The official announcement and details around Project Libra were provided to the world on June 18, 2019. Firstly, Libra was introduced: a new global reserve-backed cryptocurrency built on top of the new Libra Blockchain, with everything governed by a not-for-profit consortium dubbed the Libra Association. It was clear that each of these products and technologies will play an integral role in the project’s overall mission of creating a simple global currency and financial infrastructure that empowers billions of people.

Additionally, Facebook also announced the creation of Calibra, which is developing the initial business of Libra and its own product outside of the Libra ecosystem (i.e., an eponymous digital wallet app).

One way to answer the question is to look at how Facebook built Libra and how similar it is to that of the main and more prevalent Decentralized Applications (DApps) framework as it was originally presented in 2014 by David Johnston and a group of foundational experts — way before any public knowledge of Facebook’s cryptocurrency plans. When the entire Libra ecosystem is broken down, could Libra be the largest DApps network to date? If it checks all the required criteria laid out in the 2014 DApps white paper mentioned previously, and if the roughly 2.4 billion active users throughout Facebook’s platforms is considered, it may just be.

Today, the main question on everybody’s mind is whether Facebook is a villain and, through the announcement, is trying to enhance its current hold on customer data, or if Facebook is genuine and is trying to make a contribution as a global citizen to a problem bigger than Facebook itself. After all, even the world’s largest companies like FedEx suggest that one company cannot control this entire DApps or blockchain movement, and that only “co-opetition” (i.e., cooperation and competition) and co-creation and regulations will help crack the problem.

The most famous model of co-opetition is, of course, the open-source movement that was fully supported by IBM, one of the top-10 companies in the world in the 90s. IBM was later joined by the likes of Google, Facebook and Twitter to provide the mere foundation of what is today Software as a Service (SaaS) and cloud computing. So, one early community fully supported by the most prominent companies can go a long way without being preempted by the biggest companies. To the contrary, one of the biggest losers of this new technology was indeed IBM, which failed, for many reasons, to jump on the public cloud computing bandwagon by staying focused on hosted private clouds — even when public clouds showed far stronger growth.

As the market evolves, IBM’s position may improve, but there is no doubt that, at this point, IBM didn’t benefit as fully as others of a movement that the company helped create and foster. Compared to open source, DApps are very young — probably as young as open source was in 1995, when IBM got involved. It is also struggling with many issues, with the main ones being adoption and the need of endorsement from major brands. So, is Facebook the IBM of DApps and the main contributor to something bigger than itself?

Libra as a decentralized application

When we begin to breakdown the Libra ecosystem and apply its structure against the 2014 white paper on DApps, how does it match up? According to the general theory, for any application to be considered a DApp, it must meet four areas of qualifying criteria.

✅Criteria #1 — “The application must be completely open-source, it must operate autonomously, and with no entity controlling the majority of its tokens. The application may adapt its protocol in response to proposed improvements and market feedback but all changes must be decided by consensus of its users.”

Libra is an open-source project

Over the past year, engineers from Facebook’s Calibra team have designed a blockchain from the ground up to meet the needs of the Libra ecosystem. Facebook has consciously open-sourced a prototype of Libra Core early so that the community can influence its direction. Facebook has irrevocably contributed its rights and code to the association under the terms of the Apache License and Apache Contributor License Agreement — just as any other contributor to Libra Core should.

As it states, the application must be completely open-source. However, Libra is an undertaking from many different directions — unlike anything we’ve seen since the early days of the internet. Facebook understands this and has noted that it will continue to take a fundamental leadership role on the project’s development through launch and then transfer over everything accordingly, becoming open source for the community after that.

To ensure the first condition was achieved, Facebook did launch an open-source prototype version of Libra, called Libra Core — of which the testnet is now live — thus allowing the developer community to get an early preview of the soon-to-launch protocol, beginning engaging immediately. Even though Facebook can retract itself from this path, every communication seems to indicate that Libra will be open-source.

