Monday, Dec. 3 — Crypto markets have today again taken a major downturn, with all of the major coins by market cap seeing significant losses of within a 4 and 10 percent range, as data from Coin360 shows.

Market visualization by Coin360

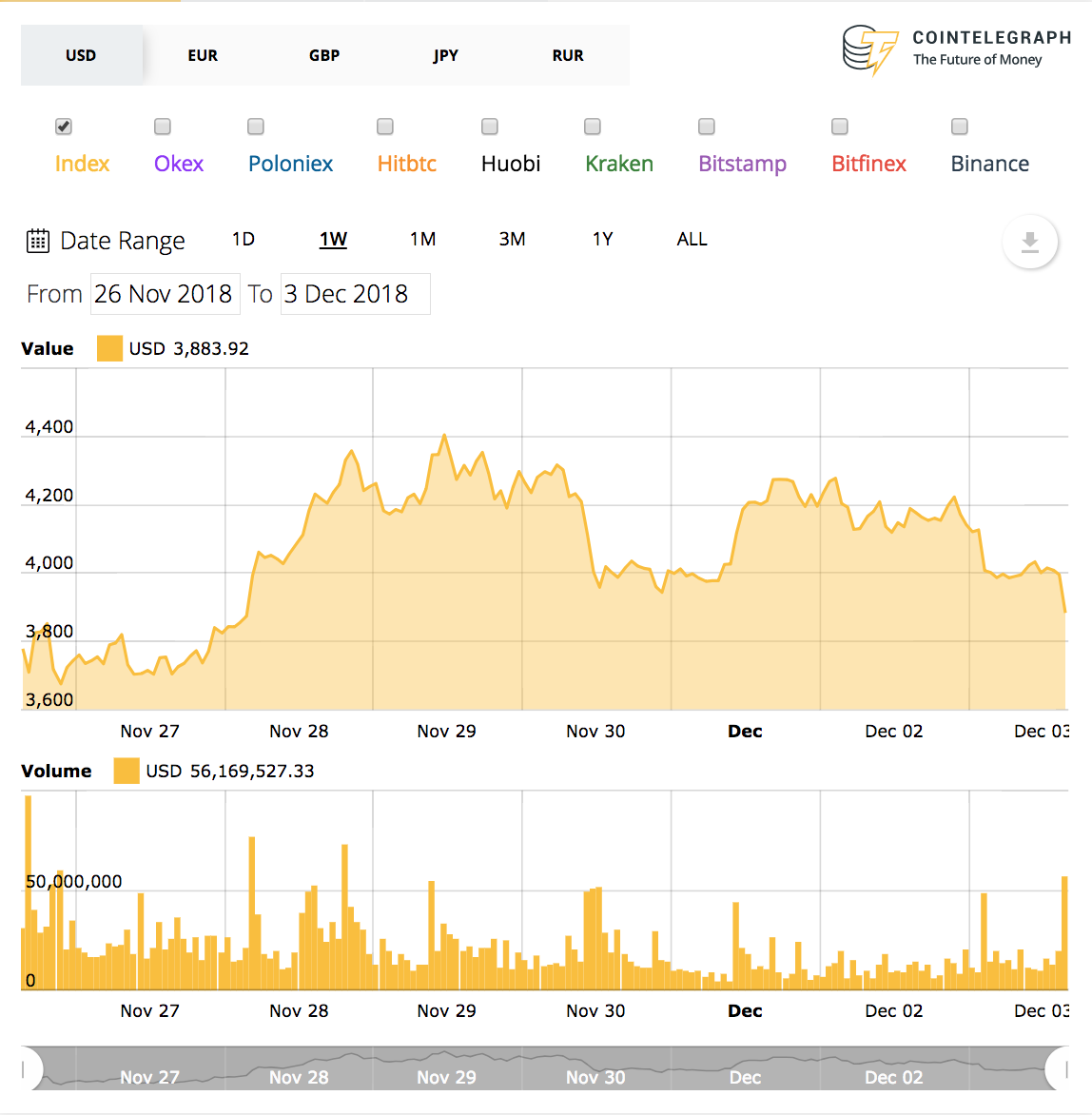

Bitcoin (BTC) has dropped below the $4,000 price point, down about 7 percent on the day to trade at $3,868 at press time. Despite rebounding to as high as $4,400 Nov. 29, the top coin has today seen a drop from a 24-hour high of around $4,135 to as low as $3,846 in recent hours.

Having lost its midweek gains, Bitcoin is breaking more or less even on its 7-day chart, up by just a fraction of a percent; monthly losses are at a stark 39.6 percent, according to Cointelegraph’s Bitcoin Price Index.

