Following Baidu’s Hong Kong secondary listing, the company would become the latest Chinese tech giant to secure money in this financial hub.

Chinese multinational technology company Baidu Inc (NASDAQ: BIDU) plans to raise a minimum of $3 billion in Hong Kong secondary listing sometime this month. The tech giant’s plan for a secondary listing was revealed by sources that are familiar with the matter. Baidu is currently listed in the US on Nasdaq.

Baidu Hong Kong Secondary Listing

Following Baidu’s Hong Kong secondary listing, the company would become the latest Chinese tech giant to secure money in the financial hub.

According to the sources, Baidu will complete its secondary listing before the end of March. One of them added that Baidu would issue 4% of its shares.

Further citing familiar sources, CNBC said the company would begin its book building process as early as the 12th of March. Also, details on the pricing of the shares will be announced in the coming week.

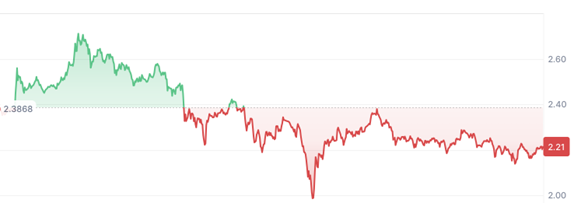

CNBC stated that Baidu may be leveraging on its increase over the past year to raise capital. MarketWatch data revealed that Baidu has grown 157.72% in the last 12 months. Also, the company has gained nearly 18% since the beginning of January and surged 61.15% in the last three months. Despite the growth, the Chinese tech giant has declined 17.59% over the past month and about 2% in the last five days. At the time of writing, Baidu stock is at pre-market trading of $266.31, a 4.38% addition over its previous close of $255.14.

One of the sources said that Baidu’s new deal would have launched earlier. However, the tech company delayed for vitality in stock markets to ease.

The Hong Kong secondary listing trend started in 2019 when Alibaba Group Holding Ltd (NYSE: BABA), which is listed in the US under the New York Stock Exchange, was also listed in Hong Kong. At the time, Alibaba sold $12.9 billion worth of shares in Hong Kong. In 2020, more US-listed Chinese companies listed in Hong Kong. According to Refinitiv data, there were 12 secondary listings in 2020, which raised $19.06 billion.

Baidu to Begin Production of EVs With Geely

Baidu has been focusing on setting up standalone companies. Coinspeaker revealed in a report earlier this year that the tech giant has decided to conduct the production of electric vehicles (EV) with Geely Automobile Holding Ltd. Geely (OTC: GELYF). Per the report, Baidu will be in charge of providing smart driving technologies. At the same time, Geely will take care of the design and manufacturing.

Notably, Baidu has been working on autonomous driving since 2017. Now, the new business will operate as a subsidiary of the tech company. In addition, Baidu units, such as Apollo and Baidu maps, will contribute to the development of the EV business, while Geely remains a strategic partner.

Geely stock is currently closed at $2.9800, a 2.61 loss over its previous close of $3.0600.

Ibukun is a crypto/finance writer interested in passing relevant information, using non-complex words to reach all kinds of audience. Apart from writing, she likes to see movies, cook, and explore restaurants in the city of Lagos, where she resides.