This approach is very similar to how a majority of the most successful open-source projects have been initially developed, mainly by the most prominent companies and then contributed to by the community. Successful transitions include products like Hadoop, Kubernetes, and Ruby On Rails. Over the last 15 years since its creation, Facebook has continuously been open-sourcing products that are now standards in their respective industries and the approach taken for Libra follows the same path.

Related: Facebook Libra Regulatory Overview: Major Countries’ Stances on Crypto

Libra will be run by the Libra Association, not by Facebook

The second condition to meet requires that the application must operate autonomously, allowing for decisions to be made by a consensus of its users. Facebook, as it stands, is leading the implementation of the Libra project while the vital decision-making resides with the founding members of the Libra Association. Facebook’s leadership will be transitioned to that of that Association as soon as an operating structure is in place — and hopefully no later than the end of 2019.

The association, based in Geneva, Switzerland, is the acting independent, not-for-profit, membership-based organization and consortium, whose mission is to empower billions of people through the creation of a simple global currency and financial infrastructure.

The Association has goals to:

- Transition to a permissionless governance and consensus node operation.

- Minimize the Association’s role as manager of the Libra Reserve.

- Coordinate the open-source community to define and operate the technical road map of Libra.

The Association’s initial responsibilities will be to:

- Oversee and govern the operations along with the technical road map for the Libra blockchain.

- Recruit new founding members, raise funds from the members as well as other investors through the sale of Libra Investment Tokens (a token that grants rights to a share of the future interest accumulated in the Libra Reserve).

- Design and implement incentive programs, including the distribution of such incentives to members of the association.

- Distribute dividends to Libra Investment Token investors.

There are three types of members in the Association:

