A staggering 86% of Fortune 500 executives believe tokenization could be valuable for their companies — and The State of Crypto report says they’re bullish on stablecoins too.

Coinbase’s latest The State of Crypto report has landed — and as ever, it makes for interesting reading.

The exchange’s research struck a bullish tone, and noted that ETFs based on Bitcoin’s spot price in the U.S. have mopped up “significant pent-up demand” by allowing investors to gain exposure to the world’s biggest cryptocurrency. Assets under management in these funds now stands at $63 billion, with Coinbase anticipating a healthy appetite for Ether ETFs should they be given the green light by the U.S. Securities and Exchange Commission.

Beyond this, it wasn’t the buoyant recovery in the crypto markets that was the focus of Coinbase’s report, but the high levels of enthusiasm for on-chain projects seen among some of America’s biggest businesses.

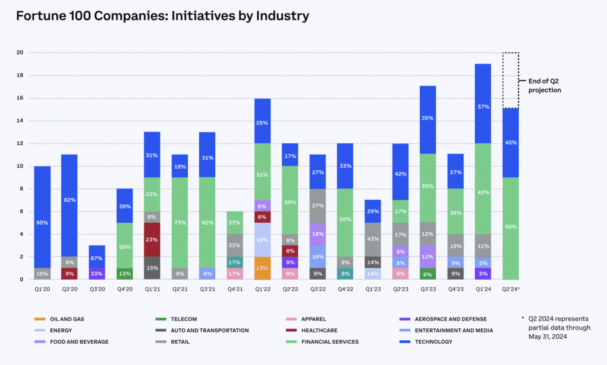

Data suggests that the number of on-chain projects among Fortune 100 companies has accelerated by 39% over the past 12 months. What’s more, 56% of executives in Fortune 500 firms now say they’re starting to experiment and build using this technology — with “consumer-facing payments applications” a pressing priority for some. They’re not afraid to splash some cash too, with the typical on-chain project boasting a budget of $9.5 million.

According to Coinbase, there is a diverse range of benefits to stablecoins and tokenization that entrepreneurs find appealing.

When it comes to digital assets pegged to the U.S. dollar, the prospect of instantaneous settlements came out top as the biggest advantage identified by Fortune 500 executives. There’s also optimism that accepting stablecoins as a payment method could help drive down fees for merchants with razor-thin profit margins — but given the scalability concerns known to plague major blockchains, this isn’t always a given. Slicker transfers within a business, as well as immediate cross-border payments, also made the list.

The report also underlines how the tokenization of real-world assets has the potential to transform the global economy in the years to come. Here, top benefits and use cases that fascinate top execs include reduced transaction times, operational efficiencies, greater transparency, streamlined regulatory processes, and the ability to drag loyalty programs into the 21st century — enhancing engagement among target audiences. Coinbase cited figures that suggest the value of tokenized assets could hit $16 trillion by the start of the next decade. Illustrating how significant this is, the exchange pointed out that this is equivalent to the European Union’s GDP.

Tokenization in action

To borrow an oft-used crypto phrase here, “we’re still early” when it comes to seeing how the push for tokenization will play out. Many potential use cases haven’t emerged yet. But one company that has huge ambitions here is Mastercard.

Earlier this week, the payments giant revealed that it’s working to dramatically modernize the world of e-commerce — and ultimately make the need to type in long credit card numbers when buying something online a thing of the past.

This is about much more than saving shoppers a little bit of time at the checkout, as this approach could prove to be a silver bullet in tackling fraud. Artificial intelligence and growing demand for e-commerce in emerging markets have seen the value of false and illegal transactions taking place online surge. Mastercard cited figures from Juniper Research that indicate merchants around the world will lose $362 billion between 2023 and 2028.

In practice, Mastercard wants to make the 16 digits on payment cards obsolete by replacing them with a secure token. The company believes tokenization also has the potential to transform smartphones and cars into “commerce devices” — building upon the great progress that’s been made with contactless payments.

As part of the company’s plans, e-commerce will be 100% tokenized in Europe by 2030 — with Mastercard’s executive vice president Valerie Nowak describing this as a “win-win-win for shoppers, retailers and card issuers alike.”

“In Europe we have seen tokenization gaining momentum across the ecosystem, the convenience and reduced rates of fraud sell themselves.”

Valerie Nowak

Returning to Coinbase and its report noted that on-chain government securities have emerged as an especially popular use case — with the value of tokenized U.S. Treasury products now hitting $1.29 billion, a 1,000% increase since the start of last year.

Franklin Templeton, which was highlighted in The State of Crypto as a case study because of its tokenized money market funds, has described its embrace of this technology as a necessity.

“The market infrastructure on which we have been issuing, trading, and wrapping assets into portfolios is 50 years old … What we are starting to see with blockchain technologies is that there are ways to improve that tremendously. There are ways to cut processing times, get more real-time information, and enable 24/7/365 trading because we live in a global world where our businesses operate around the clock.”

Sandy Kaull, Franklin Templeton’s head of digital assets

Overall, the report indicates that 86% of Fortune 500 executives believe tokenization could be valuable for their operations — a substantial figure.

