Global markets business CME Group said that institutional interest toward the firm’s Bitcoin futures is thriving and 2019’s third-quarter data showed a record number of open interest. Moreover, despite the lackluster start, the Intercontinental Exchange’s (ICE) Bakkt platform has seen an increase in interest with the company’s physically-settled bitcoin futures product.

Also read: Honestnode Founder Discusses the First Stablecoin Built on Bitcoin Cash

CME Group’s Bitcoin Futures Continue to Prosper

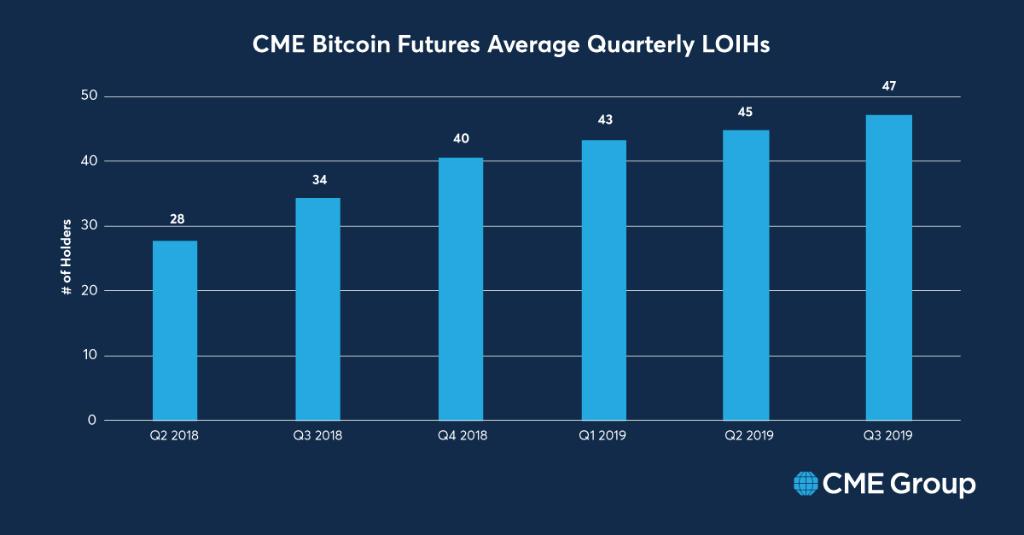

Since going live with its bitcoin futures in December 2017, CME Group’s BTC derivatives has allowed individuals and organizations the ability to hedge exposure to the digital currency. Throughout 2018 and 2019, CME has seen a significant rise in open interest in its bitcoin futures. This summer CME saw unprecedented numbers compared to the volumes recorded a few months prior.

“CME Bitcoin futures reached a record $1.7B in notional value traded on June 26, surpassing the previous record by more than 30% — The surge in volume also set a new open interest record of 6,069 contracts as institutional interest continues to build,” CME Group stated. The Chicago-based exchange detailed on October 11 that open contracts during the third quarter grew significantly in comparison to Q3 2018. The number of outstanding positions almost doubled and the company explained that the rise stems from institutions.

“Institutional interest in CME Bitcoin futures (BTC) continued to build in Q3 with a record number of large open interest holders (25+ BTC),” the trading platform imparted last week.

The news follows CME’s announcement that due to “growing interest in cryptocurrencies and customer demand for tools to manage bitcoin exposure” the exchange would begin offering options on Bitcoin futures (BTC) in early 2020. The day before it’s third-quarter update, CME Group’s global head of equity index and alternative investment products, Tim McCourt, explained there is a huge interest in bitcoin futures in Asia. For instance, cryptocurrency miners based in Asia appreciate derivatives products because they can hedge their costs. Even though the company is preparing for BTC options, McCourt disclosed that CME is not planning to provide physically-settled products like Bakkt. In an interview, McCourt stated:

While futures give you a one-for-one exposure, whereby the movement of the underlying bitcoin translates directly to a specific dollar value per contract, an option gives you varying strike-price levels and can give you either downside protection, or upside exposure at a fraction of the underlying [assets’] price.

Bakkt’s Bitcoin Futures Volume Spikes and Ethereum and Bitcoin Cash Derivative Products Are Coming Soon

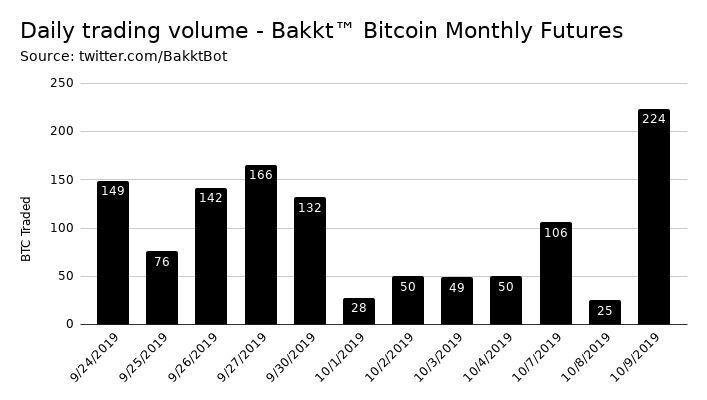

When Bakkt launched its physically-settled bitcoin futures the first week was quite dismal and only started to pick up steam after it executed its first block trade between Galaxy Digital and XBTO. Despite the weak start, Bakkt’s BTC trading volumes rose sharply on October 10, from 25 contracts to 224 contracts seeing a 796% rise. The Bakkt Volume Bot shows that futures volumes touched 53 on October 15 and went up 49% with 79 contracts the day after.

Bakkt CEO Kelly Loeffler believes the future of these derivatives products is just getting started and recently wrote about the subject in a blog post called “The Dawn of an Asset Class.” “Seamless coordination between ICE Futures U.S., ICE Clear US, and the Bakkt Warehouse is an important feature of Bakkt’s Bitcoin Futures,” Loeffler wrote for FIA’s global futures magazine. “Much like cotton and coffee futures contracts that can go to physical delivery, many of the same processes apply to the Bakkt Bitcoin Futures,” Loeffler added:

The Bakkt Warehouse stands between the customer and the clearing member to securely manage bitcoin movements based on deep domain knowledge, along with significant investments in infrastructure and operations. This design allows clearing members to manage margin balances in USD or U.S. Treasuries, rather than bitcoin.

The market has shown demand for futures products tied to BTC, but there’s a strong desire for other cryptocurrency derivatives products as well. At Yahoo Finance’s All Markets Summit in New York City on October 10, Heath Tarbert told the press that he believes Ethereum-based futures will be coming. “It is my view as Chairman of the CFTC that Ether is a commodity, and therefore it will be regulated under the CEA. And my guess is that you will see in the near future Ether-related futures contracts and other derivatives potentially traded.” Further, David Shin, the head of the exchange business at Bitcoin.com recently revealed that the public could see a bitcoin cash (BCH) futures products in Q1 2020.

What do you think about the rising interest in Bitcoin and other cryptocurrency products? Let us know what you think about this subject in the comments section below.

Image credits: Shutterstock, Pixabay, CME Group, Bakkt Volume Bot, Twitter, and Bakkt.

Do you want to keep an eye on moving cryptocurrency prices? Visit our Bitcoin Markets tool to get real-time price updates, and head over to our Blockchain Explorer tool to view all previous BCH and BTC transactions.