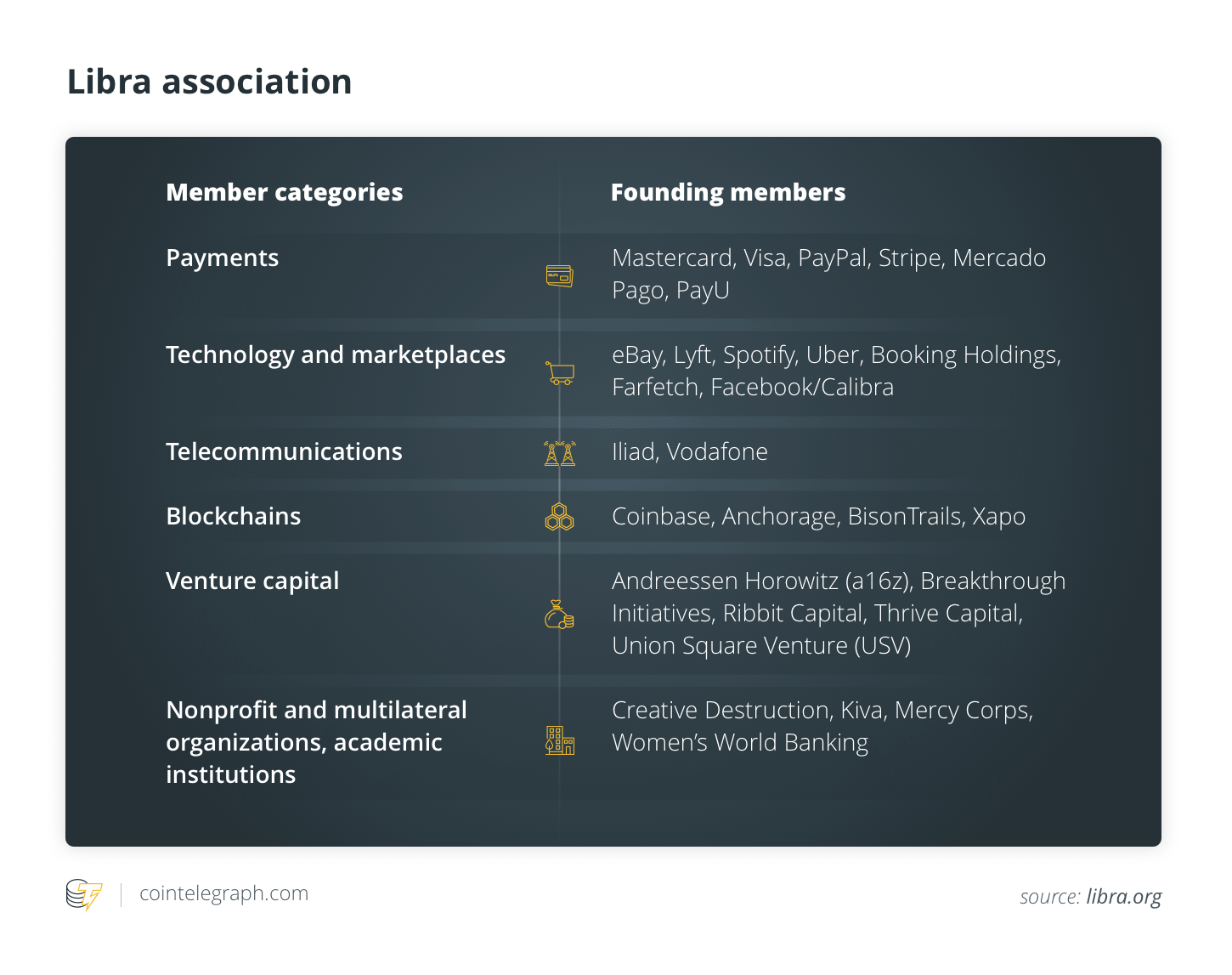

#1 — Founding Members, who have been vetted and meet a series of requirements voted on by the other founding members, ensuring industry diversity of the members. Requirements include market value, scale (reaching more than 20 million people a year) and being recognized as one of the top-100 industry leaders by a third party. Some exceptions are allowed for newly emerging industries like cryptocurrency and blockchain infrastructure companies. Some companies may be extended invitations if their participation would make a meaningful contribution to the success of the network.

Each must also provide a required investment of $10 million that will be used in the Libra Reserve, which backs the Libra coin and is used for operations. Additionally, each must act as a node validator (more details in Criteria #4) for the network. creating one with optimized performance.

#2 — Social Impact Partners, who are nonprofit and multilateral organizations that must be elected by the other founding members and meet a certain number of criteria: alignment with Libra mission, global reach, trust and scale.

#3 — Academic Institutions, who are selected by the other founding members and must meet the criteria based on trust and the strengths of their computer science departments.

The second and third types of founding members are exempt of the $10 million capital contribution but would not benefit from the dividends provided to those holding Libra Investment Tokens.

Today, there are 28 initial founding members, including Facebook/Calibra, that represent six different industries/categories. The goal is to have 100 members before the project is publicly launched during the first half of 2020. Here’s a breakdown of the 28 founding members.

The governing body of the Libra Association is the Libra Association Council, which is comprised of a representative from each member within the Association. Operating and policy decisions of the council require various voting thresholds, depending on the importance of the decision. The initial members of the council are the Association’s founding members.

If the main governing body is the council, the Libra Association will also have a board designed to oversee on behalf of the Libra Association Council the executive team. The executive team is responsible for the day-to-day operations of the Libra.

Related: US Congress on Libra Overview: Trust, Privacy and Genocide Accusations

Each founding member’s voting rights on the council are limited to not be greater than of one vote or 1/100. One vote is given for each $10 million invested. Any voting rights gained through additional activities or further investment are delegated to the board of the association, which can assign those rights to social impact partners and academic institutions.

With increased privacy, security and data-use concerns coming from all directions, the most substantial outstanding question has been around Facebook’s role within the project. Facebook has continued to be transparent as to its role in the project to date and, going forward, in the fact that the company will not own or be the sole decision-maker for the overall project — excluding Calibra, its digital wallet. Everything created otherwise will be governed by the Libra Association and then be open source completely later on. Facebook will also act as a validator node on the network to validate transactions with the other consortium members, a requirement for those in the group.

