The bitcoin price has not bottomed yet, but it’s close — and the sooner it tanks, the better. That’s the assertion of Alex Sunnarborg, a founding partner of New York crypto hedge fund Tetras Capital.

“Calling [the bitcoin bottom] is very difficult,” Sunnarborg told Forbes. “That’s part of the reason I’m really thankful that we’re in the position we are right now.

“We can hedge ourselves, remain more neutral, and not have to call that exact price or timing bottom. I’m not confident right now. Our portfolio is relatively neutral. We have cash and short positions.”

Sunnarborg Prefers Scorched-Earth Approach

Alex Sunnarborg (Twitter)

Sunnarborg — who admits he’s an avowed bitcoin fan — wishes the crypto market would crash and hit rock-bottom already. Why? Because then it could start rehabilitating itself.

In addition, he’d love for the Securities and Exchange Commission to crush the bad actors in the space in order to clean it up.

In fact, Sunnarborg wishes there were a Crypto Apocalypse right now where everything that could possibly go wrong would — all at once — so the industry could start afresh.

“What would be really good for a market bottom to happen would be for every potential bad thing to happen immediately. I would love to see the SEC come down on people really hard.

“One of the biggest problems in this space is there are so many bad actors, and so many were related to ICOs. The SEC just has such a massive task ahead of them.”

“One way to think about the bottom is that it happens when all the bad news gets washed out. At that point the only thing to do is go up, and you can’t really talk about any negative catalysts anymore, because they’ve all happened.”

‘Crypto Without Chaos’

Sunnarborg is weary of the dribs and drabs of bad news spotlighting all the shady activity in the crypto space because the scam artists discredit the entire industry. Accordingly, the former research analyst says the crypto ecosystem needs more reputable, regulated participants to repair its image.

Winklevoss Twins: We Embrace Rules

That’s what the Winklevoss twins, Cameron and Tyler, have been promoting with their New York City ad campaign touting “Crypto Without Chaos.”

The Winklevoss twins, Cameron and Tyler, say the crypto industry would benefit from targeted regulation. (Twitter)

In January 2019, Gemini — the Winklevoss-led cryptocurrency exchange — rolled out ads on taxis, buses, subways, and the sides of building promoting its status as a regulated exchange.

The twins even took out a full-page ad in the New York Times to spotlight that Gemini embraces rules. This ad campaign was designed to ease consumer anxiety amid a steady stream of crypto-centric hacks and scandals.

As CCN reported, the state of New York established a cryptocurrency task force in January 2019. The idea of the task force was initially proposed in June 2018 after the New York State Attorney General’s Office launched an inquiry into 13 top crypto exchanges, including Gemini, Coinbase, and Binance.

Gemini: Regulation Would Buoy Bitcoin

The twins even took out a full-page ad in the New York Times to spotlight that Gemini embraces rules. (Gemini Capital/Twitter)

At the time, the Winklevoss twins applauded the investigation, saying greater transparency and prudent regulation is good for the burgeoning industry.

“These technologies can’t flourish and grow without thoughtful regulation that connects them to finance. As long as jurisdictions strike the right balance, we think it’s going to be a huge boon and win for cryptocurrencies.”

This is something that Tetras Capital’s Alex Sunnarborg agrees with. He says prospective investors are skeptical of the industry because they fear hacks and market manipulation.

To address these concerns, Sunnarborg wishes the SEC would provide more regulatory clarity and take harsher enforcement actions against shady actors. That ultimately would benefit the entire market, he says.

“What would help is if some more of that clarity and action came out. It probably would have been helpful for the bottom if the VanEck exchange-traded fund would have gotten totally rejected.”

“If the SEC slapped some more of these people around, and essentially maximum pain came onto the market. At that point we would see where, if any, buyers jumped in.”

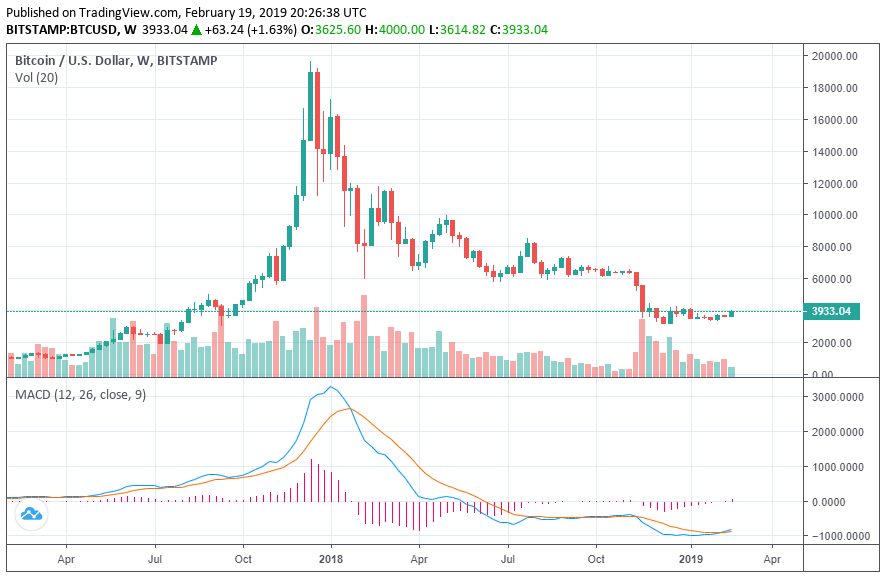

Featured Image from Shutterstock. Price Charts from TradingView.