The price of Bitcoin (BTC) suffered a tremendous crash on March 12, falling from almost $8,000 to stabilize at around $5,000, a loss of about 40% in the span of less than two days. This happened in the context of a global sell-off in all equity markets, where United States stock market indices such as the Dow Jones Industrial Average and the S&P 500 lost around 10% in a single day — a substantial loss for traditional markets.

Some were quick to decree the end of the narrative that Bitcoin is a safe haven asset, sometimes called a store of value, while others pointed to the fact that even gold fell during the bloodbath.

According to TradingView data, the gold price began a fairly steep descent on March 12 from $1,660 per ounce to lows of $1,450 on March 16, a loss of 13% in value. The fact that the precious metal didn’t behave as a hedge during the collapse may have come as a surprise to some. In light of this inconsistency, it is important to understand exactly what a safe haven asset is and how it should behave.

Not all safe havens are equal

The traditional definition of a safe haven asset is “an investment that is expected to retain or increase in value during times of market turbulence.” In the context of Bitcoin, this term is used interchangeably with store of value — which normally refers to long-term wealth storage, however. While gold is often considered a store of value, it’s far from the only one. As Matthew Hougan, global head of research at Bitwise, told Cointelegraph:

“A lot of people say the words ‘store of value’ without thinking about what that means. It’s important for investors to distinguish between three separate types of assets: stable assets, inversely correlated assets, inflation hedging assets.”

It is the first two categories that are relevant during a sudden market crash, where the effects of inflation are generally minimal. In periods of extreme uncertainty, institutional and retail investors alike tend to go for extremely safe assets. “The best stable asset is cash,” noted Hougan.

All analysts interviewed by Cointelegraph agree that the dramatic fall across all asset classes was due to every market actor scrambling for liquidity. John Todaro, head of research at TradeBlock, expressed his view of what happened in a conversation with Cointelegraph:

“There has been a flight to a highly liquid safe haven (cash) that can meet your everyday obligations (rent, groceries, medical supplies, etc.) or for institutions (debt servicing, supply purchases, etc.)”

But even if it’s not cash, there is a long list of assets used by trading institutions as stores of value. Ashu Swami, chief technical officer of the institution-focused crypto startup Apifiny — and former vice president of program trading at Morgan Stanley — explained that U.S. treasury bonds are the only assets that retain value during market crashes, while institutional investors generally “park cash” through a mix of treasury and municipal bonds, income stocks, index futures and gold. Swami noted to Cointelegraph:

“Gold has an important place in this basket but their primary choice is sovereign bonds, especially U.S. treasuries. If they are waiting for a sideways market to find direction, they typically just sit on cash. Central banks have a greater appetite for gold as a reserve.”

The second type of safe haven, inversely-correlated assets, move in opposition to stocks and other “risk-on” markets. Traditional wisdom would put commodities such as grain, oil or precious metals into this category. But data from the past 20 years shows significant correlations for many of them with the wider stock market — and there are no commodities that are negatively correlated. This means that they are at best independent from the stock market, and not a direct hedge. Whatever the case may be in longer market cycles, commodities were not spared in the recent crash. Corn, oil and even palladium suffered strong breakdowns on March 12.

The only assets that can really go against the stock market in a price crash are stocks themselves. Specifically, a category called “defensive stocks” that includes companies resilient to or even benefiting from a tumultuous economy. A modern example of such is Zoom, a video conferencing tool that benefited from an influx of new users. Its stock price barely blipped on March 12, and has continued to register new all-time highs. Many medical companies also saw their value rise thanks to the pandemic.

Hougan nevertheless warned against using inversely correlated assets as hedge, saying that “This sounds great, but it is actually not very useful: If you have one asset that goes down 10% when another asset goes up 10%, you end up flat.”

Finally, the third category of inflation-hedging assets is often considered as the true store of value over long periods. But since the immediate effects of a financial crisis are “deflationary, not inflationary,” Hougan said, these assets are less relevant in sudden shocks.

It is worth specifying that the terms “deflation” and “inflation” are defined against the price of goods and not on the supply of a particular asset. As the prices of almost every commodity and asset went down in the crisis, the U.S. dollar was subject to short-term deflation. Gold is considered an inflation-hedging asset, but so are bonds, real estate and even stocks — they only differ by their risk-reward profile.

So, which one is Bitcoin?

Expert consensus seems to be breaking down when trying to define Bitcoin and crypto in general. Quantum Economics founder Mati Greenspan is skeptical about the safe haven hypothesis: “I’ve never really seen Bitcoin as a safe haven. I don’t know who started that rumor, it certainly wasn’t in the Bitcoin white paper.”

Campbell Harvey, professor of international business at Duke University, also disagrees that crypto can be a store of value: “Cryptos fail as a store of value due to their extreme volatility. Gold and stocks have about 15% volatility and the main cryptos five times that.” He believes that Bitcoin is a speculative asset that was promptly punished in a “risk-off” environment. Todaro, however, maintains that Bitcoin could still prove itself as a safe haven while noting that “history tends to show us that Bitcoin’s correlation with traditional benchmarks is often temporary.”

