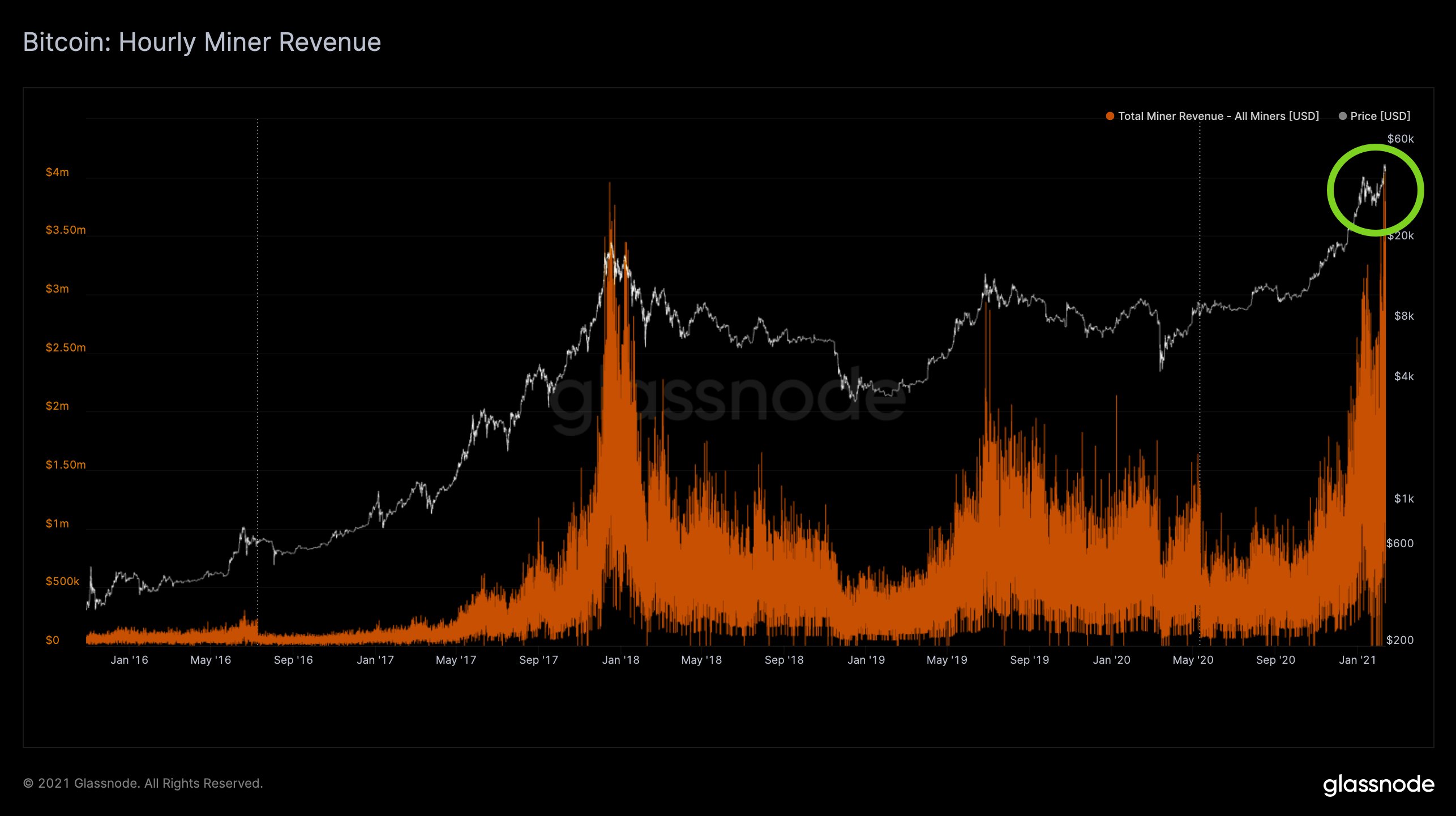

According to data from Glassnode, Bitcoin (BTC) miners made over $4 million in just under an hour on Feb. 12, making it the biggest hourly revenue in history.

