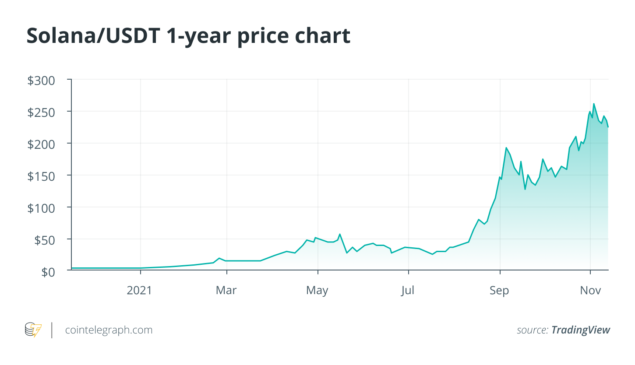

The top cryptocurrencies by market capitalization keep changing over time as the industry matures. Solana (SOL) has seen its value skyrocket so far this year and has been consistently processing over 2,500 transactions per second.

The cryptocurrency’s price, according to TradingView data, is up nearly 13,000% year-to-date as the year started with SOL trading slightly below $2. Solana is now changing hands-on exchanges for around $240.

Solana is a blockchain platform that aims to achieve high transaction speeds at a low cost without sacrificing decentralization. To do so, it relies on a number of unique features, including a “proof-of-history” mechanism. This allows Solana to process an estimated 50,000 transactions per second, compared to Bitcoin’s seven and Ethereum’s 15.

As the Solana network supports smart contracts, decentralized finance (DeFi) applications have found a home on it. Its ecosystem now has nearly $15 billion worth of crypto assets locked on it, according to DeFiLlama data.

Speaking to Cointelegraph, Kraken Intelligence manager Pete Humiston noted that almost all crypto assets have benefitted from a year-long bull run, although Solana has seen “particularly strong price appreciation due to its Web 3.0 experience.”

Humiston added that transactions on Solana are “instant, cost a fraction of a penny and the ecosystem is easy to navigate thanks to user-friendly wallets and applications” contributing to its adoption.

Solana’s adoption may be the result of retail investor demand that was priced out of Ethereum, according to Mindaugas Butkus, chief technology officer of Solana-based decentralized exchange Solanax. He told Cointelegraph:

“Growing demand for DeFi applications and NFTs on Ethereum led to exploding gas fees, which made it expensive to use ETH. Transacting on Solana is inexpensive and transactions are processed in no time, making it an attractive alternative for retail investors.”

Butkus added that Solana’s base-level protocols attracted users for the same reason Ethereum’s DeFi space initially did: flourishing innovation leading to a booming ecosystem with a good user experience.

Is Solana a threat to Ethereum?

As the price of Solana surged, many speculators suggested that SOL will one day overtake Ether (ETH) to become the second-largest cryptocurrency by market capitalization. Solana’s focus on maintaining its decentralization while offering near-instant transactions at a low cost has been a way to attract users, but there’s more to Ethereum than gas fees.

Speaking to Cointelegraph, Adrian Kolody, founder of Domination Finance — a non-custodial exchange focusing on dominance pairs — said he believes there are “too many users vested in Ethereum” for it to be surpassed by Solana.

To Kolody, Ethereum is “a truly decentralized network whereas Solana falls more into the SpeedFi category.” To him, there are idealists that refuse to interact with any ecosystem that isn’t that of Ethereum:

“Ethereum would have to totally bottle their promises for Ethereum 2.0 over the coming years for Solana to overtake it, and even if that happens, it is still very unlikely.”

To Kraken Intelligence’s Humiston, it’s in the “realms of possibility that Solana could trade inline with Ethereum this cycle if it maintains momentum and grows its developer and user community.”

Humiston added that Ethereum has a “number of tailwinds of its own” that could justify its price moving up further this cycle. To the analyst, this potential price appreciation is “why diversification among the largest smart contract platforms” is worth considering at this point.

Markus Bopp, chief technology officer of no-code nonfungible token (NFT) platform Unifty, told Cointelegraph that he believes Solana has “great potential technically,” and as it matures and developers organically jump onto its network it “could be a good #3.”

Bopp added that “this will take years moving forward,” and right now it’s “a lot easier as a developer to jump on EVMs due to much lower barriers to entry,” concluding:

“Having said that, Ethereum just can’t compete with the speed of transactions on Solana which developers may increasingly look at.”

Jack McDonald, CEO of digital asset custodian Standard Custody & Trust Company, told Cointelegraph that Ethereum will “always have a prominent place in terms of market cap” thanks to its first-mover advantage and “significant network effects.”