An initiation of this magnitude is not just disrupting a single market but instead is challenging the entire global economic foundation and the interactions among consumers, corporations and governments. For this and many other reasons around security, privacy, data, etc., one company cannot be the sole owner — also per the 2014 white paper on the general theory of DApps. Facebook knows this, and like any DApp, there needs to be an independent, not-for-profit organization in place: Thus, the Libra Association was born.

✅Criteria #2 — “The application’s data and records of operation must be cryptographically stored in a public, decentralized blockchain in order to avoid any central points of failure.”

Libra is not a public decentralized blockchain, but does avoid central points of failure

Since the goal of Libra is to create a “simple global currency and financial infrastructure that empowers billions of people,” it needs technology that can support such. Enter blockchain.

The Libra Protocol will be the underlying infrastructure for the ecosystem, with the Libra blockchain being a permissioned — not public — blockchain. It was noted that, as the technical road map advances, there is a plan over time to move toward being permissionless (i.e., open). The blockchain is maintained by a distributed network of validator nodes — also known as validators — beginning with the nodes of the Libra Association’s founding members. Each validator collectively follows a consensus protocol known as LibraBFT, which is based on the protocol HotStuff, to agree on a total ordering of transactions in the network.

To maintain accuracy and to prevent double-spend attacks, Libra’s validator nodes will use what’s called Byzantine Fault Tolerance (BFT), which allows for the nodes to reach consensus even when the nodes can’t all agree on the state of the other nodes in the network. This process applies even if up to one-third of the voting power is held by validator nodes that are compromised or failed.

With the Libra Protocol, Facebook has introduced the Move programming language for those looking to develop on the Libra Blockchain. According to its developer site, the language is a safe, flexible and executable bytecode language used to implement custom transactions and smart contracts.

Facebook has chosen for Libra to be permission-based, which means the blockchain maintains an access control layer to allow specific actions to be performed only by certain identifiable participants. Libra is neither public nor decentralized at this point. Over the last few years, we’ve seen many blockchains shying away from the public model and redesigning themselves to be permissioned, due to increased performance and flexibility. Examples of this blockchain type include JPMorgan’s Quorum, R3’s Corda and the Linux Foundation’s Hyperledger, along with others in the blockchain landscape.

In the future, the stated goal of the Libra Association is to move toward a public or permissionless-based blockchain. These blockchains are entirely open, and anyone is free to join along by participating in the core activities of the blockchain network.

✅Criteria #3 — “The application must use a cryptographic token (bitcoin or a token native to its system) which is necessary for access to the application and any contribution of value from (miners / farmers) should be rewarded in the application’s tokens.”

Libra: a different type of cryptocurrency

The Libra coin will be the network’s native token, while also being a stable, reserve-backed cryptocurrency built on top of the Libra blockchain and used throughout the Libra ecosystem, including Calibra.

Unlike traditional cryptocurrencies such as Bitcoin, the Libra coin is built as a stablecoin, a type of cryptocurrency that is designed to maintain a stable market price. Many stablecoins have their values fixed by pegging them to the price of another asset. While most of them are pegged to the United States dollar, there are stablecoins pegged to the price of other cryptocurrencies — or even commodities, like silver or gold.

As such, Libra’s value will be backed by a basket of stable and liquid assets — such as bank deposits and short-term government securities in various currencies from stable and reputable central banks — which will provide the intrinsic value beginning on day one. Furthermore, the basket of assets will help to protect the coin against the speculative swings experienced by other cryptocurrencies. These assets will be apart of the Libra Reserve and managed by the Libra Association.

It’s also worth noting that Libra coin will be accessible to users outside of Facebook’s Calibra wallet.

✅Criteria #4 — “The application must generate tokens according to a standard cryptographic algorithm acting as a proof of the value nodes are contributing to the application.”

