Bitcoin (BTC) price finally woke up and surged to a new 2020 high but as the markets surged past $10,000, some traders seem to have opened excessively leveraged long positions.

This effect became more noticeable as the funding rate for perpetual contracts reached the second-highest level this year at 12.4% per month.

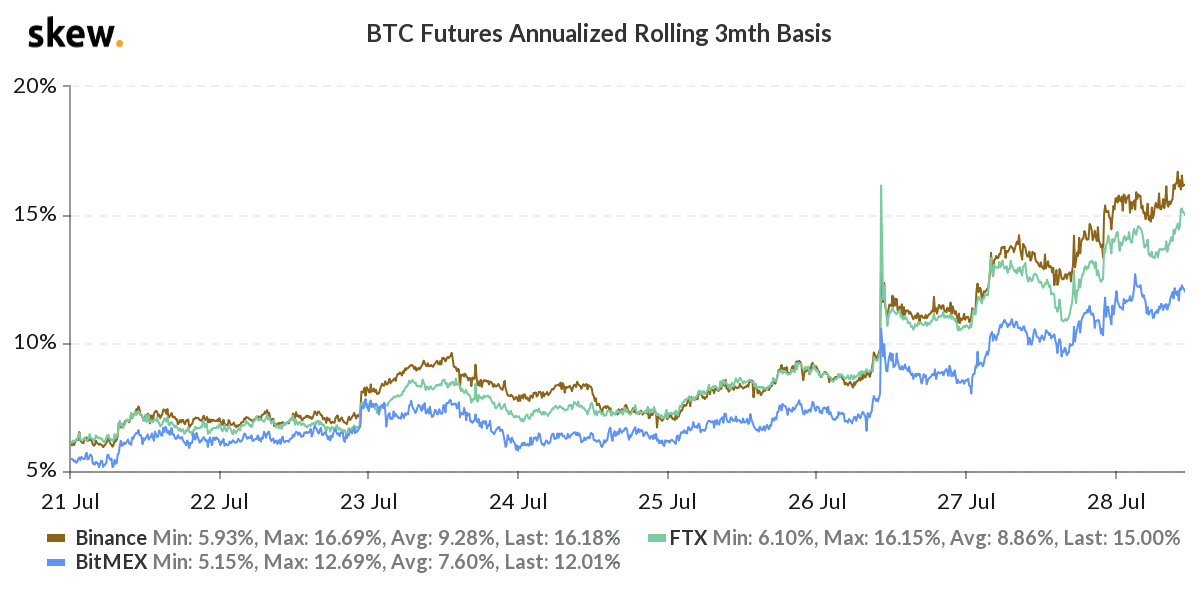

Funding alone shouldn’t be considered a red flag, especially in short-term periods. The problem lies mostly in contango, also known as futures basis, which has been unusually high in the past couple of days. This indicates that professional traders are highly leveraged on the buy-side.

Most of those leveraged positions are in profit as contango exceeded a 10% annualized rate before the $10,400 level broke. To confirm whether such optimism is under a controlled situation, one should also evaluate options markets, and determine whether the 25% delta skew is showing signs of stress.

BitMEX funding rate rises to 12-month high

Currently BitMEX ranks among the top 3 derivatives exchanges in terms of measured open interest and the exchange also provides clear reporting on its funding rate.

Perpetual contracts, also known as inverse swaps, require 8-hour adjustments through a funding rate and this will vary depending on the number of active longs versus shorts leverage.

Bitcoin XBT perpetual 8-hour funding rate. Source: BitMEX

The funding rate at BitMEX recently reached 0.13%, meaning buyers are paying 12.4% per month to hold long positions. Such level isn’t unprecedented, but as time goes by, it creates an uncomfortable situation for long perpetual contract holders.

Contango is approaching dangerous levels

It’s important to monitor this metric as contango measures the premium of longer-term futures contracts to current spot levels. Professional traders tend to be more active than retail on such instruments as their prices fluctuate more widely, plus there is the hassle of having to handle expiry dates.

These contracts usually trade at a slight premium, indicating sellers are requesting more money to withhold settlement longer.

Bitcoin futures 3-month annualized basis. Source: Skew

The 3-month futures annualized basis surged past 10% annualized a couple of days ago, and currently it sits at its highest level since early-March. Such strong 15% annualized rates indicate professional traders are paying a sizable premium to spot markets, hence highly leveraged on the buy-side.

No set level becomes unbearable for its holders, although a sideways market from here will cause leveraged long positions to become more expensive.

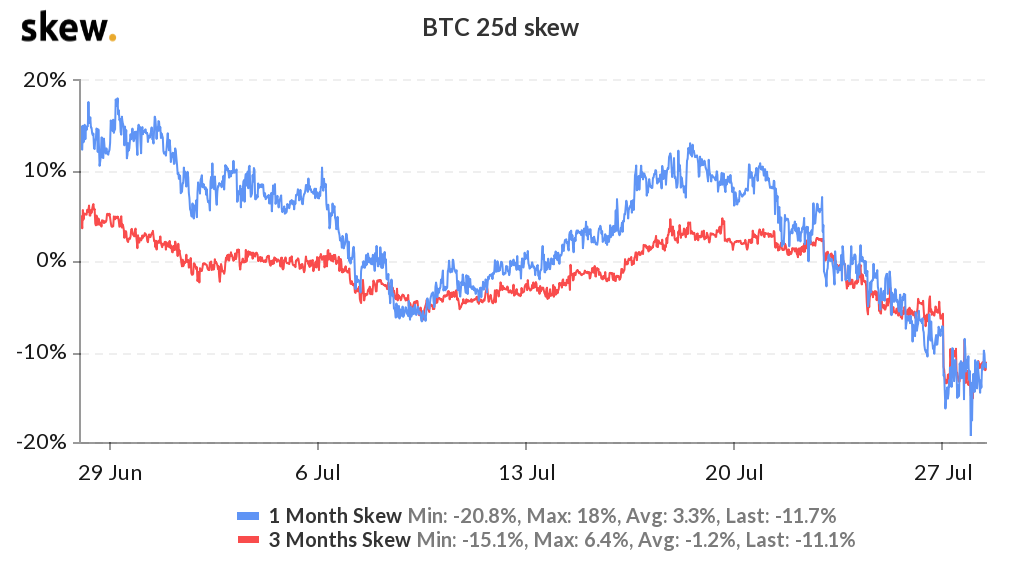

Options markets show no signs of excessive optimism

Whenever markets enter an ultra-confident scenario, options markets will tend to present unusual data. The 25% delta skew measures how the more expensive market is pricing bullish call options compared to equivalent bearish put options.

Bitcoin options 25% delta skew. Source: Skew

The 25% delta skew, considered a fear/greed indicator and it is currently sitting at a negative 12%, meaning protection to the upside is costlier.

Once again, this is not a worrisome level, in fact, some will say it is natural after such an impressive $2,000 bull run occurred in less than a week.

Leveraged bulls seem comfortable right now

Even surpassing a 100% annualized rate is not unusual on derivatives markets, mostly because positions are not kept for that long. Nonetheless, no trader would be willing to hold such a leveraged position for more than a couple of weeks on sideways markets.

Highly leveraged positions could also indicate that traders are expecting to close it soon enough. Professional investors know that others closely monitor such indicators and use that information on their benefit. Others could have withheld their gains leaving only profits as margin and this could also be contributing to the current excessive leverage phenomenon.

Long contract holders seem comfortable enough now that they are in no rush to close their positions. This might change if the $10,400 level is retested, but there are currently no signs of weakness on derivatives markets.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.