In May 2020, Bitcoin underwent the third block reward halving in its history, cutting the amount of new Bitcoin mined in half.

After a block reward halving, the amount of BTC miners can mine using computing power decreases by half. Hence, miner revenues decrease by 50% overnight, which could cause strain on mining operations in the short term.

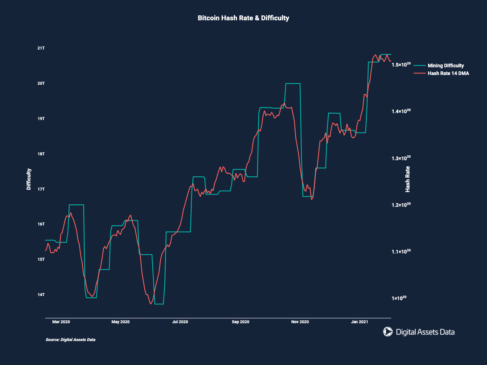

At the same time, the hash rate of the Bitcoin network is also at new all-time highs with the fourth consecutive upward difficulty adjustment by roughly 2.5% expected in seven days.

So why are Bitcoin miner revenues surging?

A block reward halving occurs every four years to decrease the rate the remaining supply of Bitcoin is introduced to the market.

As Bitcoin nears its fixed supply at 21 million, the pace at which new BTC is mined is reduced through a halving. But the halving can put immense pressure on miners that depend on the BTC they mine to cover operational costs in the short term.

Theoretically, when a halving occurs, the price of Bitcoin is expected to rise because of the lower supply of new coins entering the market. Therefore, a higher BTC price can make up for the lower number of BTC miners are rewarded with for mining a block.

This week, Bitcoin miners generated the biggest hourly revenue in history, despite mining half the BTC they used to mine compared to last year.

This shows that Bitcoin is working as designed with its value increasing following the block reward halving, incentivizing miners to increase their hash rate and invest in the security of the network. Analysts at Glassnode said:

“#BTC miners just made over $4 million in a single hour – the highest hourly miner revenue in Bitcoin’s history so far.”

Another reason behind the rising miner revenue is the increasing number of transactions on the network and the accompanying fees paid to miners as a result. Miner revenue is comprised of the transaction fees plus the block rewards collected by miners, with the former comprising roughly 13.5% of the total revenue, according to data from Clarkmoody.

Will miner revenue continue to increase with BTC price?

