- China’s former finance minister warns the world is at risk of turmoil.

- The trouble is loose monetary policies and economic stimulus measures.

- That’s a joke coming from the world’s largest managed economy.

Lou Jiwei, former finance minister of China, recently warned that the nation could be stuck in economic turmoil for years.

Anti-Globalization, Overstimulated Economies Are the Problem

Lou sees the problem as two-fold.

The first problem is that anti-globalization views will likely persist. That could pinch world trade and keep economies from recovering from the coronavirus as quickly as possible.

The second problem: All the monetary and fiscal stimulus to solve the first problem could overstimulate.

“It is not unlikely that a global crisis more serious than the one in 2008 could break out if the withdrawal pace is not fast enough,” Lou stated.

Speculation is on the rise about a wave of anti-globalization following the pandemic. Also, global trade is down considerably, thanks to the pandemic. The World Trade Organization expects total trade to fall between 13 and 32%.

In that most pessimistic scenario, however, a 32% drop would still take world trade to levels seen in 2008.

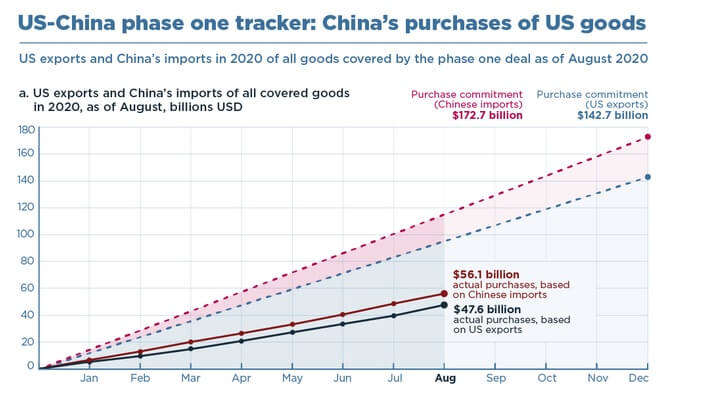

Meanwhile, the view of Chinese officials that anti-globalization is a problem could support world trade. However, based on import and export data, it’s clear that China is nowhere near to its old level of imports. The nation is even lagging the “phase one” trade deal commitment of imports from the United States.

It’s clear that trade is down, thanks to a global recession. Chances are that a recovery will naturally occur in time, even as sentiment sounds anti-globalist. What isn’t clear is the belief that other nations have overstimulated their economies.

China’s Managed Economy Problem

While China’s economy has been moving towards capitalism for decades, allowing some local free markets to flourish, the country remains deeply embedded in a top-down, controlled structure dominated by the Chinese Communist Party.

That’s allowed the country to post some robust growth rates. That would occur to any economy starting at such a low level as China’s economy in the 1970s.

With the party pulling the strings, it’s been easy for banks and companies in China to acquire cheap loans to make all sorts of developments that sound like capitalist projects. But that’s how you end up with the country’s infamous empty cities. It’s also fueled speculation that China will, someday, have a financial reckoning.

Western nations employing stimulus right now are attempting to create bottom-up demand. For China to claim that the process may harm economic development is only natural when you look at the world from a top-down approach.

Meanwhile, keeping the rest of the world economically weak allows China to continue behaviors the rest of the world typically finds unacceptable. The litany is familiar: building artificial islands and expanding its territory, trying to rein in Hong Kong, and furthering its internal campaign against human rights.

Western countries need to decide on appropriate fiscal and monetary policies for themselves. There’s no danger yet. But thwarting a recovery by raising interest rates or cutting back on stimulus could create one instead.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. Unless otherwise noted, the author has no position in any of the securities mentioned.