Due to Libra’s current and unique structure, there will be no mining reward system in place at launch for the community beyond Libra Association members, which must also run a validator node — of which will be provided transaction and new user rewards, along with dividends from Libra Investment Tokens. All transactions on the network will run through the validator nodes. This also allows for an improved transaction speed, the primary function of the network.

However, the question remains: As the network evolves into a permissionless blockchain, will we see a proofing structure similar to that of proof-of-stake (PoS) be implemented? For reference, Bitcoin uses the proof-of-work (PoW) algorithm.

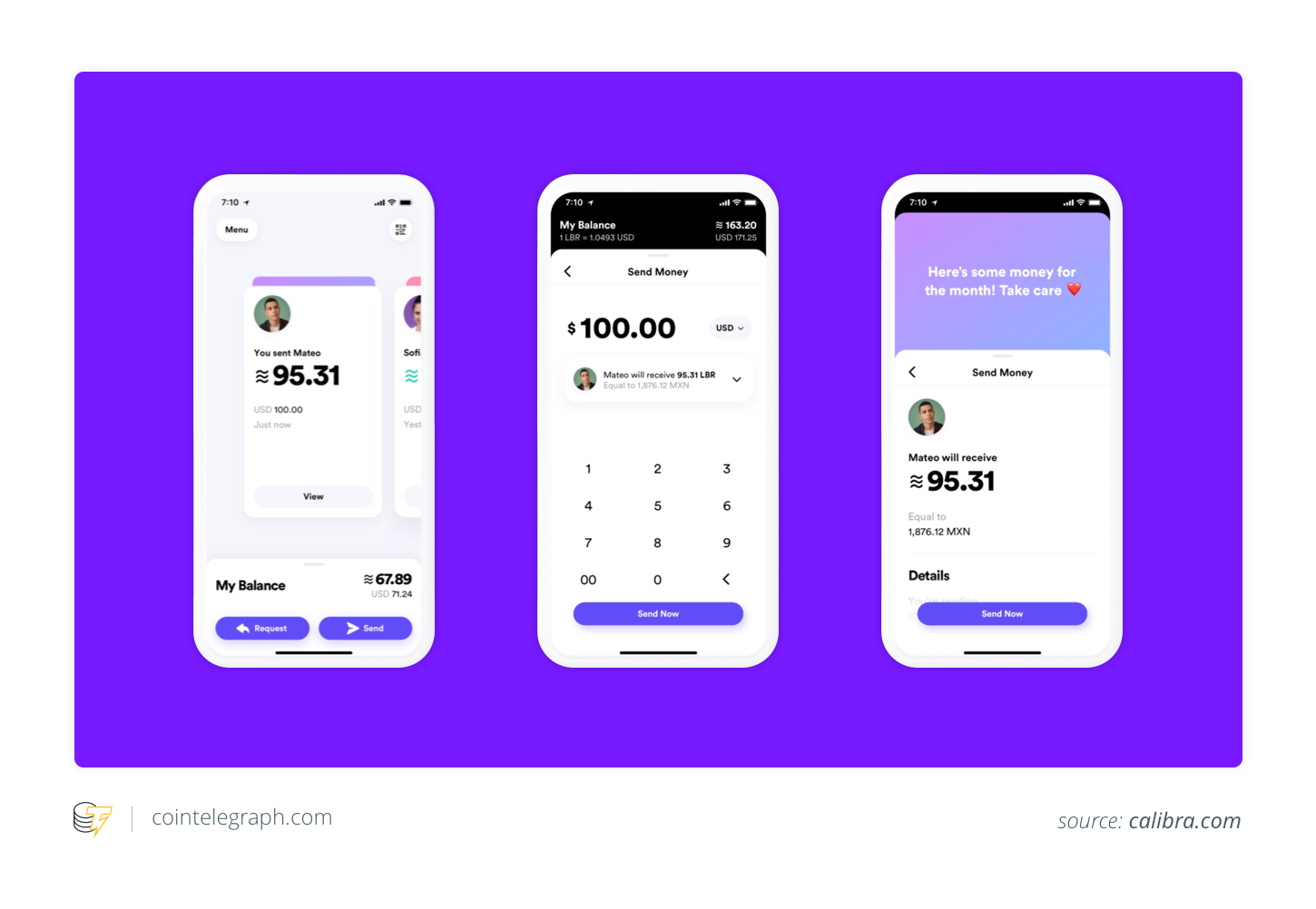

Calibra, Facebook’s WeChat challenger and why Facebook is doing this in the first place

