Another day, another all-time high for Bitcoin.

The benchmark cryptocurrency continued its upside trend heading into the European session Wednesday as its price jumped above $51,700 for the first time in history. Meanwhile, its market capitalization surged to over $960 billion, just 3 percent shy of hitting $1 trillion.

“We should hit $2 trillion this year,” said Ronnie Moas, the founder of Standpoint Research, after the rally. “The 2021 price target is $112,000.”

Fundamentally-Driven Bitcoin Boom

Traders increased their bids in the cryptocurrency market after Nasdaq-listed software intelligence firm MicroStrategy announced that it plans to buy $600 million worth of bitcoins by raising funds via a debt sale. It already holds more than 70,000 BTC in its reserves, whose current worth is a little over $3.5 billion.

Bitcoin was already riding higher after Tesla, a Fortune 500 company, revealed that it holds $1.5 billion worth of BTC in its reserves. The US carmaker also raised upside speculations in the Bitcoin market after announcing that it may purchase more of the cryptocurrency and might even start accepting it as a payment mode for its products and services.

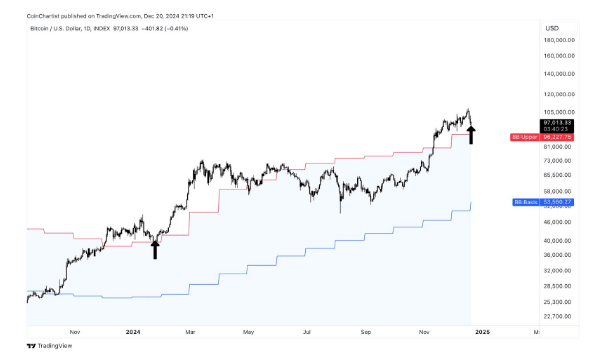

Bitcoin is close to hitting a $1 trillion market valuation. Source: BTCUSD on TradingView.com

The latest spike brought the Bitcoin price up by 56.07 percent in February and in March 76.32 percent on a year-to-date timeframe. Measured from its mid-March nadir of $3,858 last year, the cryptocurrency was up 1,188 percent.

Further Upside or Correction?

Many analysts anticipated the Bitcoin price rise to continue further into the quarterly session, with upside targets flying between $52,000 and $65,000 all over social media.

$BTC is going to 60k from her quicker than anyone expects

— LilMoonLambo (@LilMoonLambo) February 17, 2021

#Bitcoin Price Breaks $50K! Is $63K Next For #Bitcoin?

Small market update on $BTC and #altcoins posted here:https://t.co/l6h3UrBHDW

Don’t forget to subscribe to the channel!

— Michaël van de Poppe (@CryptoMichNL) February 17, 2021

Nonetheless, some analysts also recommended traders wait for a confirmed breakout before extending their long position targets. A pseudonymous analyst noted that Bitcoin’s latest upside move pushed it over a crucial short-term resistance level, but that does not guarantee a further parabolic move ahead.

Bitcoin needs to confirm the resistance trendline as new support to confirm a breakout, as presented by the Crypto Cactus. Source: BTCUSD on TradingView.com

“Imagine being chopped out on this, now [that the] price is showing a clean breakout of this key trendline resistance,” the analyst stated. “We should technically expect a retest at some point of this trendline to validate it has been flipped into support before moving much higher in the macro.”

Meanwhile, Bitcoin entered an overbought zone on its daily timeframe chart, per its Relative Strength Index readings. That points to an imminent downside correction/consolidation in the sessions ahead.