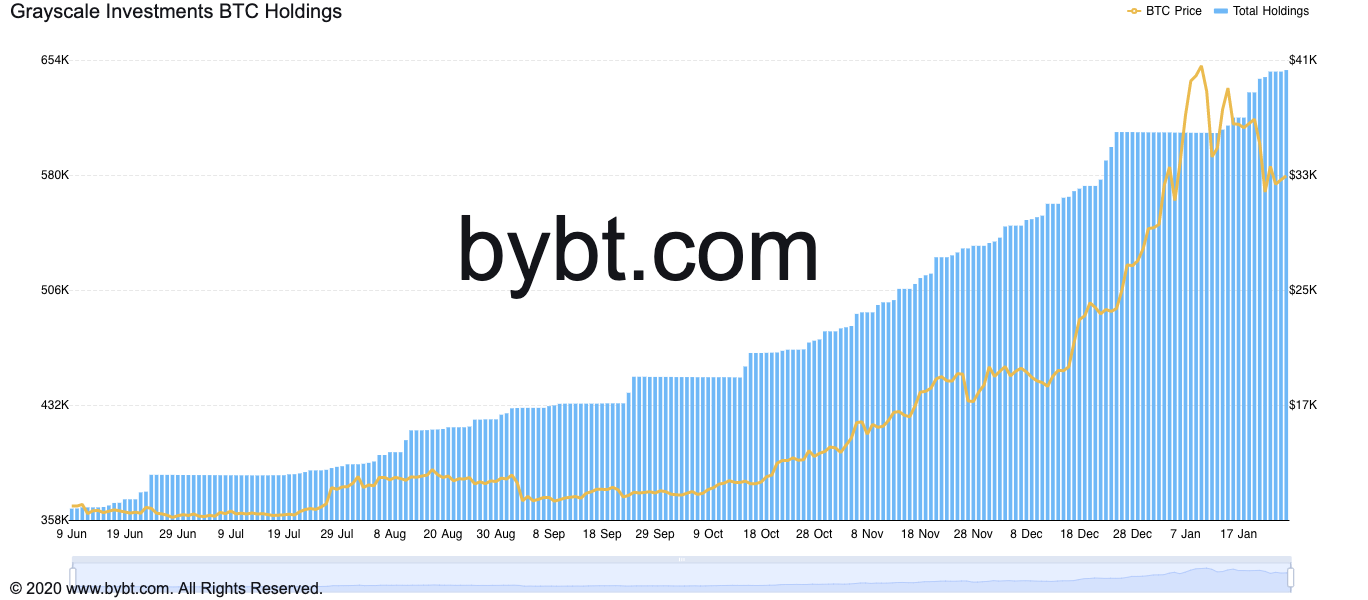

Amid a sea of explanations for the sudden slump, proponents are highlighting institutional involvement as an antidote to panic from retail sellers and criticism from the mainstream news and financial sector. Grayscale, for example, has resumed its buying after the holiday break ended, regularly adding many more times the amount of BTC than is mined during the same period.

<img decoding="async" src="https://fastcrypto.trade/wp-content/uploads/2021/01/Bored-with-Bitcoin-The-BTC-bull-run-is-about-to.jpg"/> Grayscale BTC holdings. Source: Bybt.com “$1.31 billion flowed into Bitcoin and crypto investment products last week (a new record) as investors rushed to buy the dip,” entrepreneur Alistair Milne summarized on Twitter Tuesday.

He added that 97% of that new capital entered Bitcoin, specifically.

Disclaimer: Quotes in this article taken from previously published sources have been lightly edited.

Original

Post navigation

<img width="640" height="426" src="https://fastcrypto.trade/wp-content/uploads/2025/05/019699af-70de-7bb3-baf9-2ef0d0bd3ac2-840x559.jpeg" class="attachment-large size-large wp-post-image" alt="" decoding="async" srcset="https://fastcrypto.trade/wp-content/uploads/2025/05/019699af-70de-7bb3-baf9-2ef0d0bd3ac2-840x559.jpeg 840w, https://fastcrypto.trade/wp-content/uploads/2025/05/019699af-70de-7bb3-baf9-2ef0d0bd3ac2-548x365.jpeg 548w, https://fastcrypto.trade/wp-content/uploads/2025/05/019699af-70de-7bb3-baf9-2ef0d0bd3ac2-768x511.jpeg 768w, https://fastcrypto.trade/wp-content/uploads/2025/05/019699af-70de-7bb3-baf9-2ef0d0bd3ac2-100x67.jpeg 100w, https://fastcrypto.trade/wp-content/uploads/2025/05/019699af-70de-7bb3-baf9-2ef0d0bd3ac2.jpeg 1200w" sizes="(max-width: 640px) 100vw, 640px" />

