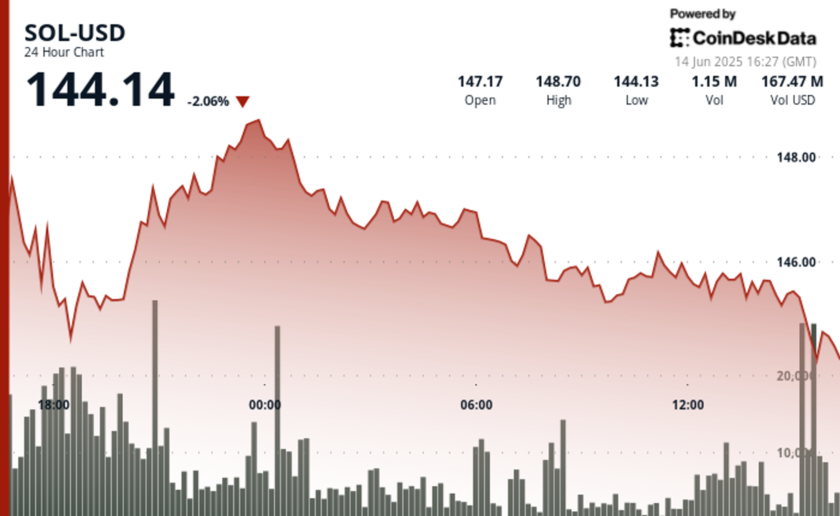

Over the last month the crypto market has seen a significant amount of volatility as a 6-month altcoin bull market abruptly came to an end with the most recent Bitcoin (BTC) price rejection at $12,000.

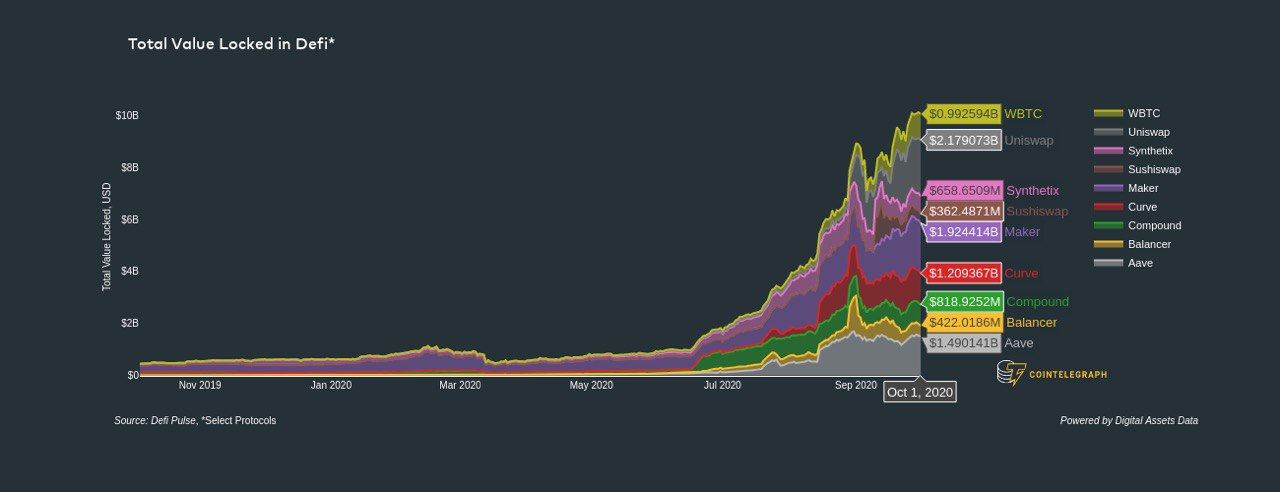

At the same time, the DeFi sector saw an amazing run as the total value locked in DeFi platforms surged above $10 billion but at the time of writing the sector is in the midst of a mild correction.

DeFi index daily, weekly, monthly gains. Source: Messari.io

As reported by Cointelegrah, when Bitcoin (BTC) and Ether (ETH) started to pull back in late September, DeFi tokens crashed in tandem. Then U.S. President Donald Trump’s unexpected COVID-19 diagnosis put additional pressure on the DeFi market.

Despite this, Maker (MKR), Uniswap (UNI), Yearn.finance (YFI), and other decentralized finance (DeFi) tokens saw their values plunge in the past two weeks. Yet, various data points show that the fundamentals of major DeFi tokens remain strong.

Most notably, Maker, Uniswap, and Aave saw their revenues spike by 130% to 440% within the past 30 days and this occurred as the prices of their underlying tokens fell substantially.

