Quick take:

- Timothy Peterson has postulated that Bitcoin could soon experience 30-day gains of 20 – 40%

- His analysis is based on a significant drop on Bitcoin’s sentiment value to a threshold known to precede a pump

- Mr. Peterson had earlier concluded that Bitcoin was undervalued with a jump to $11k likely in the near future

Crypto analyst Timothy Peterson has shared his latest analysis of Bitcoin where he explains that BTC could soon experience 30-day gains of 20 – 40%. His analysis is based on Bitcoin’s sentiment dropping to a level known to precede a major breakout in the upward direction. Mr. Peterson shared his analysis of Bitcoin via the following tweet and accompanying chart highlighting the aforementioned drop in Bitcoin sentiment.

When #bitcoin‘s 30-day return hits this lower threshold (we are very close now), it is usually followed by 30-day gains of 20-40%. pic.twitter.com/rSv29bqCHQ

— Timothy Peterson (@nsquaredcrypto) September 10, 2020

Bitcoin Could Jump to $11k

Furthermore, in an earlier tweet, Mr. Peterson had pointed out that Bitcoin was undervalued and could witness a jump to $11k very soon. His analysis was based on the price of Bitcoin deviating far below its Metcalfe value as can be seen in the chart accompanying his tweet below.

#bitcoin is probably undervalued in the short-term. May jump over $11k suddenly. See “Valuing Bitcoin: Metcalfe’s Law at Work” at https://t.co/1x4jidIqg8 pic.twitter.com/GDv1v9N2Io

— Timothy Peterson (@nsquaredcrypto) September 8, 2020

Bitcoin Yet to Break Away from the Influence of the Stock Market

However, Bitcoin’s breakout to the upside has been put on hold due to the stock markets taking a bit of a nosedive this month. The S&P 500 is currently on a downtrend that began on the 2nd of September when it was valued at around $3,589. At the time of writing, the S&P 500 is trading at $3,352 indicating a 6.6% drop in a time span of a little over a week.

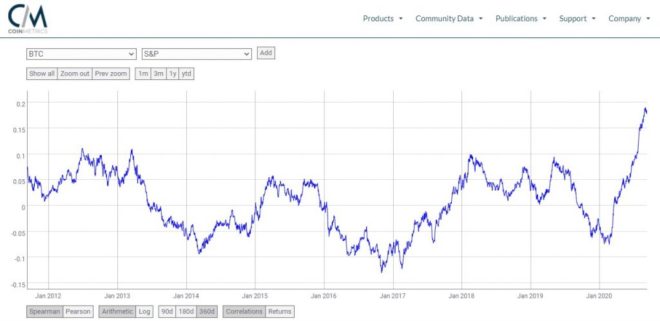

Checking the correlation chart on Coinmetrics reveals that Bitcoin’s 360-day correlation to the S&P 500 is at record high levels as seen in the chart below.

Conclusion

Summing it up, Timothy Peterson of Cane Island Alternative Advisors has identified that Bitcoin could be gearing up for a 30-day period of 20 – 40% gains. His analysis is based on Bitcoin’s sentiment dropping to levels known to precede a major breakout in the upward direction for BTC.

Additionally, he has proposed a situation where Bitcoin spikes to $11k in the near. This latter prediction is based on Bitcoin’s price deviating far below its Metcalfe value.

However, Bitcoin’s fate is firmly tied to that of the stock market as seen through its high correlation to the S&P 500. Therefore, for Bitcoin to experience a bullish move, the stock markets need also to be in the green.

As with all analyses of Bitcoin, traders and investors are advised to use adequate stop losses and low leverage when trading BTC on the various derivative platforms.