<img width="640" height="480" src="https://fastcrypto.trade/wp-content/uploads/2025/05/pexels-davidmcbee-730564-840x630.jpg" class="attachment-large size-large wp-post-image" alt="" decoding="async" srcset="https://fastcrypto.trade/wp-content/uploads/2025/05/pexels-davidmcbee-730564-840x630.jpg 840w, https://fastcrypto.trade/wp-content/uploads/2025/05/pexels-davidmcbee-730564-487x365.jpg 487w, https://fastcrypto.trade/wp-content/uploads/2025/05/pexels-davidmcbee-730564-768x576.jpg 768w, https://fastcrypto.trade/wp-content/uploads/2025/05/pexels-davidmcbee-730564-1536x1152.jpg 1536w, https://fastcrypto.trade/wp-content/uploads/2025/05/pexels-davidmcbee-730564-2048x1536.jpg 2048w, https://fastcrypto.trade/wp-content/uploads/2025/05/pexels-davidmcbee-730564-100x75.jpg 100w" sizes="(max-width: 640px) 100vw, 640px" />

<img width="640" height="360" src="https://fastcrypto.trade/wp-content/uploads/2025/05/fidelity-bitcoin-gold-comparison-840x473.jpg" class="attachment-large size-large wp-post-image" alt="" decoding="async" srcset="https://fastcrypto.trade/wp-content/uploads/2025/05/fidelity-bitcoin-gold-comparison-840x473.jpg 840w, https://fastcrypto.trade/wp-content/uploads/2025/05/fidelity-bitcoin-gold-comparison-649x365.jpg 649w, https://fastcrypto.trade/wp-content/uploads/2025/05/fidelity-bitcoin-gold-comparison-500x280.jpg 500w, https://fastcrypto.trade/wp-content/uploads/2025/05/fidelity-bitcoin-gold-comparison-768x432.jpg 768w, https://fastcrypto.trade/wp-content/uploads/2025/05/fidelity-bitcoin-gold-comparison-100x56.jpg 100w, https://fastcrypto.trade/wp-content/uploads/2025/05/fidelity-bitcoin-gold-comparison.jpg 1280w" sizes="(max-width: 640px) 100vw, 640px" />

<link data-minify="1" rel='stylesheet' id='wp-block-library-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-includes/css/dist/block-library/style.min.css?ver=1734834998' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='contact-form-7-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/plugins/contact-form-7/includes/css/styles.css?ver=1734804993' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='easy-sidebar-menu-widget-css-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/plugins/easy-sidebar-menu-widget/assets/css/easy-sidebar-menu-widget.css?ver=1734804993' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='wp_automatic_gallery_style-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/plugins/wp-automatic/css/wp-automatic.css?ver=1734804993' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='wordpress-popular-posts-css-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/plugins/wordpress-popular-posts/assets/css/wpp.css?ver=1734804993' type='text/css' media='all' /><link rel='stylesheet' id='jquery-bxslider-css' href='https://fastcrypto.trade/wp-content/themes/supermag/assets/library/bxslider/css/jquery.bxslider.min.css?ver=4.2.5' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='font-awesome-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/themes/supermag/assets/library/Font-Awesome/css/font-awesome.min.css?ver=1734804993' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='supermag-style-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/themes/supermag/style.css?ver=1734804993' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='supermag-block-front-styles-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/themes/supermag/acmethemes/gutenberg/gutenberg-front.css?ver=1734804993' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='the_champ_frontend_css-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/plugins/super-socializer/css/front.css?ver=1734804993' type='text/css' media='all' /><link data-minify="1" rel='stylesheet' id='wp-paginate-css' href='https://fastcrypto.trade/wp-content/cache/min/1/wp-content/plugins/wp-paginate/css/wp-paginate.css?ver=1734804993' type='text/css' media='screen' />