McDonald, whose company brought Solana staking to institutions earlier this month, added that Ethereum needs to get its transition to a proof-of-stake consensus mechanism right and “do it smoothly and in a timely manner, as that will fix their gas fee issue.”

Solana’s 17-hour outage

On Sept. 14, the Solana network went offline for roughly 17 hours after enduring a denial-of-service disruption. At the time, Twitter account Solana Status explained a large increase in transaction load to 400,000 per second overwhelmed the network, causing it to start forking.

1/ Solana Mainnet Beta encountered a large increase in transaction load which peaked at 400,000 TPS. These transactions flooded the transaction processing queue, and lack of prioritization of network-critical messaging caused the network to start forking.

— Solana Status (@SolanaStatus) September 14, 2021

After Solana’s engineers were unable to stabilize the network, its validator community coordinated a restart that brought it back to full speed. That same day, Ethereum layer-two rollup network Arbitrum One reported its sequencer went offline for roughly 45 minutes.

The attacks failed to affect the Ethereum network, which to Domination Finance’s Kolody was to be expected. Kolody noted that Ethereum is “totally decentralized and it is essentially impossible for the network to completely shut down,” which is “why gas fees can become insanely high.”

Ethereum’s resilience, he said, is part of the reason why it will “always have users and developers building on top of it.” Kraken Intelligence’s Humiston noted the incident was a result of “unprecedented demand” that did not scare away investors.

Humiston further noted that once the network came back online, the price of SOL rallied and returned to levels seen before the network went down. To the analyst, this “suggests investors didn’t see the incident as ruinous to Solana’s overall narrative and value proposition.”

If anything, Humiston concluded, Solana’s price action proved that the market “acknowledges the difficulties in building a globally distributed system and expects growing pains as the network scales, evolves and innovates.” To other experts, however, things aren’t as clear.

A network hiccup?

While most experts seemingly agree that Solana’s 17-hour outage was a small hiccup in a nascent network, others believe it may represent a problem that needs to be addressed before further outages occur.

According to a Solana network explorer, the network has already processed over 39.6 billion transactions and currently processes over 2,300 transactions per second. Part of those transactions may, however, be in part “thousands of critical consensus messages” that all blockchains have but don’t process as transactions.

That’s according to Justin Giudici, head of product at Telos Blockchain, who told Cointelegraph that these processes are “typically handled separately from on-chain transactions via a distinct communications channel — for good reason.”

Per Giudici, Solana’s design approach “results in amazing scalability claims” that are “entirely misleading.” Giudici said that in real terms, a lack of separating critical processes “required for each Solana node to run from the real transaction which prevents the correct prioritization of CPU cycles,” which led to the crash.

Giudici sees Solana’s 17-hour outage as a “serious problem” for the network, as he believes that if Solana sees “enough real transactions,” which he said are estimated to be “as little as 200–300 transactions per second” these can “out-prioritize the functioning of the networks core processes due to lack of separation of concerns in the networks architecture.”

Interest in Solana keeps growing

Interest in Solana has steadily been growing, as evidenced by its growing DeFi ecosystem that has steadily been supported with the launch of new NFT marketplaces and collections. Its cheap transaction fees make it an attractive alternative for retail investors, although institutions are also keeping an eye on it.

Standard Custody & Trust Company’s McDonald revealed that institutional investors aren’t the only ones interested in Solana. Per his words, the firm has had “tremendous institutional interest” to custody and stake SOL.

Oscar L. Andrade, founder of Solana-based DeFi platform Bancambios, noted high profile projects built on Solana: Reddit co-founder Alexis Ohanian has teamed up with Solana Ventures to launch a Web 3.0 and social project investment fund while Brave founder Brendan Eich announced it will integrate with Solana on its privacy-enabled browser. Andrade told Cointelegraph:

“Reddit and Brave are onboarding millions of users into the Solana ecosystem because they realized it has the potential to help cryptocurrencies achieve mass adoption. Its near-free transactions and instant finality make the use of blockchain technology seamless.”

McDonald predicted the boom will continue as institutional investors continue to invest in Solana and retail investors keep following that trend. Wall Street’s interest in the cryptocurrency has been such that SOL became the third cryptocurrency to hit the Bloomberg Terminal, after Bitcoin (BTC) and Ether.

Solana’s features have indeed been attracting a plethora of users but that’s not all helping it stand out. Its booming DeFi space is allowing retail investors to explore new funding options, decentralized exchanges and nonfungible tokens at accessible rates.

Whether Solana will maintain its status as the go-to platform because of its features, or whether Ethereum 2.0 and ETH’s layer-two scaling solutions will grow to overtake it remains to be seen.

Related posts