On the other hand, Swami and Hougan are both firmly in the safe haven asset camp. But their views still go against the traditional hypothesis of Bitcoin as a safe haven, which focuses heavily on being a hedge against the S&P 500 and the stock market in general.

Swami concedes that Bitcoin may very well be a stock market hedge, though its price history is too short to determine this. But this is not the reason why he believes it’s a safe haven. While Hougan firmly placed Bitcoin as an inflation-hedging asset in his framework of different safe haven types, what distinguishes Bitcoin, in his view, is that it is still an “emerging store of value,” just like gold was in the 1970s, adding:

“After the U.S. completely untethered from gold and it was forced to find its way in the world as a stand-alone asset for the first time in hundreds of years. And the 1970s was an extraordinary period for gold, with prices rising more than 1300% in nominal terms and 600% in real terms.”

But while the proposition that Bitcoin is a safe haven against a generic market downturn seems to be generating controversy, there is a surprising amount of consensus to be found when the discussion shifts to the fiat system and the U.S. dollar.

Bitcoin and the fiat system

Bitcoin was born as a direct response to the Great Financial Crisis of 2008, which triggered a slew of economic measures to deal with the crisis, including multiple bank bailouts, the Fed slashing the interest rate and mass quantitative easing.

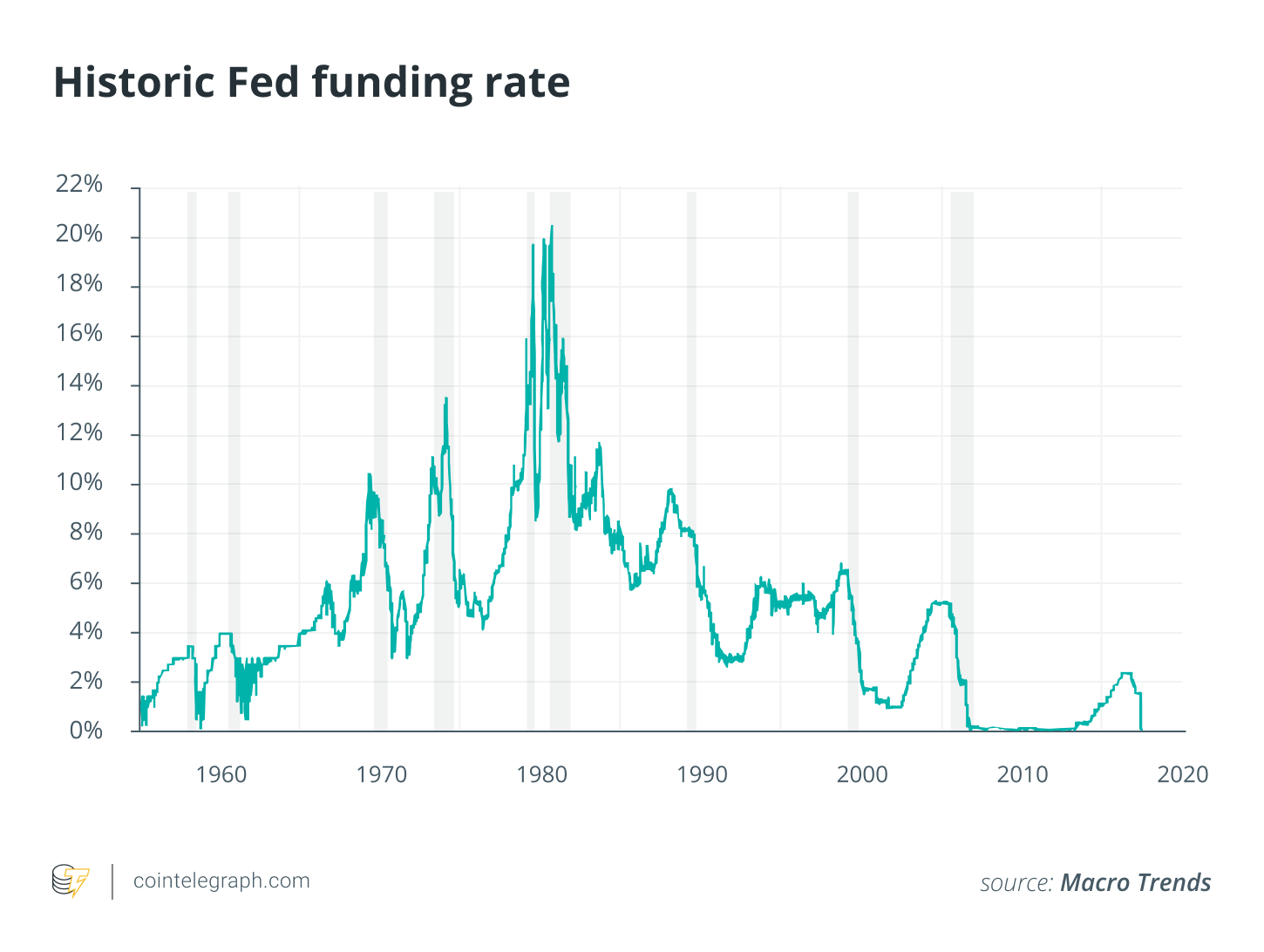

In times of crisis, the U.S. Federal Reserve and other central banks usually drop the “funding rate” interest for banks to stimulate investment and lending, and thus the economy. As a “master interest rate,” it influences both consumer borrowing rates and government bond yields. During 2008, the Fed brought interest rates to almost zero in a historic move. This depressed rate persisted for more than five years as the bank continued its stimulus.

