Altcoins are finding support with prices edging higher in line with Sep 27 buy attempts. While traders and the larger community retain a bullish outlook thanks to last week’s surges from key support levels, positive fundamentals could prime bulls thrusting them above key resistance levels in Cardano, Litecoin, EOS and Tron. Tron stands a chance for CoinBase addition now that the company has offices in NYC and is working hard for listing at US exchanges. Aside, Feng Li is an early investor in both Tron and CoinBase helping magnify the dots.

Let’s have a look at these charts:

EOS Price Analysis

All things constant, EOS performance is modest. So far, prices are up three percent at the back of Sep 27 trend resumption candlestick. While our forecast is positive, what we need to see are strong surges above last week’s highs at $6 and later $7 triggering risk-off bulls in line with our last EOS trade plan.

After all, EOS prices are consolidating within a $2 range marked by $7 on the upper side and $4 on the lower side. Anyhow, despite yesterday’s slow down, we remain expectant of higher highs aware that dips below $4.5 or even $4 confirms trade activities of Sep 9 ushering in sellers aiming for $1.5.

Litecoin Price Analysis

More often than not, after periods of strong surges, volatility do taper. That was replicated yesterday following Sep 27 price spike that saw Litecoin adding 10 percent thrusting it to the top performer list. Needless to say, we still retain a bullish outlook expecting break outs above $70 over the weekend or early next week. That’s as long as bulls keep up with momentum after small position longs went off on Sep 27.

On a more cautious approach, sellers could sync back should there be resistance at $70 confirming Sep 5 bear bar. This can end up triggering a sell-off in the process with candlestick formations backing this. Note that even after 24 days of higher highs, Sep 5 sharp losses overshadows bulls brewing concerns on whether this is an effort versus result scenario where buyers are finding upside resistance. That’s why it’s imperative for traders to wait for conclusive and ideally high-volume spikes above $70 before loading buys.

Stellar Lumens Price Analysis

In the daily chart, Sep 23 bull candlestick is conspicuous. Subsequent consolidation was expected and as long as it remains that way, bulls have a sentiment tailwind.

From yesterday’s trade plan, our bull trades syncing with last week’s resurgence is live following the 50 percent Fibonacci retracement anchoring on Sep 23 high low.

Despite yesterday’s resistance for higher highs, we maintain a bullish outlook recommending buys on dips with stops at 22 cents. Bull targets are constant at 50 cents.

Tron Price Analysis

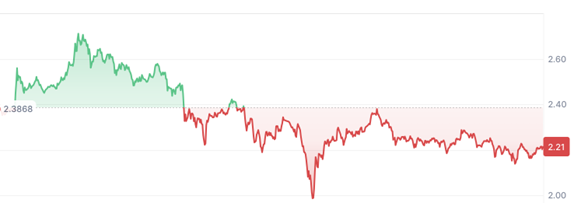

Even after Sep 27 bulls, Tron prices are stable but traders are expectant of higher highs as long as prices are trading above last week’s lows.

As mentioned from our last Tron price analysis, traders need to see prices edge above 2.5 cents or last week’s highs for trend continuations. From price action, that seems to be in progress thanks to Sep 27 double bar reversal pattern shooting off from around the 50 percent Fibonacci retracement level.

All in all, our last trade plan is valid. Going forward, traders can begin loading buys at current prices with stops at 2 cents. On the contrary, if sellers press lower and our stops are hit, then we shall take a neutral to bearish stand as we watch for what happens at 1.8 cents or Aug lows. The level is an important support and a sell trigger line.

Cardano Price Analysis

ADA is now available for trading at Kraken

Kraken to list two new assets – Cardano (ADA) and Quantum (QTUM). Trading in both starts Friday Sept 28! https://t.co/jcaVr0u9z7

— Kraken Exchange (@krakenfx) September 27, 2018

Overly, our previous Cardano price forecast holds true. From yesterday’s preview, ADA bulls are in control As long as prices are syncing in line with Sep 27 bulls, buyers should have an upper hand.

Because of this, we recommend ramping ADA on dips on lower time frames more so if there is a break out above last week’s highs at 9.5 cents.

Assuming there is an acceleration where prices spike above 12 cents, then conservative traders can begin loading up on every retracement with first targets at 20 cents.

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.