On Dec. 11, a total of $540 million in Bitcoin (BTC) options open interest is set to expire. This number mimics the past month’s $525 million options expiry, as monthly and quarterly options typically concentrate the most volume.

Although both dates present somewhat unusual activity, this time around, bears seem in control. Data also shows that the Bitcoin bulls appear to have become too optimistic.

Currently, the exchange Deribit holds 85% market share for Friday’s expiry, with $189 million worth of call (buy) options stacked against $282 million put (sell) options. Even though the 1.44 put-to-call ratio is favoring the more bearish options, a more granular view is needed.

Bears were hurt as BTC surpassed $16,000

Traders tend to have a short memory, but BTC was trading below $16,000 less than four weeks ago. Thus, many put options were bought around that level. That has led to a $120 million put options open interest between $15,000 and $17,000.

Notice how the above chart shows Deribit holding a considerable open interest in a range that no longer makes sense after the most recent BTC price appreciation. Some of these options previously traded for $365 apiece, such as the $16,500 put on Nov. 28.

They are currently worth less than $25 each and will lose all their value as we approach Friday’s expiry. Still, this does not mean that bulls got the better end of the deal.

Bulls bought overly optimistic calls

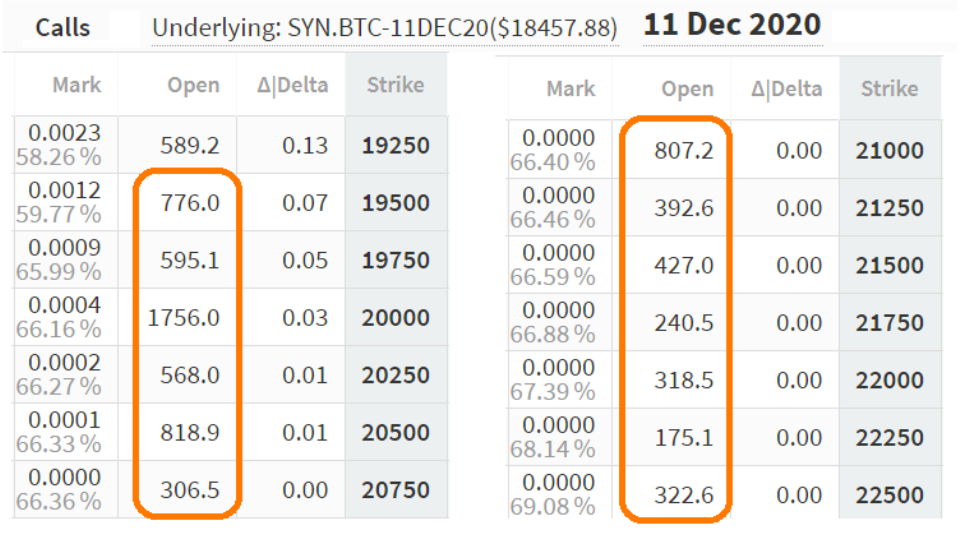

This time around, a decent volume of call options above $19,500 has been traded. After failing to break the $19,800 resistance and later facing a plunge below $18,000, overly optimistic bulls ended up being the ones getting hurt.

To understand the result of this volatility, one needs to exclude the options with dim odds. By excluding put options below $17,500 and call options above $19,500, traders can attain a more realistic view of the current market conditions.

Deribit holds 2,420 BTC call options ranging from $17,000 to $19,000. Bit.com has 320 BTC, and OKEx currently holds 140 BTC. Therefore, there’s an immediate $52 million in open interest supporting current levels.

Meanwhile, the put options ranging from $17,500 to $19,500 amount to 6,870 BTC at Deribit, followed by 800 BTC at Bit.com — plus, there is another 290 BTC at OKEx. Thus, the immediate sell-side pressure amounts to $145 million open interest from put options.

The reason behind this difference is that call options above $19,500 have been depreciated and have no market value. This movement excludes 70% of the aggregate $225 million call options open interest.

The data above shows just how extremely optimistic bulls became as they bought call options up to $22,500. Most of those options are now deemed worthless, as signaled by their delta below 5%.

Therefore, when analyzing just the option strikes closer to market levels, there is a sizable $93 million imbalance favoring the sell-side.

Despite having quickly bounced from Tuesday’s $17,640 low, these short-term options are currently favoring bears.

OKEx, Bit.com and Deribit weekly contracts mature on Dec. 11 at 8:00 am UTC.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.