On Thursday, November 19th, the BTC rate stabilized after a rally which, however, does not seem to be over yet. The coin is chiefly trading at 17,658 USD, while yesterday’s peak was 18,483 USD. The price of the leading cryptocurrency has been growing for several weeks, pausing from time to time to find a balance point.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- Tech analysis of BTC/USD

- The CME reports bursting demand for trades with the BTC.

- The capitalization of the BTC has reached its all-time high.

On W1, not much has really changed, the coin keeps developing the ascending dynamics, heading for 100.0% Fibo. The aim of the growth remains at 18,850 USD. The MACD histogram is positive, giving yet another signal for growth. The signal lines of the indicator keep growing upon forming a Black Cross, which increases the chances for further growth of the coin. The Stochastic is slowly heading for the overbought zone, allowing a soon correction. Judging by all the factors, the BTC might correct on its way to 18,850 USD but then go on growing.

Photo: RoboForex / TradingView

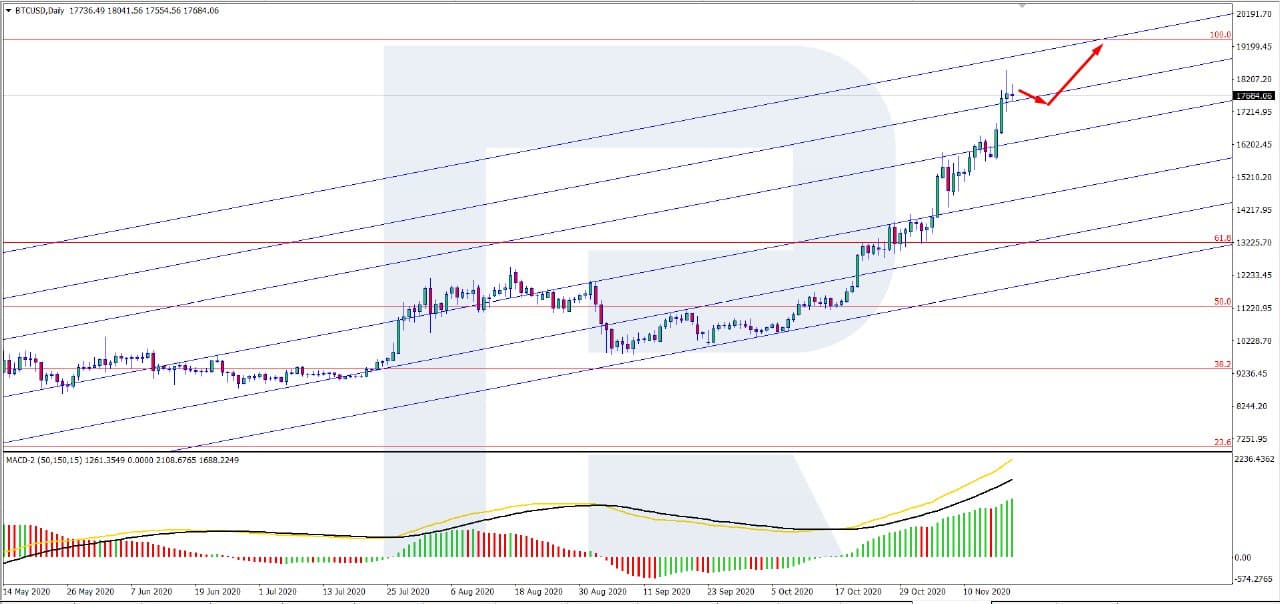

On D1, the picture is almost identical to that on W1: the pair goes on with the uptrend. The aim of the growth remains at the resistance level of 100.0%. The MACD is above zero, promising further growth. The signal lines keep growing in favor of further growth after forming a Black Cross. Both charts give a good chance for a correction before the ascending continues, heading for the same goal of 18,850 USD.

Photo: RoboForex / TradingView

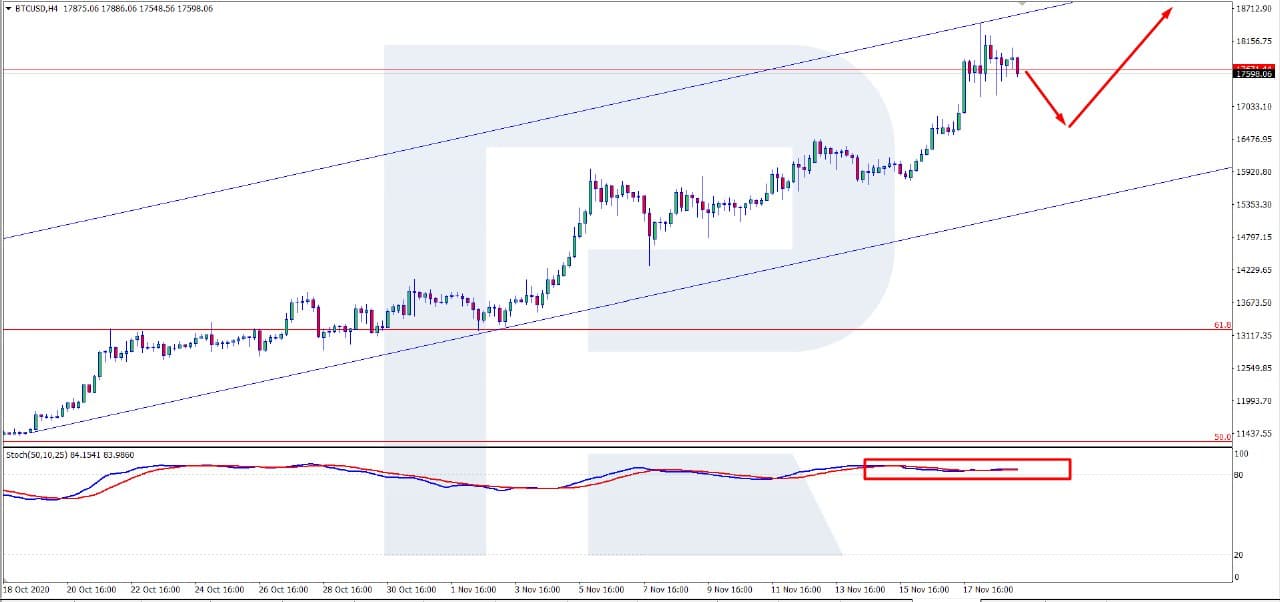

On H4, the perspectives of growth after a correction are also bright. The Stochastic remains in the overbought area, additionally hinting at a correction before further growth. The aim of the pullback might be the support level of 17,000 USD. The goal of the growth is the same as on larger timeframes – 18,850 USD.

Photo: RoboForex / TradingView

According to the information of the CME, the demand for trades with the BTC has overcome 1 billion USD, which is a new record for the exchange. Since March 2020, the volume has grown by 550%. The sky-rocketing of the BTC has no fundamental driver – you can try any explanations but obviously, the Bitcoin is pushed upwards by the tide of common excitement.

To some extent, the BTC rate is supported by the lack of trust of investors in normal fiat assets; market participants keep looking for new means of investing and making money – indeed, in such a situation, the crypto market attracts attention.

The increase in the BTC price pulled the capitalization up as well – for the first time ever it was estimated higher than 340 billion USD. Yesterday the capitalization approached 342 billion USD, which is the all-time high-frequency. For the last time, the record was renewed in 2017, when the capitalization reached 325 billion USD.

The BTC share in the crypto market now amounts to 66.5%; since the beginning of November, the price of the leading cryptocurrency has grown by almost 30%.

For this article, we’ve used BTCUSD charts by TradingView.

Disclaimer: Any predictions contained herein are based on the author’s particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.