However, since the bank could not lower the interest rate further, it also introduced the policy of quantitative easing, or QE — purchasing securities from the market with newly conjured dollars. Many consider it to be a euphemism for money printing.

These policies continued throughout the 2010s in a bid to discourage saving and stimulate lending and spending to grow the economy. The continuation of these policies left central banks with few instruments to fight the current recession triggered by the coronavirus lockdowns.

Bitcoin as a hedge against the dollar

In the wake of the 2020 economic crisis, the Fed slashed rates once again and, in an escalation of stimulus money printing, eventually announced “QE Infinity.” Swami added that, “Before the end of 2020, the Fed’s balance sheet could be three times bigger than what it was at the peak of the financial crisis.” The prospects of millions of unemployed Americans and continuous multi-trillion stimulus rounds are generating uncertainty, according to Swami:

“This is when foreign investors start considering a hedge against the dollar. That can only be gold or Bitcoin, because every domestic and foreign government or corporation is in the same boat and has significant exposure to [the] dollar.”

Hougan also pointed to the current bailout policies as “an extraordinary monetary experiment.” While he believes it is right to enact these measures to save the economy, their scale makes them dangerous. Even Greenspan agreed with the negative outlook for the dollar, saying:

“It’s very likely that we’ll see a very inflationary environment, and we don’t know, obviously, how inflationary. That could be mild inflation to extreme.”

He conceded that Bitcoin is a “valid hedge against inflation,” but he still expects it to perform well only in a “speculative environment.”

Finally, geopolitical tension may also rise as the pandemic ends. As President Trump continues to blame China for letting the coronavirus out, tensions may escalate further — especially once the public health emergency is dealt with. China itself is clearly feeling uneasy about the global dominance of the U.S. dollar. Even the creation of the digital yuan was motivated by Chinese officials as a way to remain competitive in the face of a potential U.S.-dominated Libra.

Related: Digital Yuan: Weapon in US Trade War or Attempt to Manipulate Bitcoin?

For Hougan, the coronavirus pandemic represents a “rising probability of a reshuffling of the global currency regime,” as both geopolitical risk and currency regime reshuffling “augur well for Bitcoin long-term.”

Will the safe haven hypothesis hold?

As comparisons with other markets suggest, Bitcoin’s crash on March 12 was to be expected even if BTC was widely recognized as a safe haven. But most Bitcoin trading is still considered to be of a speculative nature. As Harvey put it, “Right now, it is mainly used as a ‘store of value’ in the context of speculation.” He believes that BTC, like gold, is an unreliable store of value due to its volatility. “Nevertheless, many believe it will increase in value and hold it,” he concluded.

Todaro cautions that safe haven assets need to be viewed from a long-term perspective. However, his view for Bitcoin is that of a fundamentally lone asset whose “correlation with traditional benchmarks is often temporary.” Swami summarized that while the “SoV thesis is very much unbroken,” the upcoming recession would be the first time that it could be tested. Hougan was more positive, saying that Bitcoin is a “great hedge against inflation” and that “institutions are beginning to agree with this point of view.”

But, it’s important to temper one’s expectations in regards to how Bitcoin’s price should behave. As Hougan noted, “a true ‘store of value’ asset is really boring except during periods of hyperinflation.” In order for Bitcoin to be a stable safe haven asset — a category mostly occupied by treasury bonds and cash — it should also have almost no potential for gains. It also cannot be an inversely correlated asset to the stock market, as that would — at the very least — dampen its growth during bullish periods.

Related: Institutional Investment Builds in Q1 2020, Sentiment Toward Crypto Funds Changing

While it is unlikely that Bitcoin can be a true store of value any time soon, it can still become an uncorrelated asset where institutional investors allocate small portions of their portfolio for diversification. As Swami revealed, most top asset managers have either already set up crypto trading desks or are looking to do so. “Even if 10% of these managers move 5% of their assets into Bitcoin, that will send the Bitcoin price much higher than it has ever been,” he added.

Hougan believes that the next year will be crucial for Bitcoin and how it responds to potential inflation. Concluding his thoughts, he said: “One paradigm I can imagine emerging from the coronavirus crisis is Bitcoin emerging as a core alternative asset in the minds of many investors.” In the end, given the features of most safe haven assets, categorizing Bitcoin as simply an alternative asset is likely to be a much more attractive proposition for many of its holders.