Did you hear?

Donald Trump will speak at the Bitcoin 2024 conference. The Republican Party put crypto on its electoral platform.

Not too shabby.

Another US presidential candidate, Robert F Kennedy, Jr, said he’d use blockchain to improve the government and offered Bitcoin as a currency option.

That’s nice to know, but doesn’t that defeat the purpose?

Why would you use blockchain technology to manage a centralized entity? You only need blockchains to manage entities that don’t share a common database or business process.

Why does it matter whether the US government or any political party “approves” of Bitcoin? Bitcoin is a non-governmental source of money. Anybody can use it.

Methinks the concept isn’t sinking in. When people talk about crypto as a new paradigm, do they really know what that means?

A few months ago, a commentator said blockchain technology needs massive data centers, so you should invest in data centers and everything necessary to support them, not the tokens themselves.

She missed a crucial detail.

If cryptocurrency works how it’s supposed to, you won’t need data centers.

You’ll have vast, public, global networks of computing power provided by people and businesses all over the world, using their own assets and equipment in exchange for rewards.

You won’t have any opportunity to invest in real estate, commercial properties, machines, and other things that support data centers. Normal people will provide all those things in return for compensation from these networks in the form of tokens (including, potentially, tokens pegged to national currencies).

You’ll have an opportunity to invest in these tokens, the people who contribute to the network, and businesses that profit from its cryptocurrency — for example, miners, developers, entrepreneurs, validators, and everybody who participates.

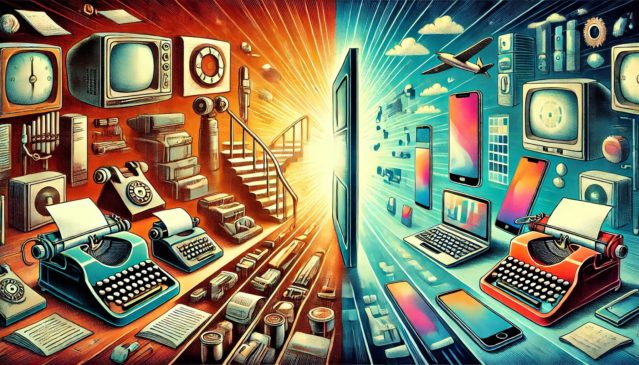

This is not the only paradigm that cryptocurrency will flip on its head.

Boomers have grown so used to their government’s monopoly on money that they don’t know any other way. So-called monetary experts still think money has intrinsic value or some innate properties that make it worthy of usage.

We know money is a social technology. Its value comes from social consensus. If enough people agree to use it, they’ll use it.

Whether that agreement comes because the government says so or because of some other agreement, belief matters more than utility.

Shiny metal flakes? Pixels displayed on a screen? Writings in a ledger or pictures on scraps of paper?

Sure. Whatever gets you what you want.

A while back, my son told me the story of “kid money.”

He said that a million years ago, somebody dug orange dirt out of the ground and called it money. He only let the kids use the money. Then, when the kids turned 18, they forgot about the money and how it came to be.

Sounds familiar.

Many civilizations have had two sets of money: the government’s money and common currencies. One form of money for the rulers, another for the people. One currency by decree, another by consensus.

Today’s economists consider that unstable and untenable, but humans created vast empires, stable trading networks, and prosperity with these systems before the Fed was created.

Our money is a meme, an emotional connection to pictures and images that quantify our wealth. It’s a mirage — the product of financial engineering, propped up by government edicts and collective nostalgia.

Try telling that to Billy the Neighbor. He’ll look at you funny and ask you for a stock tip or memecoin recommendation. He doesn’t know how money works. He just wants more of it.

That’s what Wall Street is banking on. That’s what the politicians see.

You and I know the opportunities in crypto go far beyond that.

We don’t need to make up stories, win presidential endorsements, or debate monetary principles. We need to design and iterate. Let technology flourish or fail, and trust that people and markets can figure this out.

Bitcoin’s network funds itself. The protocol runs without human involvement, and no programmer can hack or take over the Bitcoin network.

Some altcoins will reach the same level of autonomy and relevance, in time.

So you can have ETFs, bans, US government chokepoints, useless DeFi protocols, scams, Ponzis, smart contract platforms, angry politicians, and greedy developers.

None of it changes the fundamental value proposition of cryptocurrency:

Money for the people.

With Bitcoin, you can send money to anybody, anywhere, anytime, in any amount, without restriction, without revealing your sensitive personal information, without putting your property in another person’s control, with certainty that your transaction will go through and confirmation that every payment you receive is authentic and valid.

It works in all conditions, even when counterparties fail. It can sustain itself without political violence, military coercion, government manipulation, or sovereign debt.

Other cryptocurrencies leverage some or all of these features for different purposes, with the same result: everybody has access to all the tools of finance.

That’s the investment opportunity.

With cryptocurrency, you can choose who to associate with, how to associate with them, and the terms of your agreements. You don’t need to petition the government or wage war if you don’t get your way.

You can simply create another protocol or deploy a new smart contract.

Crypto doesn’t need Wall Street to make it safe or easy. Each failure, hack, and attack exposes a vulnerability for developers to fix. Each “cycle” brings more money and attention to the technology, its flaws, and how to solve its problems.

When you use crypto, monetary power doesn’t flow to those who can capture the hearts and minds of regulators. It flows to entrepreneurs, developers, and community members.

Now, we have Wall Street ETFs. Crypto commentators think these will attract a lot of money and attention. They seem eager to sacrifice their share of the world’s wealth in exchange for a fraction of whatever’s left after the legacy financial system gets its share.

But Wall Street has a different playbook. Its firms sell financial “picks and shovels” — access to financial markets.

Crypto gives us our own picks and shovels for free.

If you’re buying into one of those ETFs, ask yourself:

Why do you want to own a stake in Blackrock’s success instead of your own?

That’s the real paradigm shift.

With cryptocurrency, a teenager in Indonesia has as much power as the most prestigious Manhattan financier. All you need is a laptop and Internet connection, and you can create a new monetary system that is global, permanent, and accessible on demand.

The sooner you wrap your head around this idea, the sooner you realize:

We have shrunk the tools of finance into a format that you can take anywhere and use at any time for whatever purpose you intend.

And there is nothing a politician, financial firm, or government can do about it.

—