As Facebook stated, it will be moving away from being the leader of the overall project nearer to the public launch of the project. However, that doesn’t mean it didn’t save a little something for itself. Welcome the shiny new digital wallet Calibra. We’ve seen several digital wallets rise and fall throughout the blockchain and fintech landscapes, but this one stands to be different from its predecessors because it will begin with approximately 2.4 billion global users on day one and provide them a unique ecosystem that only one other rival can provide — i.e., Tencent’s WeChat.

Calibra will be built natively into all of Facebook’s platforms — including Messenger, WhatsApp and Instagram — as well as having a standalone mobile app. Facebook has been transparent about it not only being the owners of wallet, but that Calibra will sit in a regulated subsidiary of the company, ensuring the appropriate handling of users’ social, identity and financial data.

Why does Calibra matter even more so now than ever before? According to the 2017 Global Findex report from the World Bank, 1.7 billion people — 31% of the global adult population — remain unbanked, meaning they do not have access to an account at a financial institution or to mobile money. This will put Calibra in the position to provide instant financial, banking and remittance services to all of its current and future users.

Other than the unbanked, Calibra undoubtedly will put Facebook in the position WeChat currently is as a platform — but with more than twice as many users (roughly 2.4 billion to around 1 billion respectively).

With Calibra’s integration throughout the Facebook ecosystem, it becomes the de facto platform for everything in your life, beyond just social and communication. WeChat is this for almost a billion users globally, regularly providing users every reason to stay in the application and no reason to leave. WeChat has been able to accomplish this by allowing a user the ability to communicate socially via a social feed and privately through messaging or groups; be entertained through games, etc.; transfer money globally in seconds for little to no fee; donate to charities and causes; pay the majority if not all bills (utilities, etc.) and rent; and purchase digital and physical goods or services inside or outside of the app (restaurants, retail, etc.). Users no longer have to be concerned about currency conversion, reaching for a wallet, cash or a credit card — thus, almost completely replacing paper cash in China and other countries.

With Libra and Calibra, Facebook could bring together global partners and all of WeChat’s additional features to create the single most significant digital currency (Libra coin) and marketplace ever in history — thus opening the door to a thriving future economy of DApps and introducing new business models, markets, products and services, all of which Facebook has successfully proven with its developer community in the past.

