Chainlink has seen an impressive rally thus far this year. It has been fueled by different partnerships that have put this altcoin in the spotlight of the cryptocurrency market.

The decentralized oracles token provided investors a mid-year return of investment of nearly 160% as its price rose from a yearly open of $1.76 to close June at $4.57.

Despite the considerable returns, market participants worry about a potential correction that could wipe out some of the gains incurred.

Chainlink Forms a Potential Double Top

The price action that Chainlink has seen over the past couple of weeks appears to have led to the development of a double top pattern on its 12-hour chart. This technical formation is considered an extremely bearish reversal pattern, according to Investopedia.

While the second rounded top appears to be currently forming slightly below the first top, it suggests that the trend is getting exhausted, and there is a high probability of a sharp retracement.

The TD Sequential indicator adds credence to the bearish outlook. This index is presenting a sell signal in the form of a green nine candlestick within the same time frame. The bearish pattern suggests a one to four candlestick retracement before the continuation of the uptrend.

Chainlink Appears to Form a Double Top. (Source: TradingView)

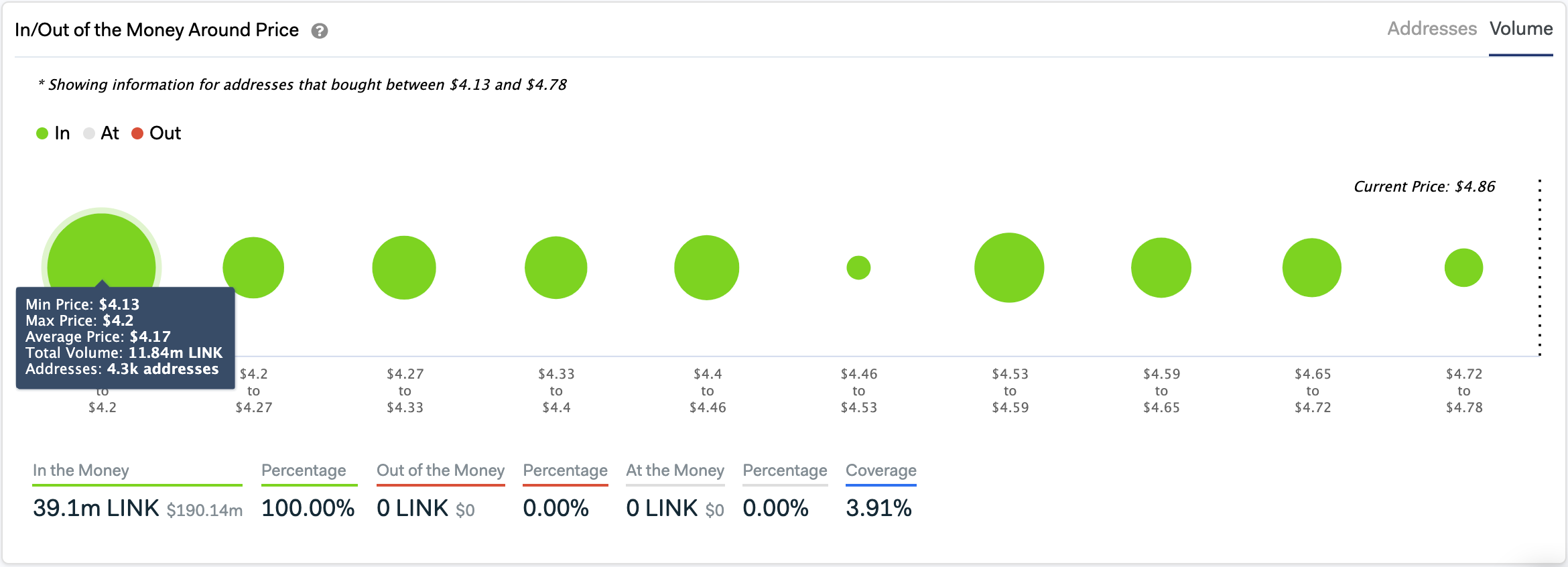

If these bearish signals are validated, IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model indicates that Chainlink could drop to $4.15, which is also where the 23.6% Fibonacci retracement level sits. Here, the IOMAP cohorts reveal that 4,300 addresses had previously purchased nearly 12 million LINK.

This massive supply barrier could have the ability to absorb any downside pressure and allow oracles token to bounce off towards new yearly highs. But failing to do so may trigger a further decline to the 38.2% or 50% Fibonacci retracement levels.

The Most Significant Support For Chainlink Sits at $4.16. (Source: IntoTheBlock)

Everything’s Not Lost

A look at Cainlink’s Network Value to Transactions Ratio, or “NVT”, provides insightful information what is the fair value of this token. When the LINK’s NVT is high, it indicates that its network valuation is outstripping the value being transmitted on its payment network.

“LINK is getting an abundance of token circulation right now. Five straight months of being well under the trendlines is great to see. And as long as things continue to look green heading into July, expect to see plenty more independent surges from Chainlink,” said Santiment.

Chainlink’s NVT Ratio Is Bullish. (Source: Santiment)

Market participants seem worried about a potential correction that is supported by different technical metrics. Regardless, given the current value that is being transmitted on Chainlink’s network, it seems like this cryptocurrency has more room to go up. Now, it is just a matter of time to see whether or not LINK can the $5 resistance level into support, which will help invalidate the bearish signals and propel its price into new all-time highs.

Featured Image by Shutterstock

Charts from TradingView.com