The power of stablecoins

Elsewhere, Coinbase reflected on how stablecoins are gradually starting to play a larger and larger role in the global economy — with daily stablecoin transfer volumes smashing records and hitting $150 billion in the first quarter of this year. Of course, this exchange has skin in the game given how it has a stake in Circle, which issues USD Coin.

The report’s authors pointed to how the companies behind USDC and USDT now hold huge amounts of U.S. Treasury bills in reserve — equivalent to Norway, Saudi Arabia and South Korea combined.

This has also coincided with concerted efforts to simplify the process of using stablecoins, which is especially important for consumers who are unfamiliar with digital assets.

“Via Circle, merchants on Stripe can now accept payment in USDC via Ethereum, Solana, and Polygon — with payments automatically converting into fiat currency. PayPal is supporting cross-border transfers for stablecoin users across about 160 countries — with no transaction fees.”

Coinbase

Remittances — which see foreign workers send funds back home to their loved ones — are a particular area where stablecoins could offer a faster and fairer service.

As Coinbase notes, this is a $860 billion market. But right now, cross-border payments made through traditional channels often incur fees of up to 6.39%. Put another way, this means hard-working consumers, their families, and local economies are missing out on as much as $55 billion every year.

There was another fascinating use case in the form of a Washington DC chain called Compass Coffee. With many of their customers shifting from cash to cards, the company said it was fed up with paying high transaction fees — funds that could be reinvested in the business. It’s now started to offer stablecoins as an alternative payment method.

“Accepting crypto payments could be transformational for our business. We hope to help transform retail experiences by accepting USDC.”

Michael Haft, Compass Coffee founder

Challenges that lie ahead

While there is a lot to be optimistic about, and plenty of traction in the crypto industry, Coinbase warned there are external factors holding progress back.

“Increased activity increases the urgency for clear rules for crypto that help keep crypto developers and other talent in the U.S., fulfill its promise of better access, and enable U.S. leadership on crypto globally.”

Coinbase

Illustrating the impact of regulatory paralysis that has seen several companies move offshore, the exchange warned that America’s share of crypto developers has plunged by 14 percentage points since 2019 — meaning just 26% are now based in the U.S.

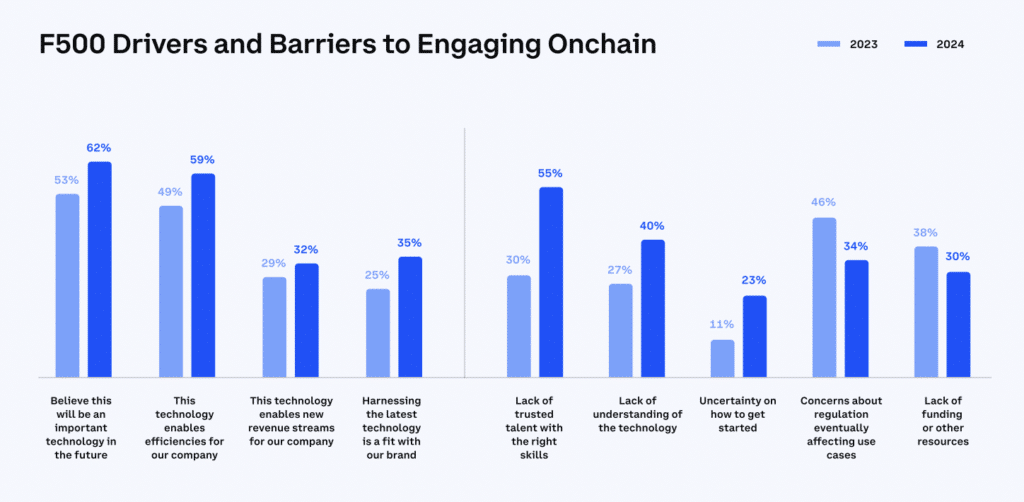

Interestingly, 55% of Fortune 500 executives polled said that a lack of trusted talent with the right skillset was the biggest barrier that stood in the way of them rolling out an on-chain project, compared with 30% in 2023. This hurdle then has a knock-on effect in other ways. For example, 40% surveyed admitted that they don’t fully understand how this technology works — and a further 23% wouldn’t know how to start developing their idea.

With crypto-literate legislation starting to work its way through Congress, and the SEC softening its stance toward Bitcoin and Ether ETFs, it’s telling that just 34% of entrepreneurs now cite regulation as a barrier — down 12 percentage points on the year before.

We’ve already seen how digital assets are becoming a hotly contested issue in the upcoming presidential election, with Donald Trump — who once spoke of his disdain for Bitcoin because of how it competes with the dollar — now declaring that he’d like every single one of the remaining 1.3 million BTC to be mined in the U.S. Reports suggest that even Joe Biden is now weighing up whether to accept crypto donations from supporters.

For its part, Coinbase has also been stepping up its efforts to advocate for the industry — and giving its customers the resources they need to make their voices heard.

After a turbulent few years, there are only three words to describe the state of crypto right now: an impressive turnaround.