Major DeFi tokens may be oversold

It is difficult to measure the value of DeFi projects based on fixed metrics because each is structurally different but the two most widely utilized metrics are revenue and total value locked (TVL).

Revenues show how much capital a DeFi project is making from their products and it is an efficient metric for gauging general user demand and market sentiment.

The TVL shows how much capital is locked in the DeFi protocol, typically demonstrating investor confidence along with the project’s share of the market. TVL is also loosely associated with the liquidity and volume of the various staking pools.

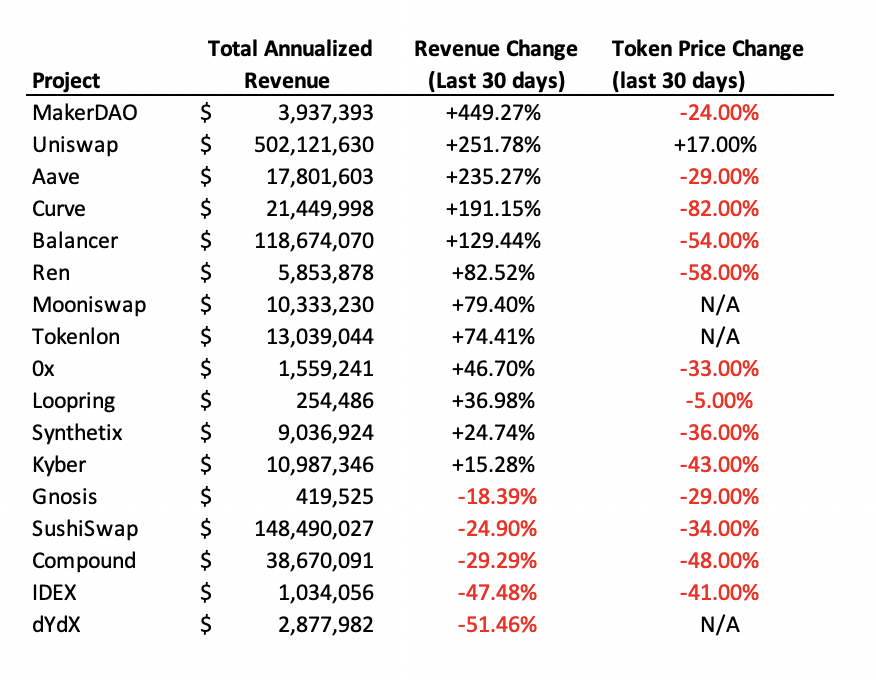

Revenue change versus token price change of major DeFi networks. Source: Twitter.com

As shown in the chart above, in the past 30 days the revenues of major DeFi protocols soared. Yet, the price of the underlying DeFi tokens plunged by 20% to 82%. For example, Maker dropped by 24% in the last 30 days but in the same period it recorded a 449% increase in revenue.

If a project’s TVL is stable and the revenues are increasing, a major price plunge likely signifies extreme caution in the DeFi market. Similarly, Uniswap and Aave recorded a steep price slump, while they both recorded over a 235% increase in revenue.

Jeff Dorman, the chief investment officer at Arca, explained that fundamentals do not necessarily move with the price. Citing the revenue change of DeFi protocols in contrast to token prices, Dorman wrote:

“Price and fundamentals don’t always move the way you’d think. DeFi is a great example this month. According to data from Messari and Token Terminal, here are 30-day changes in Revenue for select DeFi protocols, compared to their 30-day changes in Price.”

In the medium term, Dorman emphasized that it is the “perfect” setup for value investors. It shows which projects have fundamentals that outweigh the recent price wreck from the crypto market correction. He noted:

“Not all tokens are created equal. Some accrue no economic value regardless of earnings, while others directly accrue value when earnings increase. This is a perfect setup for value investors — the sector is collectively dumping, but there will be long-term winners and losers.”

TVL and daily DEX users continues to rise

On-chain data from Digital Assets Data indicate that the TVL of the DeFi market remains relatively unchanged. While most DeFi tokens dropped by 30% to 50%, the TVL has remained above $10 billion.

Total value locked in DeFi. Source: Digital Assets Data

Yearn.finance, for instance, saw its native YFI token drop by 44% within five days and the digital asset is currently 56% down from its peak.

Despite this startling decline, investors and analysts remain strongly bullish on the project and earlier this week the Yearn.finance team revealed that it plans to release new stablecoin vaults.

Further proof that token price is not a reflection of a project’s viability comes from Defipulse data showing Yearn.finance with a TVL of around $700 million, a figure which is close to its TVL in August when the price was much higher.