Related: What Is Libra? Breaking Down Facebook’s New Digital Currency

Libra, demystified

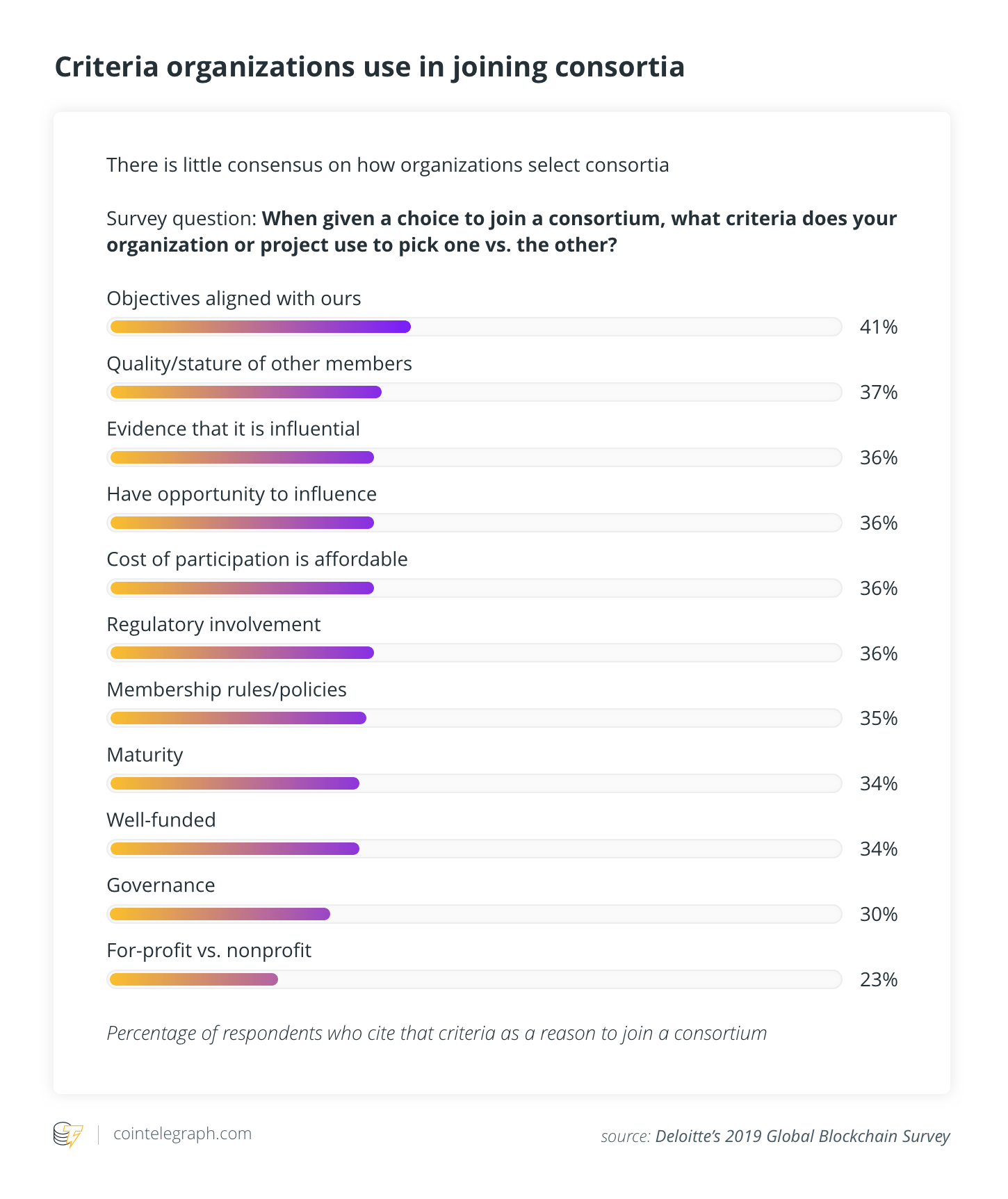

Libra is a permission-based blockchain dedicated to finding a solution for global payments, and it is a consortia with a set goal of 100 founding members. The concept of a consortium in the blockchain ecosystem is not groundbreaking, as there have been a growing number of them emerging around various industries, and with more to come. In a 2019 survey conducted by Deloitte, the researchers identified several consortia dedicated to financial services alone. In that same survey, it was shown that 41% of enterprise organizations select to join a consortium like Libra because the group’s objectives are aligned with theirs. Additionally, Deloitte found that a number of enterprises have either joined (35%) or are planning to join (34%) a consortium in the next 12 months.

Libra is a cryptocurrency that’s currently led by Facebook. Again, this is not new for an enterprise. There are at least three cryptocurrencies at the testnet level that are driven by major institutions. The others include JPMorgan Chase (JPM) and Telegram (TON).

Related: Libra, TON and JPMorgan Coin Compared: Are They Heroes or Villains?

