Chinese VCs, Crimean Crypto Hub: Can Investors Cope With Corruption?

January 3, 2019 by Jeff Fawkes

The Crimean occupation government’s Deputy Prime Minister Georgiy Muradov has outlined plans to create a mining equipment plant, a new investment fund, and a cryptocurrency exchange–all on Crimean territory.

Also read: Paper Outlines Proof-of-Stake Sidechains for Cardano Ouroboros, Beyond

Subscribe to the Bitsonline YouTube channel for great videos featuring industry insiders & experts

Crimea May Become A Crypto Hot Spot

The RIA news agency reports that a number of foreign companies have expressed a willingness to invest in Crimean cryptocurrency infrastructure.

Chinese venture companies would seem to be the most obvious source of investment. Also, the widespread adoption of cryptocurrencies may help Crimeans bypass the banking sector blockade and sanctions imposed by the U.S. since 2014.

According to the report, Crimean Deputy Prime Minister Muradov is waiting for the appropriate laws to enact the initiative:

“While Russia has no laws to regulate blockchain and cryptocurrency markets, the implementation of such technologies is put on hold. However, we have a project of [a] cryptocurrency fund in development. It may allow [us] to execute a number of investment programs on Crimean territory, and maybe abroad too. The important fact here is that a system of cryptocurrency circulation allows for solving the actual problems of Crimean banks. They experience a need of moving away from the current restrictions and the dollar-based accounting.”

Rumors about the “Crypto Crimea” project first emerged in April 2018, during the IV International Economic Forum in the beautiful city of Yalta, situated on Black Sea coast. Back then, officials planned to create a blockchain cluster with the crypto exchange and a venture fund.

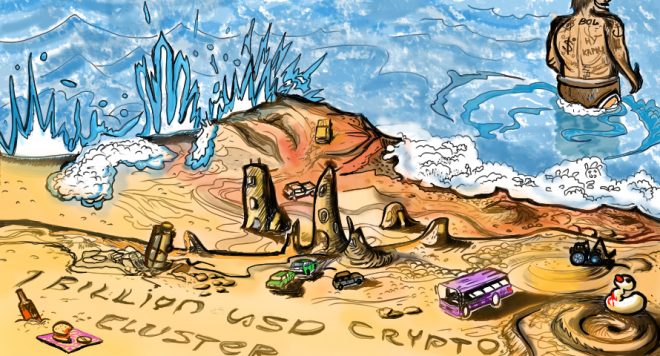

Clearance Equals a One Billion Dollar Deal

Muradov stated that a number of Chinese partners have demonstrated bold interest in the area. “In China, they have lots of crypto startups, mining rig productions, and blockchain coders”, says Muradov, “who are ready to invest in Crimea one billion US dollars to develop a mining ecosystem”.

Indeed, at the beginning of 2018, Russian Deputy Minister of Finance Alexey Moiseev put big hopes in the Crimean ICO market. He said:

“Overcoming the sanctions is not a target, but a possible path. We talk about jurisdictions that are under financial blockade. Particularly, those are Crimean Republic and the city of Sevastopol. If someone wants to open a coffee-room there, the cheap money are not there to help. Running ICO campaigns can solve this problem.”

Indeed, advertising cryptocurrencies among locals could foster their technological stamina, but not as much as Moiseev thinks. Giving one billion dollars to them is a much more appropriate way of stimulating the working class. Yet there’s still a small problem.

The Corruption Is a Vital Part of the Russian Economy

Despite changing flags in 2014, local authorities didn’t change habits. You can easily find roads in Crimea with huge holes in them that were made in 1980 or earlier. Lazy chameleons rule the peninsula, eating money from the Russian budget and giving absolutely nothing in return.

While many of the countries in the world are implementing “curated blockchain solutions” for the government to use, they do not always guarantee clarity. Most of them are closed or even appear uninteresting to the majority of OG crypto users.

However, millions of dollars in local currencies are already spent on useless “blockchain developments”. You can pick any ten projects and find large holes in at least seven of them. Even without diving into technical details.

Many modern government-curated blockchain firms look more like laundry schemes. For example, how can a government corporation invest millions of dollars in a very stupid idea? One of the possible answers is that startup founders are offering bribes.

How To Save The Chinese Money?

Even considering blockchain hype, when we think about Crimean budgets, we should understand that a crypto cluster from a government plan simply cannot possibly cost one billion dollars. And if it can, the Chinese investors mentioned by the officials should pay a long-lasting visit to Crimea to see what they’re going to invest in.

That’s XVIII century territory and (citing Alexander Nevzorov) “an empty piece of land with bad roads and greedy population”. As a person who lived there for almost a year, I cannot disagree. On the other hand, it is good to invest in risky regions, as the profits from such investments may unexpectedly turn out to be very high, as is often the case with African countries.

Will Crimean authorities pay successful attention to cryptocurrencies despite nation-wide internet-totalitarianism? Can Chinese investors overcome Russian corruption levels? Share your thoughts with us in the comments below.

Images by Jeff Fawkes, Pixabay