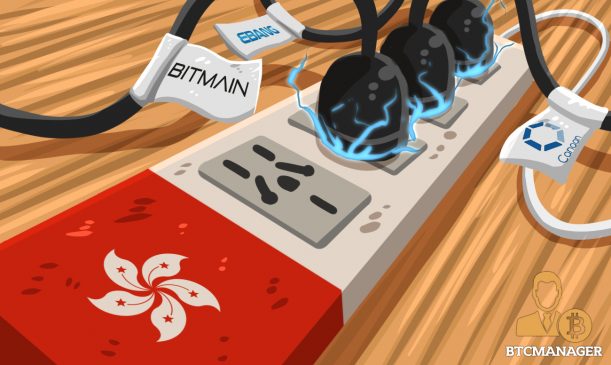

The big three in the world of bitcoin mining equipment manufacturers are all planning to list in Hong Kong and raise billions of dollars in the process. An August 27, 2018, Reuters report examined how Bitmain, Canaan Creative, and Ebang are going about their billion dollar IPO plans. At a time when other participants in the space are reporting low demand due to depressed crypto market prices, questions are being asked about the suitability of the IPO plans.

Mining rig Market Falls off a Cliff

At the height of the so-called “cryptocurrency boom” of 2017, companies like Bitmain seemed to have found a license to print money. Boosted by fabulous cryptoasset prices led by bitcoin touching $20,000, more and more investors poured into the crypto mining space, buying up a dizzying amount of ASIC and GPU mining equipment to hash blockchains in exchange for bitcoin, ether, dash, litecoin and every other token that embarked on a moonshot.

Even after the crash earlier this year, bitcoin mining continued recording fabulous growth, led by mining industry lodestar Bitmain. The Chinese company was one of the first to recognize the market potential of ASIC mining rigs, and over time it came to control a massive 75 percent of the total market for bitcoin mining equipment, with Canaan Creative’s estimated 14 percent a distant second.

(Source: CNBC)

Plans for a Bitmain IPO were met with much market excitement as investors saw the potential for huge returns. Bitmain’s market forecast for 2018 remained extremely positive despite the crypto market downturn, but crypto prices continued to tumble.

Soon some bitcoin miners began to complain that at $6,000, they were barely breaking even with electricity costs.

U.S. chipmaker Nvidia Corp recently announced its exit from the crypto space due to falling revenues, after it revealed that its Q2 2018 sales to crypto miners totaled just $18 million, compared with the $100 million it had forecast. According to its Chief Financial Officer Colette Kress, the company does not envisage any contribution to revenues from crypto mining rig sales in 2018.

Despite all of this, the big three mining rig makers continued making plans for Hong Kong IPOs, with Bitmain recently announcing a $1 billion pre-IPO funding round led by Tencent and SoftBank Group. According to the company, its desired IPO revenue is something in the region of $3 billion, with Canaan and Ebang expecting to raise roughly $400 million and $1 billion respectively.

Recent reports coming out of China, however, suggest that Bitmain may have at least slightly overstated its true market position, releasing carefully timed tidbits of cheerful information to potential IPO investors while at the same time sitting on $1.24 billion worth of unsold – and potentially unsellable – inventory.

Even more curiously, following the story about Bitmain’s $1 billion pre-IPO funding round, SoftBank publicly denied any involvement in the financing round, and Tencent refused to confirm or deny its involvement. This has led many to speculate that Bitmain may be trying to pull off the IPO equivalent of an ICO exit scam – reap a huge sum of money from investors and then bail, leaving them holding a figurative bag filled with expensive but worthless inventory.

Speaking to Reuters, Julian Hosp, president of TenX stated that in his opinion, crypto mining equipment makers have no long-term business model. In his words:

“I would be quite wary of investing in these miners. They are not long-term businesses and I think they’ve had their uptrend for now.”

IPO Preparations Continue Regardless

Notwithstanding the intense speculation, Canaan and Ebang filed their IPO plans in May and June respectively, with Bitmain due to file in September. Ebang is scheduled to meet the Hong Kong listing committee in September, while Canaan has not yet indicated when it intends to do so.

According to Reuters’ sources, Canaan is still working on clearing regulatory hurdles with HKEX officials regarding its prospectus. None of the big three have responded to requests for comment, but it is expected that in the current cryptocurrency price climate, they will carefully tailor their sales pitches to publicize the potential alternative uses of their equipment.

BTCManager reported in July that Canaan and Bitmain both launched crypto mining equipment doubling as a television and a wifi router respectively.

It is possible that the IPOs will appeal to investors on the basis of the companies’ potential to play a vital role in other activities outside of coin mining such as broader blockchain development, artificial intelligence tools, and the development of 5G telecoms networks.