Libra’s expressed goal is to follow the DApp and blockchain guidelines for a permission-based system, but has not yet fully met the guidelines. However, there’s no reason to assume that it won’t achieve such a goal. Facebook has the ambition to transition toward a public blockchain while maintaining sustainable business models across the board for the parties that are investing in the greater ecosystem.

Providing access to those who are unbanked and lowering the costs for remittances are solutions to well-understood problems of today’s global financial system, even though several attempts are ongoing to find other solutions.

Facebook, of all institutions, knows how to be successful in such an environment, given its more than 10 years background of open-source development.

What makes Libra different:

- Access to a 2.4 billion user base on day one and an established ecosystem of long-running applications (Messenger, Instagram, WhatsApp, etc.).

- The project is not being run directly by banking institutions, even though banks are represented through Visa and Mastercard. While represented, they are not in control.

- Regulators have not become involved in the project, yet. However, they can be involved through the association’s social impact program.

The major outstanding issues:

- Can a company like Facebook leverage its monopoly power in one industry to create a competitive advantage in another? In the case of Libra, Facebook is not directly doing this because it will not control the overall governing body — i.e., the Libra Association. To the contrary, Facebook’s Calibra wallet will not only use the Libra currency but also allow for additional payment types.

- Will Libra become the catalyst the market has been searching for to create mainstream consumer adoption for cryptocurrency? The outstanding issues around liquidity for those instruments suddenly disappear due to the 2.4 billion users.

- Given Facebook’s poor track record in monetizing data-driven platforms, is it the right company to be leading such an effort? Perhaps it is. Facebook drew on its strengths as open source contributor to create a meaningful roadmap. In addition, the thoughtfulness around how Libra has been created and communicated gives comfort that Facebook did learn from its previous mistakes and is giving consideration to doing the right thing. The real subject of concern is how Facebook limited university inclusion only based on the computer science departments when Libra will require the full power of many other departments — including economics, finances, sociology and others.

- Will Facebook be successful in creating a community around the Libra cryptocurrency? For this effort to be successful, a massive amount of new ground has to be covered. It will require a great deal of thought around this new type of partnership as well as corporate governance improvements.

- How is Facebook going to benefit from this all? As it is very early in the project’s lifecycle, it is understandable why Facebook is not communicating on this topic, yet. Facebook should be putting forward a grander vision on how this is going to fit with the company’s overall business strategy. Of course, this could be disastrous, as the project is still not yet fully formed, but it would help the public better understand Facebook’s thinking about how it is all going to play out and how it will benefit from it directly.

Not long after Facebook’s initial efforts, Libra’s ecosystem will begin leading the way and providing a blueprint on how to disrupt industries, open new customer markets that have otherwise been unreachable, force new business models, change the interaction as we have known it between enterprises and consumers — all of this building toward the creation of the most comprehensive social and financial system in history. This future collective effort will generate the next wave, if not the one and only real wave of digital transformation.

The article is co-authored by Kyle Ellicott and Philippe Cases.

Kyle Ellicott is a co-founder of Topio Networks and of ReadWrite, a noted TEDx and global speaker, strategist, published author and technologist, with over 15 years of experience at the cornerstone of digital transformation between industry and technology. He’s advised over 175 companies globally throughout industries such as the Internet of Things, transportation, blockchain/fintech/DApps, artificial intelligence, digital health and smart cities — and has successfully raised over $130 million in venture funding.

Philippe Cases is a co-founder and the CEO of Topio Networks, an industry catalyst accelerating the formation of markets by creating communities around emerging trends such as the Internet of Things with ReadWrite Labs, as well as DApps and edge computing with Edge Computing World in 2019. As an early pioneer in AI in the 1980s and SaaS in the 1990s, Philippe invested consistently as a venture capitalist in data technology with companies such as Rightpoint (acquired by E.piphany), Adknowledge (acquired by CMGI), Inquira (acquired by Oracle), Vue Technology (acquired by Sensomatic), Jaspersoft (acquired by Tibco), Silk Technology (acquired By Palantir) and Akili Interactive.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.