Compound Finance founder, Robert Leshner, says that CeFi will inevitably embrace DeFi and there are signs it is already occurring.

Speaking at the REDeFiNE TOMORROW — Global DeFi and Blockchain Virtual Summit in Bangkok, Thailand today, Leshner aired his views on CeFi/DeFi integration, the issues with Ethereum, and the advantages of decentralized governance.

Host Mukaya Panich, chief venture and investment officer of event sponsors SCB 10X (linked to Siam Commercial Bank), asked Leshner about DeFi’s integration with traditional and centralized finance.

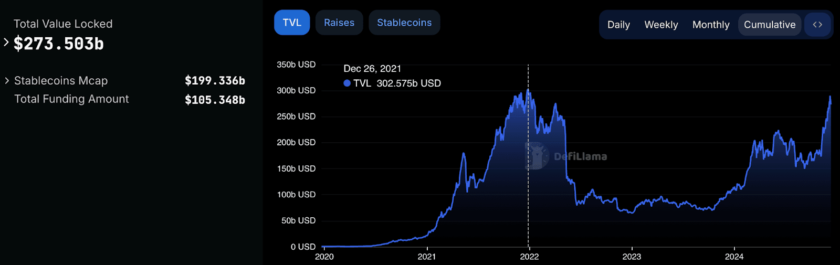

He commented that lines will blur and centralized finance and businesses will start to use DeFi to power the back end in order to improve user experiences;

“I’m really excited about seeing CeFi systems embracing DeFi back end operations,”

But Leshner warned that Ethereum, the network upon which most DeFi projects are built, may no longer be up to the task. Leshner said Ethereum had high composability but was slow and expensive to use, and reaching its limitations. An unfortunate consequence of this, he stated, would be that it is no longer economically viable to use for smaller transactions and users.

“The more transactions, the more it will crowd out small balances,”

When questioned about the advantages and disadvantages of decentralized governance such as that operated by Compound, the chartered financial analyst cited two distinct advantages. He said it meant that no single entity can maliciously ruin the protocol and that anybody can contribute to the collective upgrading of a protocol.

But on the down side he said this leads to slower governance decisions and modifications and the protocol may only slowly evolve over time. Comparing it to Bitcoin, which he said was predictable and slow to evolve, Leshner added;

“Bitcoin is so successful because it doesn’t change much — everyone knows what to expect from it,”

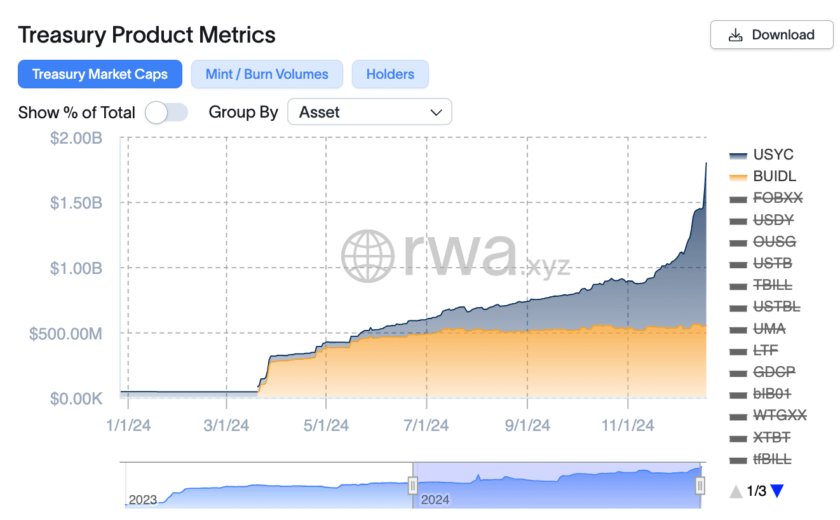

Leshner revealed plans to add more “real world” tokens to the Compound platform. The current criteria for inclusion is that the asset needs to be an Ethereum-based fungible asset with a certain amount of liquidity. He stated that more will be added as they become tokenized;

“Over time more real world assets [will be added] as they become mainstream on the Ethereum blockchain.”

When asked about the recent DAI liquidation event, which caused a number of users to lose funds due to incorrect DAI price reporting on Nov. 26, Leshner commented that Compound relies on Coinbase Pro as a “trigger for safety” and the system performed exactly as intended. He added that a solution would be to build systems that are more resilient to these extreme events.