Despite the volatility of the March 12 – 13 crypto market meltdown, Coinbase has identified several unusual methods through which traders were profiting amid the chaos.

The crash saw rare profits being generated through ‘crypto-and-carry’ derivatives arbitrage, stablecoin speculation, and the failure of MakerDAO’s auction protocol.

Derivatives arbitrage through ‘crypto-and-carry’ trades

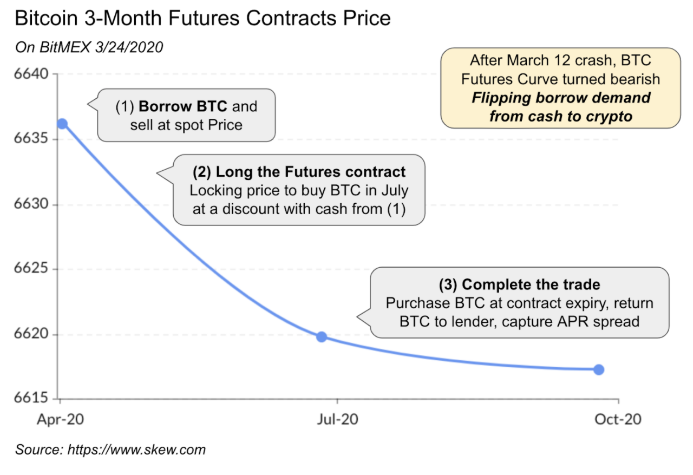

Coinbase asserts that the sudden flip in market sentiment from bullish to bearish created opportunities for derivative arbitrage through “crypto-and-carry” trades.

With the exchange estimating that the crypto market is usually net-60% bullish with futures prices higher than spot prices, Coinbase asserts that arbitrage through derivatives is typically executed through ‘cash-and-carry’ trades.

When derivative prices widen relative to spot prices, traders can borrow fiat to go long on Bitcoin (BTC) while simultaneously going short on futures to lock-in profits from the spread at the time that the futures contract expires. As the strategy necessitates a significant spread in order to cover maintenance fees, opportunities for derivatives arbitrage are typically the most abundant during periods of peak volatility.

With the markets suddenly turning bearish, traders were transversely able to long BTC while selling on the spot market in order to lock in profits through ‘crypto-and-carry’ trades during the March crash.

Stablecoin hodlers see gains

The report notes that multiple stablecoins broke their fiat-peg to the upside as traders rushed to lock in value as crypto asset selling escalated amid the crash.

While USD Coin (USDC) briefly traded at a 2% premium and Tether (USDT) tagged $1.05 during peak volatility, a failure in the liquidation engine underpinning MakerDAO’s protocol has left DAI trading at a premium of multiple percent for weeks.

Maker keeper purchased $4M in ETH for peanuts

The difficulties created a unique opportunity for the sole bidder who participated in Maker’s auctions for 3 hours by himself, who purchased batches of Ethereum (ETH) for $1 each — making out with $4 million worth of ETH for virtually free.