After a powerful breakout last week that pushed Bitcoin into a new all-time high of $118,667, the world’s leading cryptocurrency appears to be taking a breather. As of the time of writing, Bitcoin is trading around $117,953, slightly below its recent peak. The move followed a string of consecutive daily gains as bullish momentum swept across the crypto industry. In a technical analysis shared on the TradingView platform, crypto analyst RLinda pointed out two scenarios that may play out over the coming days and weeks, depending on how Bitcoin reacts…

Category: News

‘Hyperbitcoinization’ May Not Be Just Maximalist Fantasy Anymore

“Hyperbitcoinization” — an almost apocalyptic term evoking end-of-days fiat collapse and bitcoin’s parabolic rise to global reserve status — is increasingly being discussed in more serious circles. For hardcore bitcoin maximalists, it’s long been the ultimate scenario: a financial utopia where individuals, institutions and even nations are all-in on a bitcoin-only system as the fiat-based economy collapses. While we aren’t there yet, the recent events might suggest something is brewing. Bitcoin is trading at record highs above $119,000. The market cap of bitcoin is near that of the tech giants.…

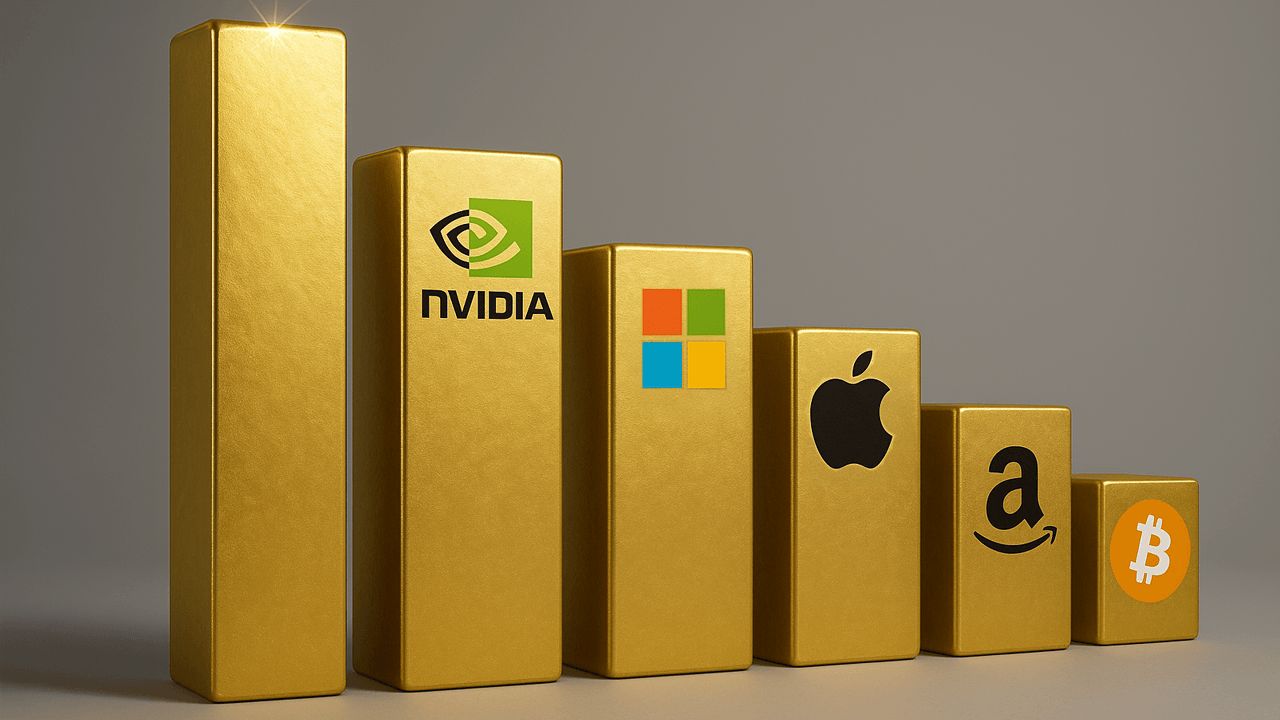

Bitcoin Climbs to No. 6 Spot Among Global Market Giants; Closes in on Amazon

On Sunday, July 13, bitcoin vaulted to $119,444 before settling at $118,724 per coin. That jump puts bitcoin in sixth place among the world’s most valuable assets, closing in fast on Amazon’s market cap. Bitcoin Breaks Into Top 6 of World’s Biggest Market Caps With its market value now sitting at $2.361 trillion, bitcoin (BTC) […] Original

