Welcome to the latest edition of Cointelegraph’s decentralized finance (DeFi) newsletter.

In a week where Rari Capital achieved the $1billion TVL milestone, read on to discover why OlympusDAO is yielding four-figure sums on its most popular protocol.

What you’re about to read is a shorter, more succinct version of the newsletter. For a comprehensive summary of DeFi’s developments over the last week, subscribe below.

Celsius Network raises $400M to expand institutional service

Cryptocurrency lending platform Celsius Network announced a $400 million equity fundraise this week led by Canadian pension fund Caisse de dépôt et placement du Québec (CDPQ) and equity firm WestCap, taking the company’s valuation in excess of $3 billion.

The firm has expressed intentions to utilize the funds in a two-fold strategy: enhance its institutional product and service offering, as well as doubling the workforce to nearly 1,000 employees across the globe.

Celsius Network CEO Alex Mashinsky revealed to Cointelegraph the financial impact the platform is having on the lending sector:

“With more than $25 billion in assets and over $850 million in yield paid to over 1.1 million users, Celsius has distributed 10x more yield for the crypto community than any other lender.”

This funding news coincides with enhanced political scrutiny for crypto lending platforms in the United States. In September this year, Celsius encountered legislative resistance from the Texas State Securities Board and New Jersey Bureau of Securities, which threatened to terminate activity due to the alleged selling of unregistered securities.

Despite this, Celsius has consistently maintained its innocence of wrongdoing and has been willing to communicate and cooperate with regulatory agencies.

Rari Capital smashes $1B in TVL

DeFi protocol Rari Capital surpassed $1 billion in total value locked (TVL) this week to reach an all-time high of $1.225 billion according to analytical data from ranking platform DeFi Pulse.

The eight-figure total marks a monumental rise from $500 million two weeks ago and just $100 million three months ago. Launched in July 2020, Rari provides an automatic yield optimizing strategy to participants in the DeFi space seeking to secure the highest possible return from their investment.

A number of its liquidity pools have garnered noticeable attention for their lucrative returns, such as the USDC deposits, which offer a 21.67% annual percentage yield (APY), and the Dai pool, which offers 26.43% APY.

Despite these higher-than-average returns in comparison to the industry standard, it has been the OlympusDAO within the Fuse Protocol’s Tetranode’s Locker that has truly stolen the headlines over the past few months.

OlympusDAO is an algorithm-centric rebase model whereby token balances fluctuate over time depending on changes in the token price and the supply in circulation. As of writing, the OlympusDAO sOHM token is yielding a seismic 7,594% APY.

North America’s surging DeFi volume

Monthly cryptocurrency transaction volume in the North American region expanded 1,000% over a one-year period from July 2020 to June 2021 by virtue of the flourishing DeFi sector according to data released this week by analytics platform Chainalysis.

The annual Geography of Cryptocurrency Report revealed that monthly volume peaked at $164 billion during May 2021 before descending to $100 billion in June. In addition, DeFi transactions equated to 37% of the region’s total volume at $276 billion.

David Gogel, growth lead at decentralized derivatives exchange dYdX, commented on the findings that the biggest volume recorded was driven by retail consumers:

“Right now, DeFi is targeted towards crypto insiders. It’s people who have been in the industry for a while and have enough funds to experiment with new assets.”

Token performances

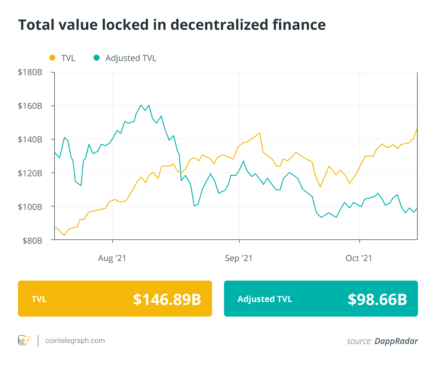

Analytical data reveals that DeFi’s total value locked has increased 8.11% across the week to a figure of $146.89 billion.

Data from Cointelegraph Markets Pro and TradingView shows that DeFi’s top 100 tokens by market capitalization performed varied across the last seven days.

Perpetual Protocol (PERP) secured the podium’s top spot with a respectable 29.7%. RenBTC (renBTC) came in second with 6.03%, while Wrapped Bitcoin (wBTC) came a close third with 6.00%.

Analysis and deep dives from the last week:

Thanks for reading our summary of this week’s most impactful DeFi developments. Join us again next Friday for more stories, insights and education in this dynamically advancing space.