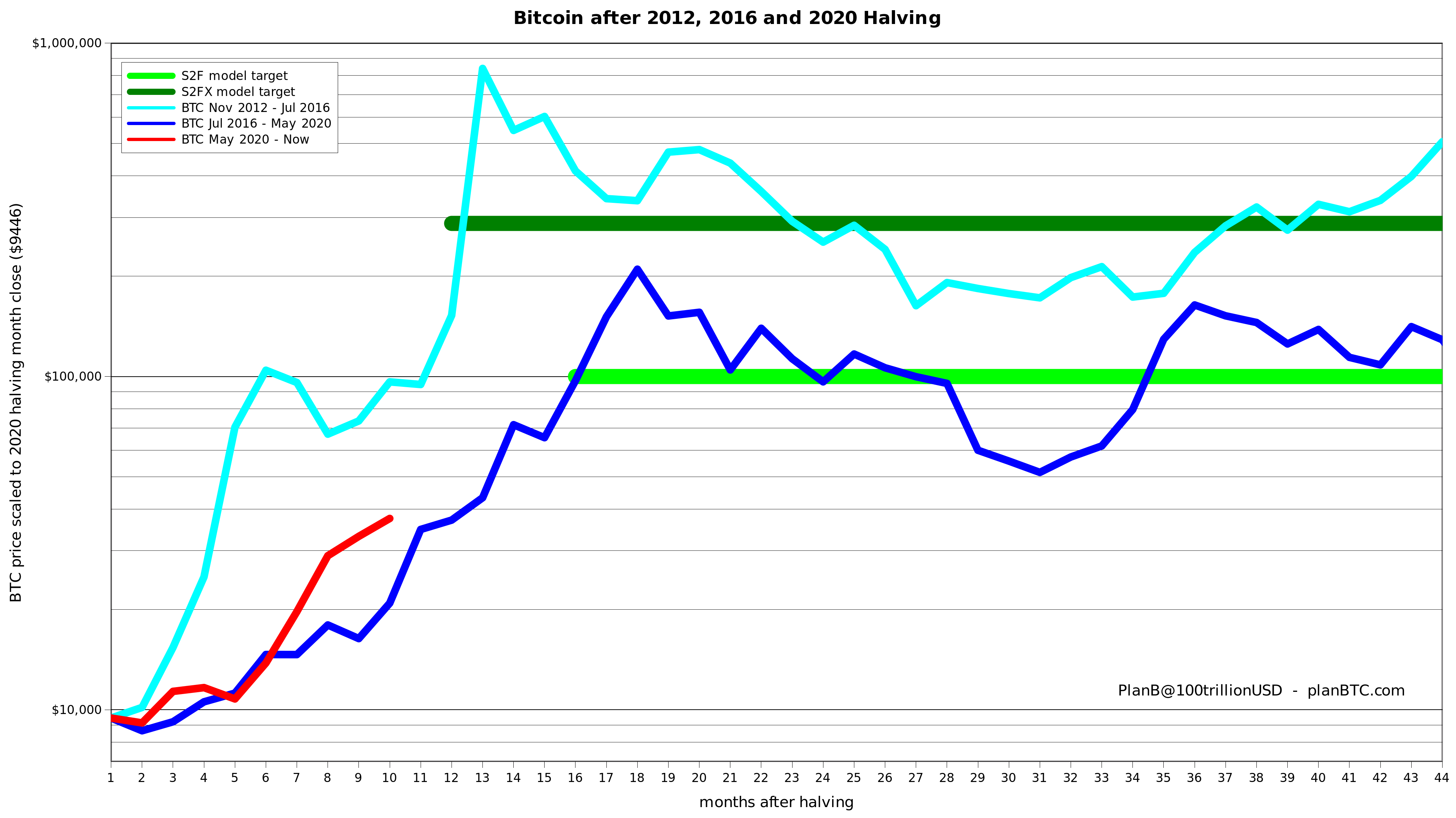

PlanB, a pseudonymous Bitcoin researcher behind the popular price model Stock-to-Flow (S2F), said Bitcoin is on track to reach $288,000.

The S2F model largely relies on BTC’s supply (the stock) and the new Bitcoins mined (the flow), predicting the price trend of BTC based on its scarcity. PlanB wrote:

“#bitcoin price track after 2020 halving is between 2012 and 2016 tracks. I added S2F ($100K) and S2FX ($288K) model targets. Targets are average prices, actual BTC price will oscillate around targets. If 2021 bull market follows 2017 then $100K it is, if we follow 2013 .. $288K.”

Currently, Bitcoin is consolidating after reaching a new all-time high above $48,500. If the price of BTC nears $60,000, it would cause the market capitalization of the cryptocurrency to surpass $1 trillion.

Moreover, at around $56,000, analysts say that there is a big options gamma squeeze awaiting for Bitcoin. Hence, the probability of BTC rising to around $53,000 to $56,000 remains high in the first half of 2021.

Lex Moskovski, a cryptocurency researcher and a quant trader, also emphasized that the market sentiment remains positive due to rising institutional interest. He said:

“Any institution, company, and individual that holds any of the ETF below or plain $TSLA, holds #Bitcoin as well. Tesla has pulled the ultimate trojan horse. Let’s welcome Warren Buffett and Swiss National Bank. Holding TSLA? You are long $BTC.”