Bitcoin May Land On 36 More Company Balance Sheets This Year, Blockchain Firm Says

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure Public firms around the globe have been piling into Bitcoin this year. According to Blockware Intelligence, the number of public companies holding Bitcoin jumped by 120% in 2025. That surge brought the total to 141 firms. And by the end of 2025, at least 36 more are expected to add Bitcoin to their balance sheets. That would represent a 25% boost from today’s numbers. Rising Tide Of Corporate Bitcoin Adoption Based on reports from Blockware’s Q3 2025…

Bitcoin ATH, Pump.fun’s wild 12 minutes, Trump jumps to Tron | Weekly Recap

Crypto.news’ latest weekly recap presents a digest of the cryptocurrency sector’s biggest stories. Last week, Bitcoin shattered records with a new all-time high, while Pump.fun lit up the charts with a $600 million token sale that sold out in minutes.… Source CryptoX Portal

Dead Broke in Canada: Could Bitcoin–or Joining the US–Be the Answer?

With inflation still high, GDP growth flatlining, and a brain drain in full swing, Bitcoin.com CEO Corbin Fraser believes Canada itself has become the risk. The Bitcoin Exit Plan Bitcoin.com CEO Corbin Fraser recently made a provocative claim: “Canadians are dead broke.” Pointing to a stagnant economy, high inflation, and political dysfunction, he argues that […] Original

‘My Fellow Pigs And I Are Feasting’

They say journalists never truly clock out. But for Christian, that’s not just a metaphor, it’s a lifestyle. By day, he navigates the ever-shifting tides of the cryptocurrency market, wielding words like a seasoned editor and crafting articles that decipher the jargon for the masses. When the PC goes on hibernate mode, however, his pursuits take a more mechanical (and sometimes philosophical) turn. Christian’s journey with the written word began long before the age of Bitcoin. In the hallowed halls of academia, he honed his craft as a feature writer…

BTC’s $118K Rally Wipes out $1B in Shorts, Canadian Woman Sues Over Sim-Swap Scam, and More — Week in Review

Bitcoin rally to $118K wipes out over $1 Billion in short bets, Canadian woman sues after $1.3M in bitcoin vanishes in SIM-swap scam, Indian crypto users slammed with 18% GST as Bybit complies with tax regulation, and more in this Week in Review. Week in Review Bitcoin surged to $118,000, triggering over $1 billion in […] Source CryptoX Portal

$BTC Breaks $119K, but $XLM and $HBAR Soar 22% and 27% as Top Percentage Gainers in Top 20

According to CryptoX Data price information, at 2:20 p.m. UTC on Sunday, the bitcoin price set a new all-time high of $119, 308, up 1.4% in the past 24-hour period. Bitcoin’s achievement was a little bit surprising because the crypto market was waiting for the U.S. stock market to open on Monday to discover the reaction to the 30% tariffs against imports from the EU and Mexico that Trump announced late Friday on Truth Social. Analysts expect the bitcoin price to reach as high as $250,000 by year-end. For example,…

Strategy Co-Founder Hints at Another Bitcoin Purchase

Strategy co-founder Michael Saylor signaled that Strategy would resume Bitcoin (BTC) buying on Monday after the company took a week-long hiatus from accumulating the digital asset. “Some weeks, you don’t just HODL,” the executive wrote on Sunday. The company skipped buying BTC last week but announced a $4.2 billion capital raise. Before the break, Strategy racked up 12 consecutive weeks of BTC accumulation. Strategy’s most recent BTC buy occurred on June 30, when the company bought 4,980 BTC for $532 million, bringing its total holdings to 597,325 BTC, valued at…