Bitcoin 7-day price chart. Source: Cointelegraph’s Bitcoin Price Index

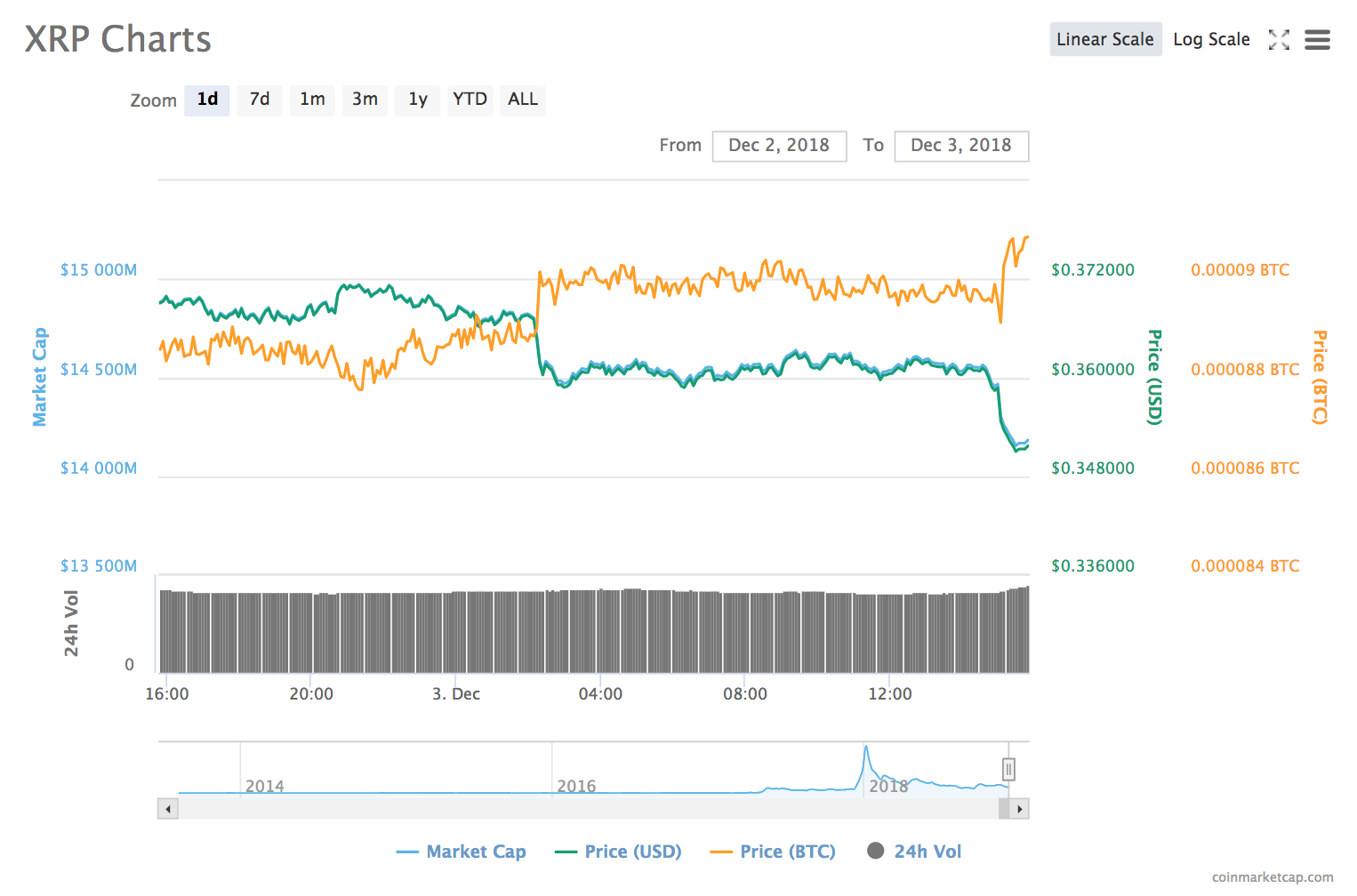

Second-largest crypto by market cap Ripple (XRP) is down by around 5 percent on the day, trading at $0.34 as of press time, according to Cointelegraph’s Ripple Price Index. Ripple’s weekly and monthly charts are also in the red, with losses of 7.6 and 23.7 percent respectively.

Ripple is down around 5.6 percent on the XRP/USD 24-hour chart, as CoinMarketCap data shows.

Ripple 7-day price chart. Source: CoinMarketCap

Third-ranked crypto by market cap Ethereum (ETH) has tumbled in recent trading hours, down almost 8 percent to trade at $107 at press time. Having trading as high as almost $119 toward the end of yesterday, the alt took a mild price hit early this morning to trade around $115, before seeing a sharp plummet in the past couple of hours down to current levels.

On the week, Ethereum is 4.6 percent in the red, with monthly losses pushing 46 percent.

Ethereum 7-day price chart. Source: CoinMarketCap

All of the remaining top ten coins on CoinMarketCap are seeing red, with EOS (EOS) the hardest hit, shedding 10.3 percent on the day at $2.64. EOS has this week become mired in renewed controversy over a move from one of the ecosystem’s so-called “block producers”: the furore comes shortly after news that Block.One CTO Daniel Larimer appears to be harboring plans for a separate cryptocurrency project.

Eight largest ranked crypto Litecoin (LTC) is also down 9.25 percent on the day to trade at $30.82.

Newly-forked “Bitcoin SV” (BSV), ranked ninth, is down over 8 percent at $92.39, with Bitcoin Cash (BCH), ranked 5th, down 7.4 percent at $160.60.

The remaining coins in the top twenty by market cap are all seeing losses of between a 5 and 10 percent range. IOTA (MIOTA) is down just shy of 9 percent to trade at $0.27: privacy-focused alt Monero (XMR) is also down 8.8 percent at $54.75. Similar losses have hit Neo (NEO), Dash (DASH) and ZCash (ZEC), down 9, 8.4, and 9.9 percent respectively.

Total market capitalization of all cryptocurrencies is down to around $125.7 billion as of press time, down a steep $10 billion from its 24-hour high at $135.7 billion.

High on the 24-hour chart of the total market capitalization of all cryptocurrencies from CoinMarketCap

China has yet again sent out renewed anti-crypto signals this week, with the director general of the Beijing Municipal Bureau of Financial Work yesterday warning that Security Token Offering (STOs) fundraising is an “illegal” activity in the country (as are Initial Coin Offerings (ICO), as of September 2017).

Despite weak crypto price action market wide, stalwart Bitcoin (BTC) community subreddit “/r/Bitcoin” — which was founded in September 2010, almost two years after the release of the Bitcoin white paper — hit the 1 million subscriber mark yesterday, Dec. 2.